Please use a PC Browser to access Register-Tadawul

Will Truist’s Upgrade of Crown Holdings (CCK) Shift Sentiment on Packaging Sector Prospects?

Crown Holdings, Inc. CCK | 101.53 | +0.28% |

- Truist Securities recently upgraded Crown Holdings from Hold to Buy, citing the recent selloff as creating an attractive entry point for investors.

- This shift in analyst sentiment reflects renewed confidence in Crown Holdings' future prospects within the packaging sector.

- We'll explore how Truist Securities' analyst upgrade could influence Crown Holdings’ investment outlook amid evolving industry drivers.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Crown Holdings Investment Narrative Recap

To be a Crown Holdings shareholder today, you need to believe in the company’s ability to keep capitalizing on demand for sustainable packaging, grow profits through operational efficiency, and manage geographic risks and input costs. Truist Securities’ recent upgrade highlights renewed market confidence, but this news is unlikely to materially shift the near-term catalyst, which remains the ramp-up of capacity expansions, while persistent input cost pressures, especially aluminum prices, pose the clearest present risk.

One recent announcement relevant to the company’s future catalysts is the planned addition of a high-speed production line at its Ponta Grossa, Brazil plant, targeting increased demand in a growth region. This move aligns with the ongoing capital investments that are central to Crown’s expansion strategy and underpin expectations for future revenue and margin improvement.

However, investors should also be aware that, despite the renewed optimism, persistent inflation in input costs remains a key risk that could quickly...

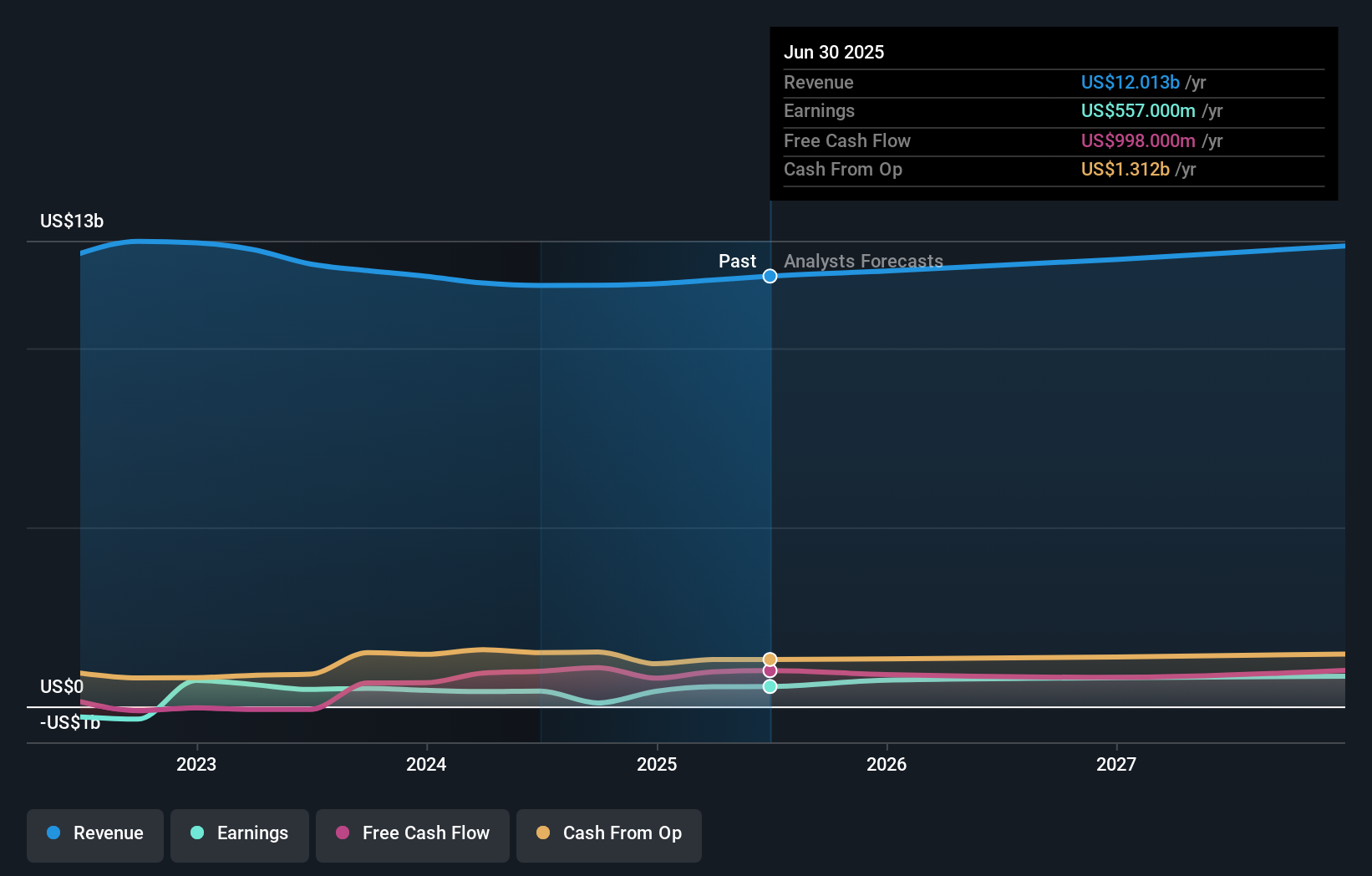

Crown Holdings' outlook anticipates $13.3 billion in revenue and $886.4 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 3.3% and an earnings increase of $329.4 million from the current earnings of $557.0 million.

Uncover how Crown Holdings' forecasts yield a $123.36 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Crown Holdings’ fair value between US$123 and US$219 per share, a span of nearly US$100. With inflation in input costs identified as a key risk, several viewpoints may help you decide what matters most for future earnings and valuation.

Explore 2 other fair value estimates on Crown Holdings - why the stock might be worth just $123.36!

Build Your Own Crown Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crown Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.