Please use a PC Browser to access Register-Tadawul

Willdan Group (WLDN): Assessing Valuation After Upgraded Earnings and Cash Flow Outlook

Willdan Group, Inc. WLDN | 104.11 | -0.38% |

Most Popular Narrative: 23.8% Undervalued

The prevailing narrative around Willdan Group suggests that the stock is undervalued by nearly a quarter compared to its estimated fair value. Analysts see substantial room for upside based on projected growth in the coming years.

Ongoing investments and planning for grid modernization, combined with the company's strong reputation with utility commissions and government agencies, position Willdan to benefit disproportionately from federal and state decarbonization mandates and infrastructure modernization initiatives. These factors are expected to support sustained revenue and EBITDA growth over the long term.

Curious about the bold forecast behind this attractive discount? The core calculations involve ambitious profit milestones and an earnings multiple that rivals some of the fastest growing sectors. What powerful combination of recurring revenues and margin expansion could justify this bullish fair value? Uncover the full story for insight into the numbers driving this optimistic projection.

Result: Fair Value of $132.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges remain. Upcoming tax changes and heavy reliance on government-funded projects could pressure margins and introduce new volatility.

Find out about the key risks to this Willdan Group narrative.Another View: Market Multiples Raise Questions

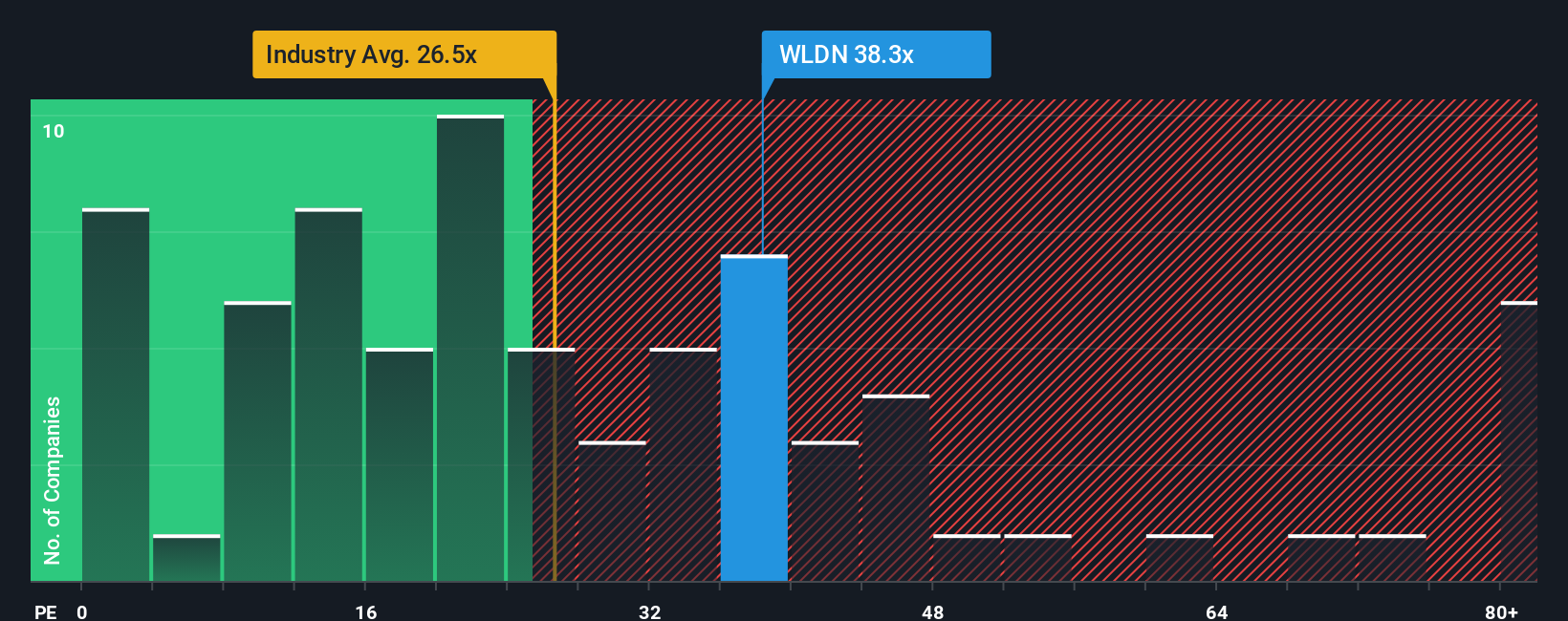

While the first method points to a sizable discount, looking at standard valuation ratios compared to the industry reveals that Willdan's shares actually trade at a premium. The key question is whether growth prospects are strong enough to justify this price.

Build Your Own Willdan Group Narrative

Feel empowered to dive into the numbers and craft your own perspective. The process is quick, and you can share your narrative in just minutes. Do it your way

A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Investment Opportunities?

Smart investors know the value of staying ahead, so do not stop at just one promising company. Open the door to a world of investment ideas that could transform your portfolio and help you catch the next big winner before the market does.

- Tap into the potential of groundbreaking artificial intelligence breakthroughs by checking out AI penny stocks making waves in tomorrow’s technology landscape.

- Secure your cash flow with steady income streams by considering dividend stocks with yields > 3% offering reliable yields above 3% in turbulent markets.

- Uncover stocks the market may be missing by browsing undervalued stocks based on cash flows that are trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.