Please use a PC Browser to access Register-Tadawul

With A 27% Price Drop For Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) You'll Still Get What You Pay For

Concrete Pumping Holdings, Inc. BBCP | 6.96 | -0.43% |

Concrete Pumping Holdings, Inc. (NASDAQ:BBCP) shares have had a horrible month, losing 27% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

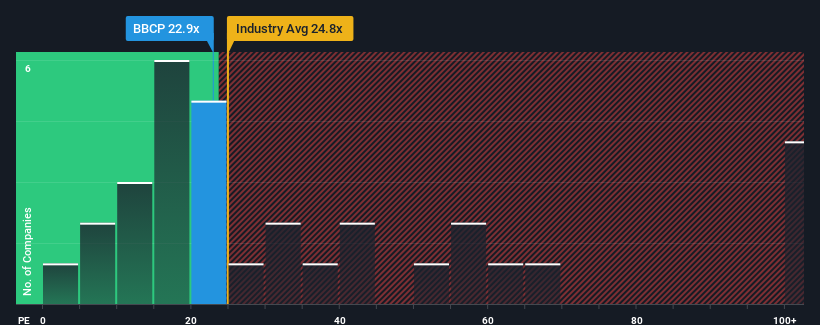

In spite of the heavy fall in price, Concrete Pumping Holdings may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.9x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Concrete Pumping Holdings hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Concrete Pumping Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 51% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 33% each year as estimated by the four analysts watching the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Concrete Pumping Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Concrete Pumping Holdings' P/E

Concrete Pumping Holdings' P/E hasn't come down all the way after its stock plunged. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Concrete Pumping Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

If you're unsure about the strength of Concrete Pumping Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.