Please use a PC Browser to access Register-Tadawul

With A 27% Price Drop For SoundHound AI, Inc. (NASDAQ:SOUN) You'll Still Get What You Pay For

SoundHound AI, Inc Class A SOUN | 7.82 | -0.13% |

Unfortunately for some shareholders, the SoundHound AI, Inc. (NASDAQ:SOUN) share price has dived 27% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

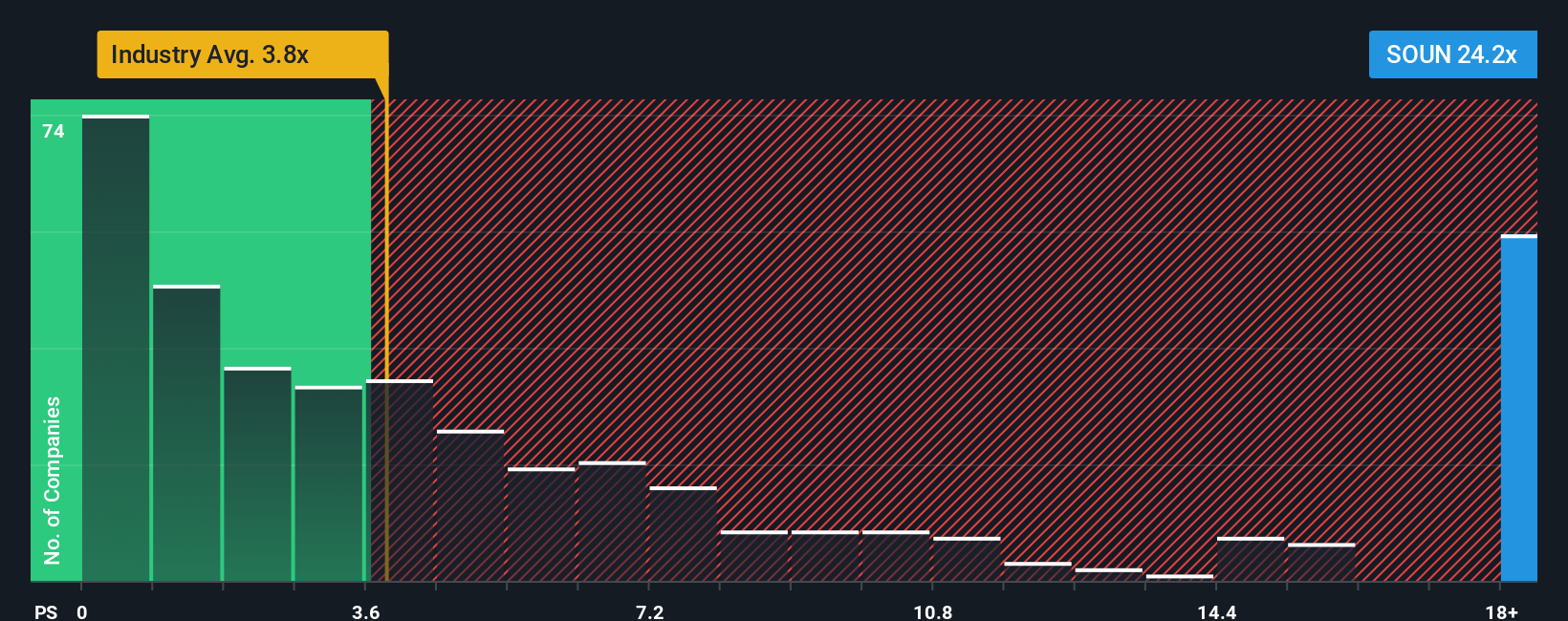

Even after such a large drop in price, SoundHound AI may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 24.2x, since almost half of all companies in the Software industry in the United States have P/S ratios under 3.8x and even P/S lower than 1.5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does SoundHound AI's P/S Mean For Shareholders?

Recent times have been advantageous for SoundHound AI as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SoundHound AI's future stacks up against the industry? In that case, our free report is a great place to start.How Is SoundHound AI's Revenue Growth Trending?

SoundHound AI's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 121% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 44% during the coming year according to the eight analysts following the company. With the industry only predicted to deliver 32%, the company is positioned for a stronger revenue result.

With this information, we can see why SoundHound AI is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On SoundHound AI's P/S

A significant share price dive has done very little to deflate SoundHound AI's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that SoundHound AI maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.