Please use a PC Browser to access Register-Tadawul

WisdomTree’s Latest AUM Record and Digital Fund Launch: Is the Valuation Up to Date?

WisdomTree Investments Inc WT | 11.83 | +1.46% |

If you are watching WisdomTree (WT) after their recent record-breaking announcement, you are not alone. The company just reported assets under management topping $131 billion, powered by net inflows and double-digit organic growth since January. This milestone comes alongside the launch of their blockchain-native Private Credit and Alternative Income Digital Fund, signaling a fresh approach to opening up traditionally exclusive markets to a wider investor base.

These updates follow a very strong run for WisdomTree. The stock has soared 52% over the past year, gaining momentum on the back of product innovation and steady expansion in digital finance. With year-to-date inflows of $8 billion and broad success across product categories, both the near-term buzz and longer-term growth narrative are hard to miss. For investors, this is part of a longer streak, as the stock has more than doubled over three years and tripled in five.

With shares near recent highs and WisdomTree posting some of its best growth metrics to date, does the current price reflect all of this success or is there still room for upside if the digital strategy continues to deliver?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, WisdomTree shares are currently trading very close to analyst consensus fair value, making the stock appear fairly valued at present.

“Growth is driven by expansion into private assets, international markets, digital finance, and alternative investment products. This supports revenue diversification and margin improvement. Innovative offerings in blockchain, tokenized assets, and wealth management position the company to capture emerging opportunities and deepen distribution channels.”

Want to see what’s powering this bold valuation stance? Analyzing the story behind these numbers reveals unexpected growth targets and ambitious margin forecasts that could redefine the stock’s outlook. Curious about the exact metrics the market is watching? Keep reading to uncover the assumptions that could make this price target a reality.

Result: Fair Value of $14.35 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid fee compression and the unpredictable nature of the farmland sector could challenge WisdomTree's optimistic growth expectations if market conditions shift suddenly.

Find out about the key risks to this WisdomTree narrative.Another View: Challenging the Consensus

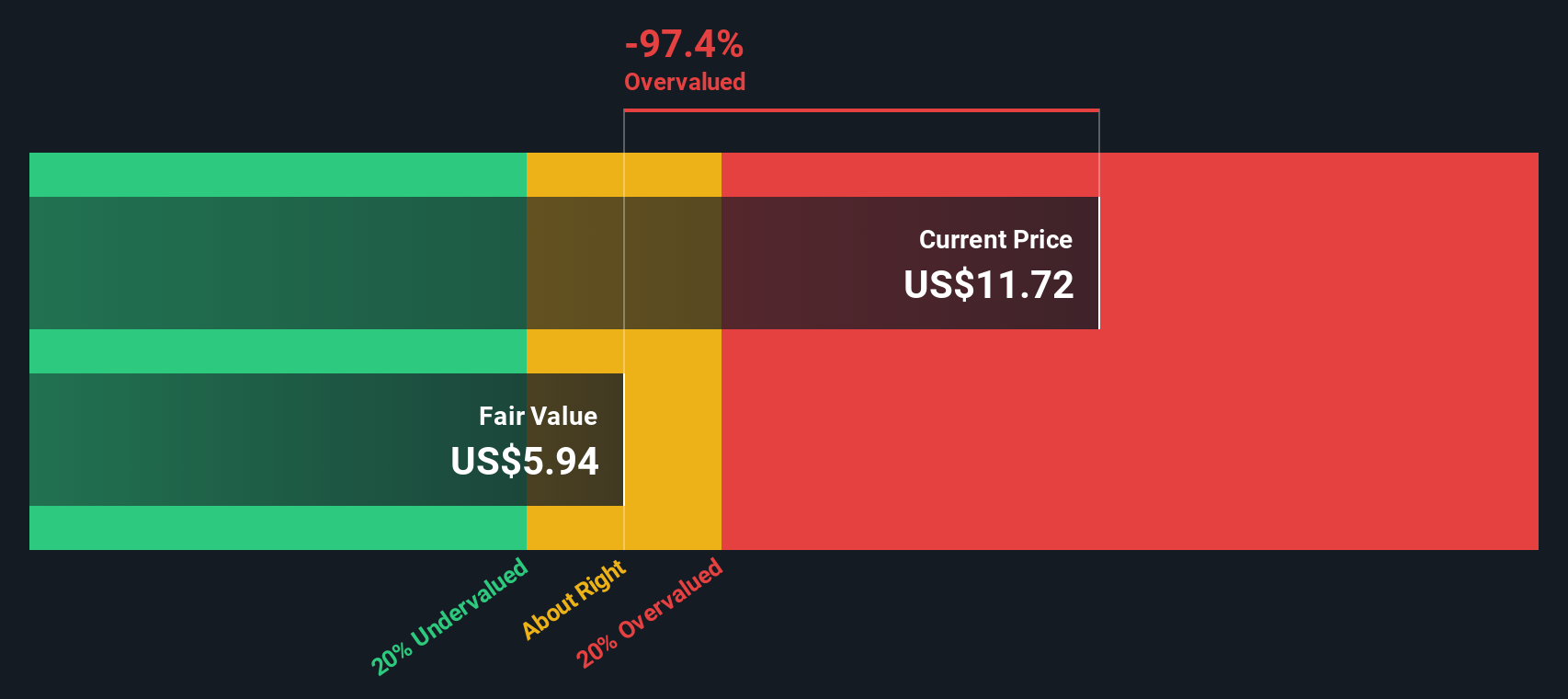

While the fair value estimate is built on future earnings growth, our DCF model takes a closer look at underlying cash flows and paints a surprisingly different picture. This suggests shares might not be as cheap as they appear. Could this signal a reality check for recent optimism?

Build Your Own WisdomTree Narrative

If you’d rather draw your own conclusions or want to dig deeper into the numbers, you can craft a personalized view of WisdomTree in just a few minutes. Do it your way.

A great starting point for your WisdomTree research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize the next market opportunity by using Simply Wall Street’s tools to find stocks that could boost your portfolio. You’ll regret missing these unique angles for potential growth and strong returns.

- Spot high-yield opportunities and add steady income to your portfolio by checking out dividend stocks with yields > 3%.

- Tap into companies at the forefront of tomorrow and capitalize on cutting-edge innovations with AI penny stocks.

- Uncover stocks flying below the radar but brimming with strong fundamentals through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.