Please use a PC Browser to access Register-Tadawul

Will Upbeat Earnings, Raised Guidance, and Joby Partnership Change L3Harris Technologies' (LHX) Narrative?

L3 HARRIS TECHNOLOGIES INC LHX | 282.85 | -1.97% |

- In the past week, L3Harris Technologies reported stronger second-quarter earnings, raised its 2025 revenue guidance to US$21.75 billion, and announced a new defense partnership with Joby Aviation focused on a hybrid VTOL aircraft for military use.

- The company also completed a sizeable multi-year share repurchase program, reflecting ongoing capital returns alongside operational improvements and new growth initiatives.

- We'll examine how L3Harris's upward earnings guidance revision further supports the company's investment appeal and future growth prospects.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

L3Harris Technologies Investment Narrative Recap

For shareholders, belief in L3Harris Technologies centers on sustained demand for advanced defense and communication technologies, capital discipline, and adaptability to global security priorities. The recent second-quarter earnings beat, higher revenue guidance, and expanded partnership with Joby Aviation reinforce a positive short-term outlook, supporting the view that higher U.S. defense procurement and operational improvements remain key near-term catalysts. However, this news does not materially change the largest risk: the company’s exposure to U.S. government budget constraints, particularly in the space and missile segments.

Among the recent updates, the raised 2025 revenue guidance to US$21.75 billion is most relevant to investors tracking growth momentum. This upward revision signals management's confidence in L3Harris’s backlog strength, improved margins, and integrations like Aerojet Rocketdyne, all factors contributing to near-term earnings visibility and offsetting some dependency risks from subcontracted projects.

Yet, investors should be aware that, despite these positive signals, risks tied to possible reductions in government defense budgets and contract volumes could still affect...

L3Harris Technologies is projected to reach $24.9 billion in revenue and $2.7 billion in earnings by 2028. This outlook requires annual revenue growth of 5.2%, representing a $1.0 billion increase in earnings from the current $1.7 billion level.

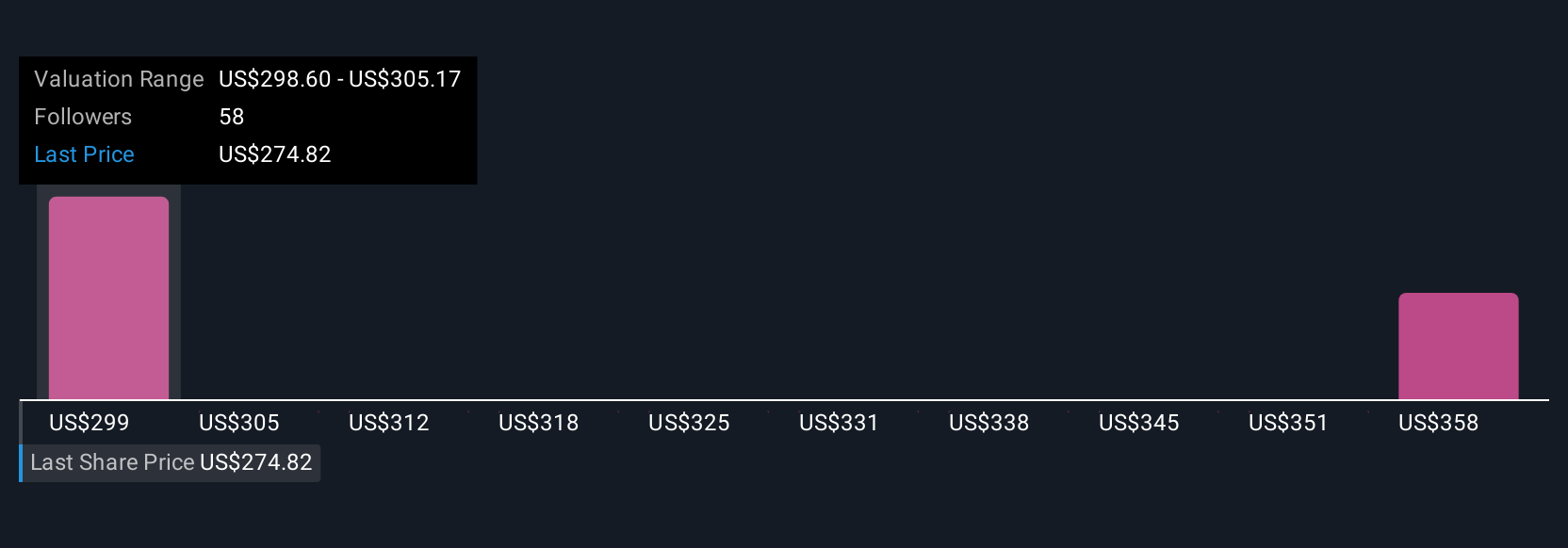

Uncover how L3Harris Technologies' forecasts yield a $298.60 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate L3Harris's fair value between US$298.60 and US$366.43, based on two varied outlooks. Facing possible headwinds from U.S. defense budget constraints, you may want to compare these perspectives before making your own assessment.

Explore 2 other fair value estimates on L3Harris Technologies - why the stock might be worth as much as 32% more than the current price!

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.