Please use a PC Browser to access Register-Tadawul

Will Vulcan’s Revenue Beat and Softer EBITDA Outlook Change Vulcan Materials' (VMC) Narrative

Vulcan Materials Company VMC | 305.92 305.92 | +1.79% 0.00% Post |

- Vulcan Materials recently reported a past quarter with revenue rising 14.4% year on year, coming in about 0.8% above analyst expectations and accompanied by a beat on adjusted operating income estimates.

- While the company delivered the fastest revenue growth among its building materials peers, its slightly softer full-year EBITDA guidance versus analyst forecasts added an important nuance to the results.

- Next, we’ll examine how Vulcan Materials’ strong revenue momentum but slightly lower full-year EBITDA guidance shape its broader investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Vulcan Materials' Investment Narrative?

To own Vulcan Materials, you have to believe in the long-term need for aggregates and construction materials, and in the company’s ability to convert that demand into resilient earnings despite cycles. The latest quarter’s 14.4% revenue growth and beat on adjusted operating income reinforce the demand side of that story, but the slightly softer full-year EBITDA guidance tempers the near-term excitement and could cool expectations for profit growth as a short term catalyst. With the shares already trading on a richer earnings multiple than peers and forecasts pointing to earnings and revenue growth that are steady rather than explosive, this guidance tweak matters more for sentiment than for the core thesis. It also puts a bit more focus on execution under upcoming leadership changes and the company’s high debt load.

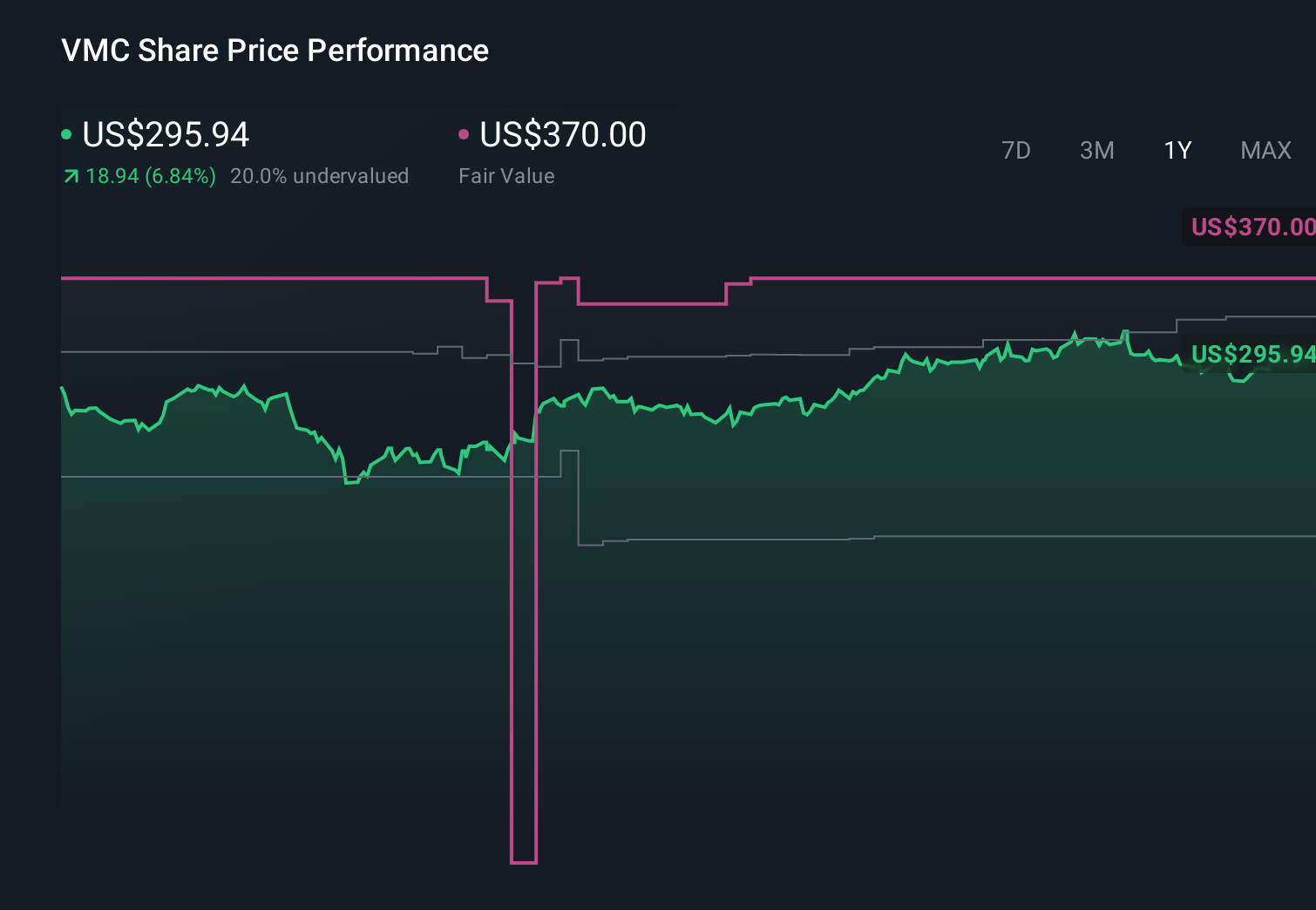

However, there is a key risk around valuation and what happens if growth disappoints. Vulcan Materials' share price has been on the slide but might be up to 11% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 4 other fair value estimates on Vulcan Materials - why the stock might be worth as much as 7% more than the current price!

Build Your Own Vulcan Materials Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.