Please use a PC Browser to access Register-Tadawul

Will Viper Energy's (VNOM) Robust Q2 Results and Buybacks Redefine Its Shareholder Returns Narrative?

Viper Energy Partners LP VNOM | 40.34 | -0.76% |

- Viper Energy announced second quarter 2025 earnings showing revenue of US$297 million, net income of US$37 million, and declared both a US$0.33 base and US$0.20 variable cash dividend per Class A share, with updated production guidance for 2025 and 2026.

- The company completed a major share buyback tranche and signaled its intention to continue aggressive shareholder returns, amid ongoing integration of the Sitio Royalties acquisition and operational expansion in the Permian Basin.

- We'll examine how Viper Energy's combination of growing dividends and updated production outlook shapes its investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Viper Energy Investment Narrative Recap

Owning shares in Viper Energy means believing in the continued strength and operational growth of the Permian Basin, as well as the company’s ability to convert expanding mineral assets into reliable dividends and long-term earnings. The most recent earnings and guidance update did little to materially alter the core short-term catalyst, the successful integration of the Sitio Royalties acquisition, while the main risk remains Viper's dependency on third-party operators for production stability and growth.

Among recent announcements, the updated production guidance for 2025 and 2026 stands out as most relevant to the current outlook, since production levels directly support dividend capacity and drive investor confidence. The company’s forecast of mid-single-digit production growth into 2026 aligns with management's growth narrative, but it also raises the importance of seamless acquisition integration and collaborative execution with key operators.

In contrast, investors should also be mindful of the operational risks tied to relying so heavily on third-party drillers because ...

Viper Energy's outlook projects $2.6 billion in revenue and $416.3 million in earnings by 2028. This is based on a 40.8% annual revenue growth rate and a $45.1 million increase in earnings from today's $371.2 million.

Uncover how Viper Energy's forecasts yield a $54.14 fair value, a 40% upside to its current price.

Exploring Other Perspectives

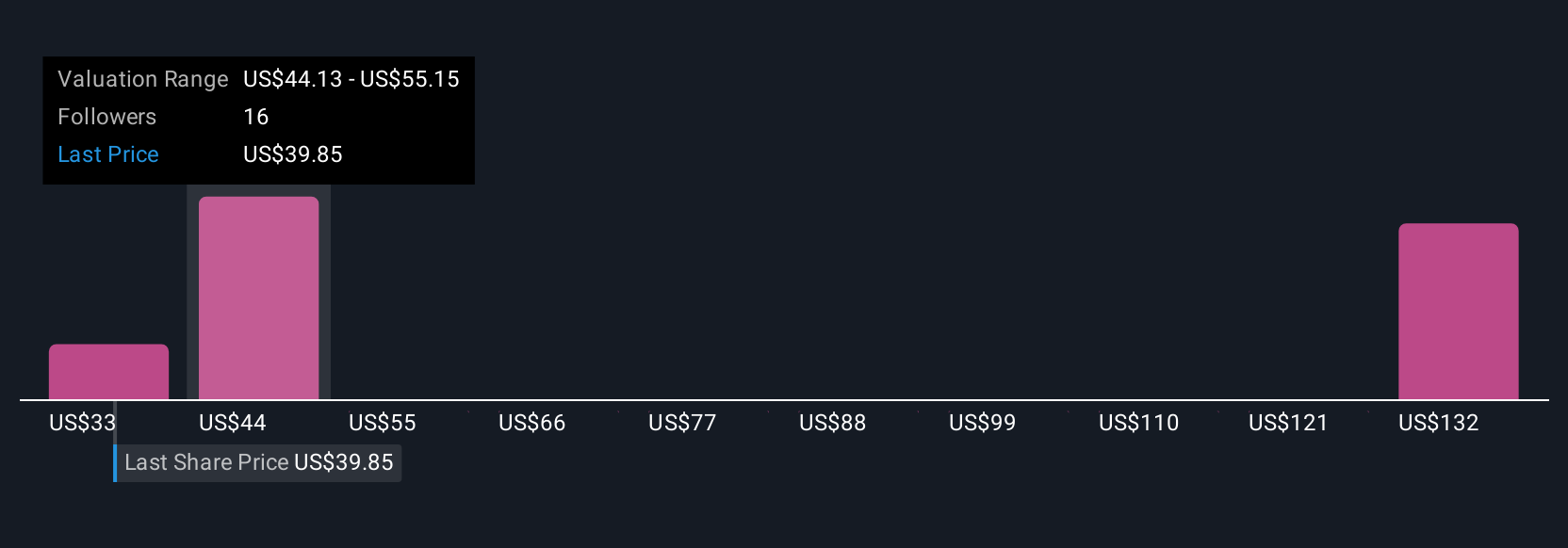

Six different Simply Wall St Community fair value estimates for Viper Energy range from US$32.10 to US$219.03 per share. While some see broad upside, the company's reliance on external operator decisions could introduce volatility to results, underlining why opinions differ so widely.

Explore 6 other fair value estimates on Viper Energy - why the stock might be worth over 5x more than the current price!

Build Your Own Viper Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viper Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Viper Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viper Energy's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.