Please use a PC Browser to access Register-Tadawul

World Kinect Turnaround Focuses On Core Profitability And Shareholder Returns

World Kinect Corporation WKC | 24.97 | -6.09% |

- World Kinect (NYSE:WKC) is advancing its turnaround by divesting non-profitable land divisions.

- The company is also pursuing aggressive share repurchases to reduce its share float.

- These actions represent a clear shift in how WKC is shaping its business mix and capital allocation.

World Kinect, known for its energy and related services, is reshaping its portfolio by exiting land operations that are not profitable. For you as an investor, that means the business mix could lean more toward units that management views as core, with fewer resources tied up in weaker segments.

At the same time, the ongoing buybacks shrink the share count, which can change how you think about per share metrics and ownership stakes over time. As this turnaround progresses, the key questions will be how effectively WKC reallocates capital and how the remaining operations support its longer term business goals.

Stay updated on the most important news stories for World Kinect by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on World Kinect.

Quick Assessment

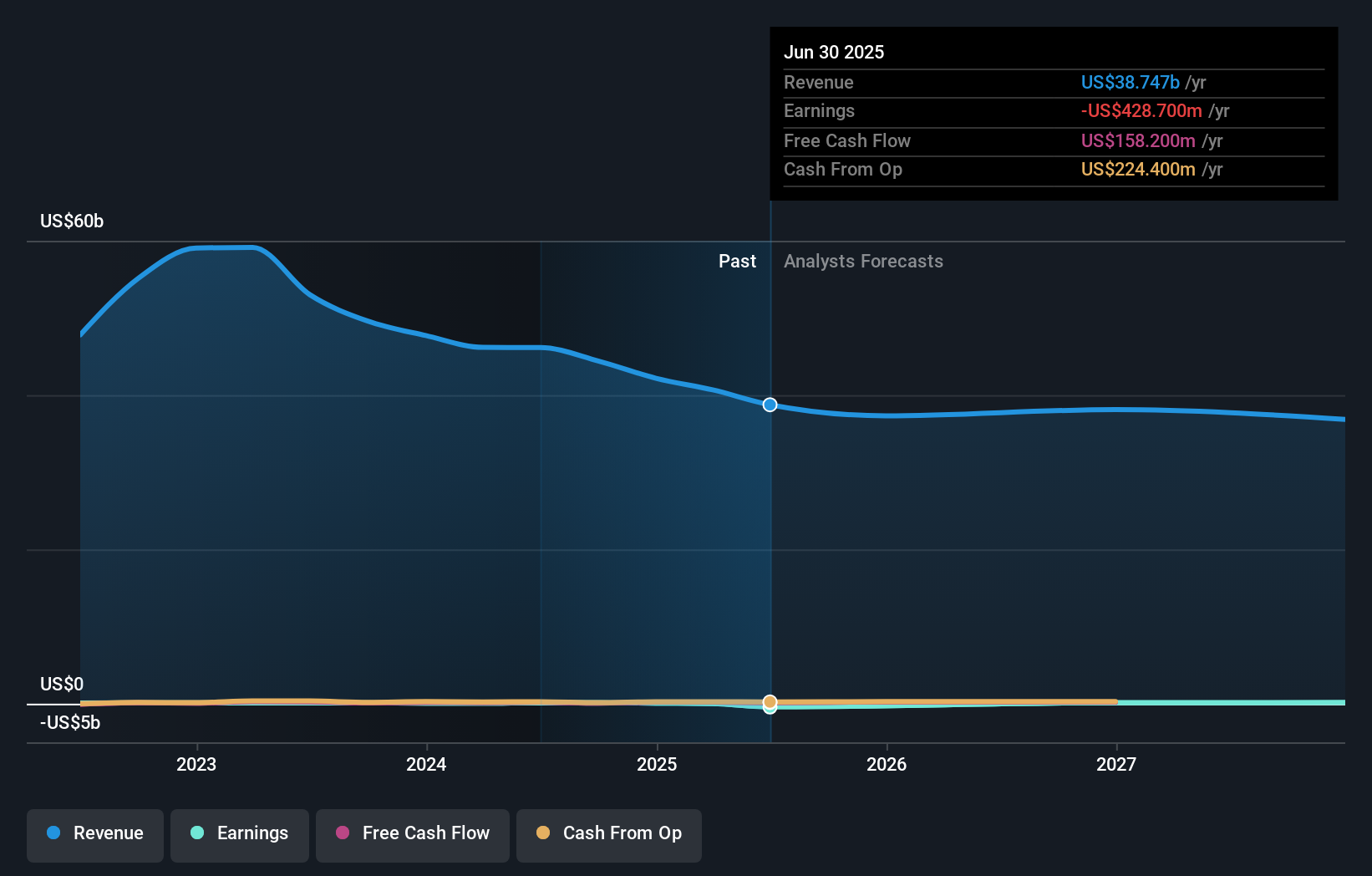

- ⚖️ Price vs Analyst Target: At US$27.99, the price is about 2% below the US$28.67 analyst target, sitting close to consensus.

- ✅ Simply Wall St Valuation: Simply Wall St estimates the shares are trading roughly 36% below fair value, which screens as undervalued.

- ✅ Recent Momentum: The 30 day return of about 6.4% points to positive short term momentum as the turnaround takes shape.

Check out Simply Wall St's in depth valuation analysis for World Kinect.

Key Considerations

- 📊 The exit from loss making land divisions and buybacks both tilt the story toward core profitability and per share metrics.

- 📊 Watch how net income, EPS and share count evolve as assets are sold and capital is returned to shareholders.

- ⚠️ With a 2.86% dividend not covered by current earnings, you need to judge how sustainable the payout is during this turnaround.

Dig Deeper

For the full picture including more risks and rewards, check out the complete World Kinect analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.