Please use a PC Browser to access Register-Tadawul

Woodward (WWD): Evaluating Valuation After $200 Million Aerospace Expansion Announcement in Spartanburg County

Woodward, Inc WWD | 294.85 | -1.17% |

If you follow Woodward (WWD), this week’s big announcement about its new precision manufacturing facility in Greer will have caught your eye. The company’s nearly $200 million investment in Spartanburg County is more than just another factory. It signals a focused push into high-tech aerospace markets, as Woodward positions itself at the center of next-generation flight controls. With plans to power Airbus A350 spoiler systems from this site, and a partnership with local organizations, Woodward is sharpening its competitive edge in a growing sector.

This move comes on the heels of steady momentum for Woodward over the past year. The stock has gained 42% during this period, far outpacing broader market indices, and investors have seen a strong year-to-date upswing as well. While shares dipped modestly over the past month, the company’s multi-year returns are striking, and recent dividend affirmations suggest resilience even as expansion ramps up.

So after this flurry of strategic investment and a strong run in the stock, are investors looking at a compelling entry point, or has the market already priced in Woodward’s next phase of growth?

Most Popular Narrative: 17% Undervalued

According to the most widely followed narrative, Woodward is trading notably below its forecast fair value. This suggests significant undervaluation based on future growth and execution assumptions.

"Woodward's recent wins in electric and hybrid aircraft propulsion components (A350 spoiler actuator program, Safran electromechanical actuation acquisition) position it for outsize long-term growth as the aerospace industry shifts toward cleaner and more energy-efficient platforms, indicating higher future revenue and recurring aftermarket streams."

Want to know what’s fueling analyst optimism? The numbers behind this bullish narrative point to ambitious profit growth and a bold future valuation, a scenario rarely seen in the industrial sector. Curious about the critical assumptions and forecasts driving this high target? Dig deeper to unravel the financial projections changing the game for Woodward.

Result: Fair Value of $291.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy capital investments and rapid shifts in aerospace technology could pressure margins and test Woodward’s ability to sustain high growth.

Find out about the key risks to this Woodward narrative.Another View: Looking Through a New Lens

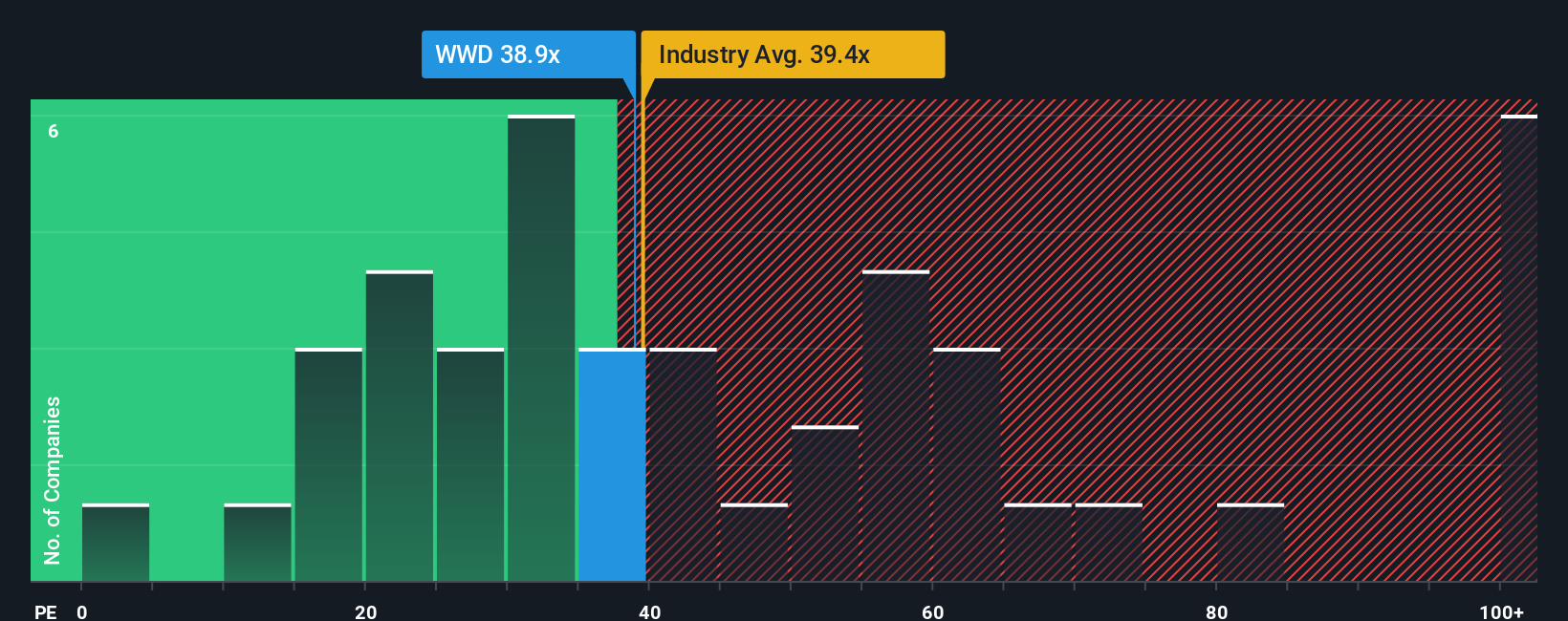

Not all analysts agree on Woodward's valuation. When comparing its price-to-earnings ratio to the broader industry, shares actually look a bit expensive. This challenges the idea that the stock is undervalued. Could expectations already be too high?

Build Your Own Woodward Narrative

If these perspectives don’t quite match your outlook, why not take a hands-on approach? You can dive into the numbers and shape your own insights in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Woodward.

Looking for more investment ideas?

Opportunities in the market are changing fast, and being proactive could give you a clear advantage. Don’t let the next big win slip through your fingers. Simply Wall St's tools help you spot unique angles that others might overlook.

- Spot rare gems by targeting undervalued companies showing exceptional cash flow strength with our curated list of undervalued stocks based on cash flows.

- Uncover AI-powered disruptors by seeking out high-growth innovators using our dynamic resource for AI penny stocks.

- Boost your portfolio’s income potential by browsing businesses with above-average payouts via our specialized guide to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.