Please use a PC Browser to access Register-Tadawul

Will Vera Therapeutics (VERA) Strengthen Its Commercial Edge With Board Appointment of James R. Meyers?

Vera Therapeutics, Inc. Class A VERA | 41.76 | -0.93% |

- Vera Therapeutics recently announced the appointment of seasoned biopharmaceutical leader James R. Meyers to its Board of Directors as the company advances commercial readiness for its lead drug candidate atacicept in immunoglobulin A nephropathy (IgAN).

- This move signals a focus on strengthening commercial capabilities as Vera prepares for potential regulatory approval and market entry of a first-in-class therapy.

- We'll explore how leadership additions such as James R. Meyers' appointment influence Vera Therapeutics’ investment narrative amid its pivotal commercialization phase.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Vera Therapeutics' Investment Narrative?

Being a shareholder in Vera Therapeutics means buying into the company’s ability to transform a strong clinical pipeline, anchored by its lead candidate atacicept, into meaningful revenue growth, despite not yet generating sales or posting profits. The recent addition of James R. Meyers, with his deep commercialization expertise, could be influential as Vera moves closer to a possible FDA approval and market launch, positioning the company to address key commercial execution risks that analysts had previously highlighted. While this board appointment signals a renewed emphasis on operational readiness and could strengthen the company’s chances in the high-stakes months ahead, the most important short-term catalyst remains the FDA’s regulatory decision on atacicept, which continues to be accompanied by substantial clinical, competition, and financing risks. In sum, while the Meyers appointment bolsters commercial prospects, the material drivers remain regulatory outcomes and execution in a competitive, capital-intensive biotech environment. However, the possibility of new competition reaching the IgAN market sooner is a risk not to overlook.

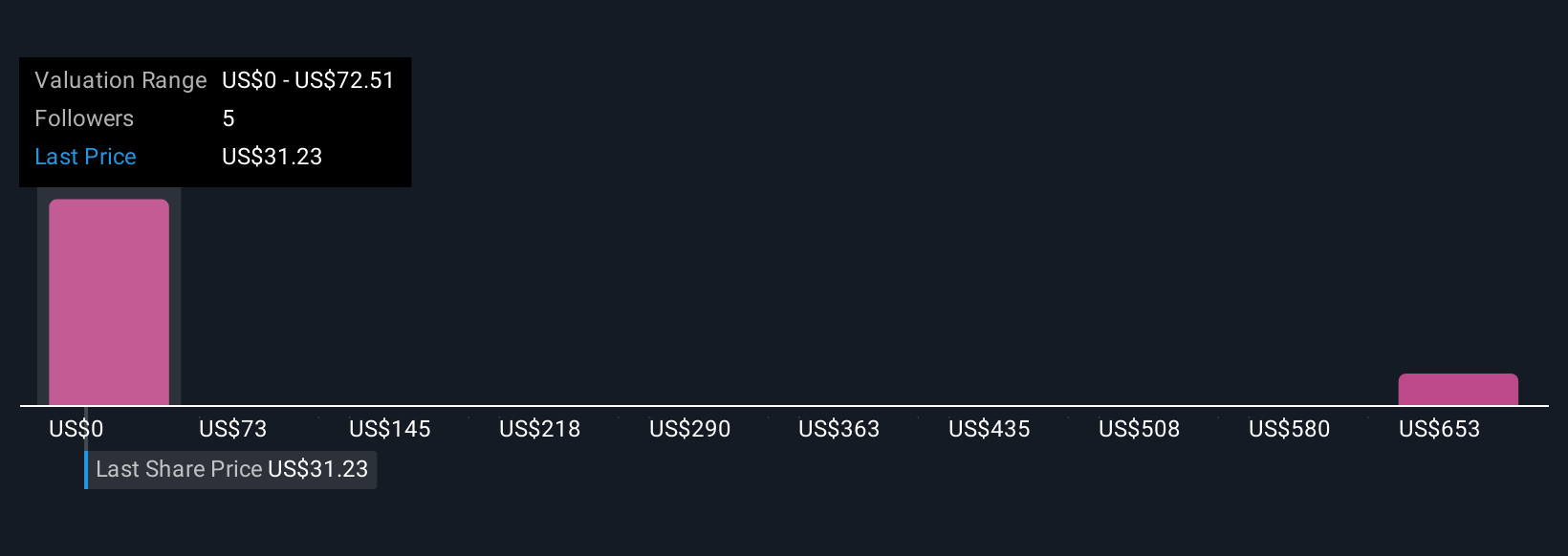

Vera Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Vera Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Vera Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vera Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vera Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.