Please use a PC Browser to access Register-Tadawul

W.W. Grainger (GWW): Valuation Insights Following Analyst Downgrades and Insider Share Sale

W.W. Grainger, Inc. GWW | 1020.42 | -0.89% |

If you’ve been following W.W. Grainger (GWW) lately, you might be weighing what to do next with the stock. After the company’s latest earnings report, some big-picture questions are swirling. Several analysts cut their outlook for Grainger, citing ongoing macroeconomic uncertainty, slower growth in contract values, and particularly softer margins in its key North American segment, even as Grainger delivered better-than-expected revenue. To add to the mix, the Chief Technology Officer recently sold a substantial portion of his shares, which tends to sharpen investors’ focus on why insiders might be trimming stakes right now.

Stepping back, Grainger’s shares have moved unevenly throughout the year. The stock is up 2% over the past twelve months but is down around 4% year-to-date, hinting at caution overcoming momentum. Over the longer term, however, it’s hard to ignore nearly tripled shareholder returns over five years, suggesting that the business has steadily rewarded patient owners, even if concerns are cropping up in the short run.

As the dust settles from recent earnings and insider selling, the question remains whether the current price offers investors an attractive opportunity or if the market is already accounting for Grainger’s future growth and potential risks.

Most Popular Narrative: 3.6% Undervalued

The latest analysis suggests W.W. Grainger may be trading slightly below its fair value, reflecting optimism for steady growth but limited immediate upside. This consensus gathers together forecasts for rising earnings, robust free cash flow, and the company's continued investment in digital and supply chain capabilities, which help offset near-term risks.

As ongoing upgrades to aging U.S. infrastructure necessitate steady MRO demand, Grainger's entrenched relationships and supply chain scale uniquely position it to capture incremental high-touch and digital revenue growth as customers prioritize reliability and efficiency.

Want to see what is driving analysts’ confidence in Grainger’s future? The path to this fair value is paved with bold growth bets, higher margins, and an ambitious profit outlook. The narrative contains key financial projections that may surprise you. Find out what numbers are lighting up the valuation models behind the scenes.

Result: Fair Value of $1,041.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure from tariff costs and a slow recovery in industrial demand could challenge the optimistic outlook for Grainger's steady growth.

Find out about the key risks to this W.W. Grainger narrative.Another View

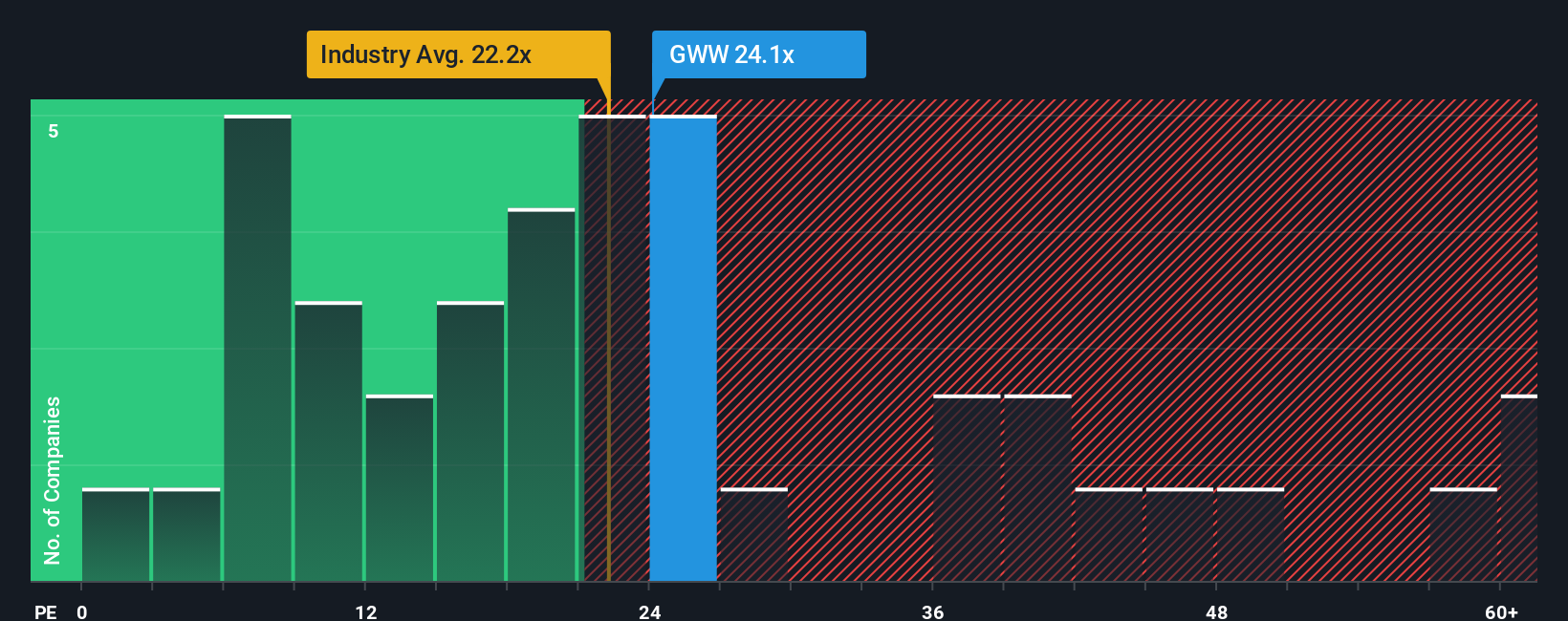

Looking from another perspective, the company appears pricier than the industry average when evaluating its price-to-earnings ratio. This could suggest the market has already priced in a lot of optimism, so which outlook will prove right?

Build Your Own W.W. Grainger Narrative

If you have your own take on the numbers or want to draw your own conclusions, you can quickly build a personalized narrative in just minutes. Do it your way.

A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act now to expand your watchlist with winning opportunities. Don’t settle for the usual picks when you can target overlooked gems and tomorrow’s leaders with purpose-built tools designed to keep you ahead.

- Capture high yields for your portfolio as you scan the market for sustainable payouts using dividend stocks with yields > 3%.

- Uncover hidden potential in healthcare innovation by searching for companies transforming medicine with artificial intelligence through healthcare AI stocks.

- Position yourself for the next wave of value by tracking stocks that may be underappreciated by the market with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.