Please use a PC Browser to access Register-Tadawul

Will WhiteFiber’s (WYFI) Conference Engagement Signal a Shift in Its Capital Markets Strategy?

WhiteFiber, Inc. WYFI | 14.90 | -2.04% |

- WhiteFiber, Inc. appeared at the H.C. Wainwright 27th Annual Global Investment Conference on September 9, 2025, in New York, with Cameron Schnier and Samir Tabar representing the company during their presentation.

- The company’s direct engagement with global investors at such a high-profile event highlights its efforts to enhance visibility and address stakeholder interests in real time.

- We'll explore how WhiteFiber's leadership presence at this conference shapes the company's investment narrative and capital markets positioning.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is WhiteFiber's Investment Narrative?

WhiteFiber’s appearance at the H.C. Wainwright conference brings a timely opportunity to clarify its outlook after a rapid sequence of major milestones, IPO, index inclusion, and strategic partnerships aimed at scaling next-generation AI infrastructure. For investors, belief in WhiteFiber rests on its ability to sustain high revenue growth while transitioning its freshly public business model and integrating new management. The direct investor engagement this week has the potential to boost sentiment, possibly influencing near-term catalysts like increased liquidity or institutional attention that typically follow high-profile events. However, the core risks remain prominent: a new and untested management team, thin trading volumes, and a relatively high valuation compared to peers. While the conference may support the company’s narrative and visibility, it is unlikely to immediately shift the fundamental risk-reward equation without further operational updates.

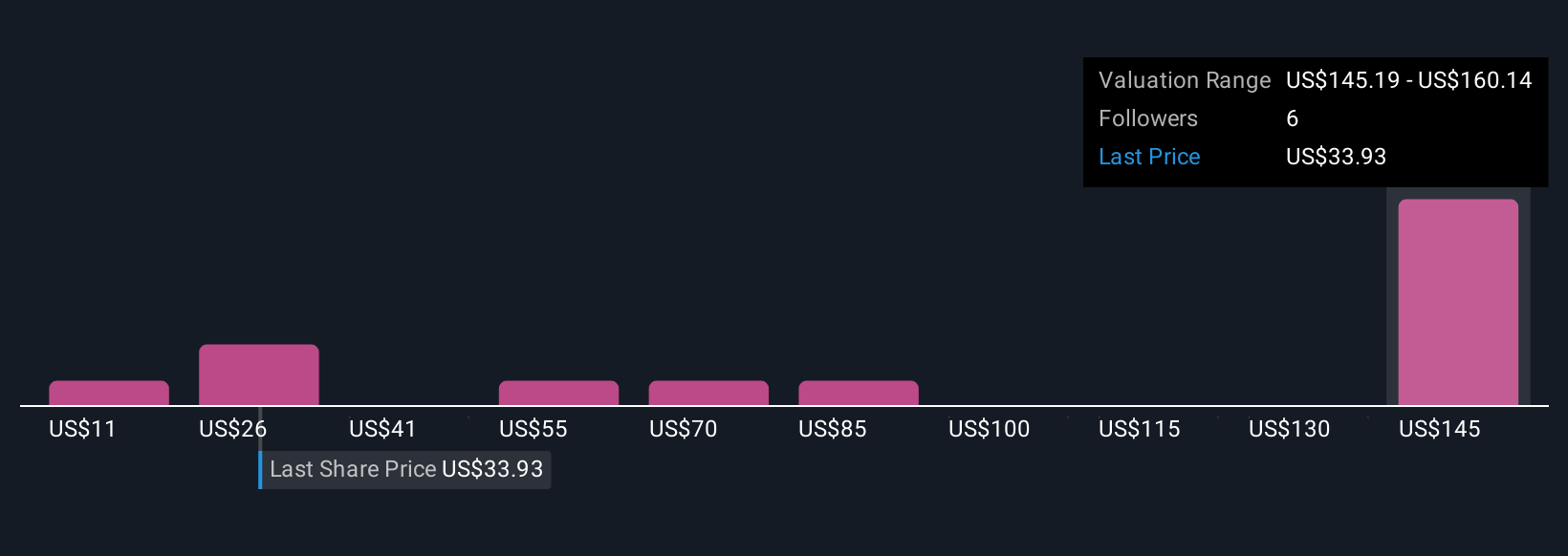

But with such a new leadership team, investors should pay close attention to upcoming decisions. According our valuation report, there's an indication that WhiteFiber's share price might be on the expensive side.Exploring Other Perspectives

Explore 5 other fair value estimates on WhiteFiber - why the stock might be worth 47% less than the current price!

Build Your Own WhiteFiber Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WhiteFiber research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WhiteFiber research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WhiteFiber's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.