Please use a PC Browser to access Register-Tadawul

XPEL (XPEL) Is Up 6.0% After Announcing OEM Window Tinting Partnership With Tesla and Major Investments Has The Bull Case Changed?

XPEL, Inc. XPEL | 53.50 | -2.64% |

- Earlier this week, Tesla announced a partnership with XPEL to offer OEM-approved window tinting services and combined warranty coverage for Tesla vehicles in the US, while XPEL reported third-quarter 2025 revenue above analyst forecasts but an earnings per share miss, alongside plans for up to US$150 million in capital investments over the next two years.

- This collaboration gives XPEL direct access to Tesla's customer base and underscores strong industry recognition of XPEL's products by a leading automaker.

- We'll now explore how XPEL's entry into Tesla's ecosystem could shift the company's growth narrative and future prospects.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

XPEL Investment Narrative Recap

To be a shareholder in XPEL, you generally need to believe in long-term growth for automotive aftermarket protection and customization, as well as the company’s ability to maintain premium positioning despite international competitive pressures. The new partnership with Tesla strengthens XPEL’s visibility and market reach but does not fully resolve near-term risks tied to increased competition from lower-cost Asian manufacturers, which continues to threaten pricing power and margins. Among the recent announcements, XPEL’s plan to invest up to US$150 million in manufacturing and supply chain improvements is especially relevant. This initiative aims to support future growth and potentially boost margins, helping the company scale up to meet higher OEM demand, like that seen in the Tesla partnership, while providing some cushion against cost pressures and volatility within the global automotive sector. However, investors should be aware that rising competition from lower-cost Asian suppliers has not gone away and…

XPEL's narrative projects $644.9 million in revenue and $100.3 million in earnings by 2028. This requires 12.8% yearly revenue growth and an earnings increase of $51.6 million from the current $48.7 million.

Uncover how XPEL's forecasts yield a $52.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

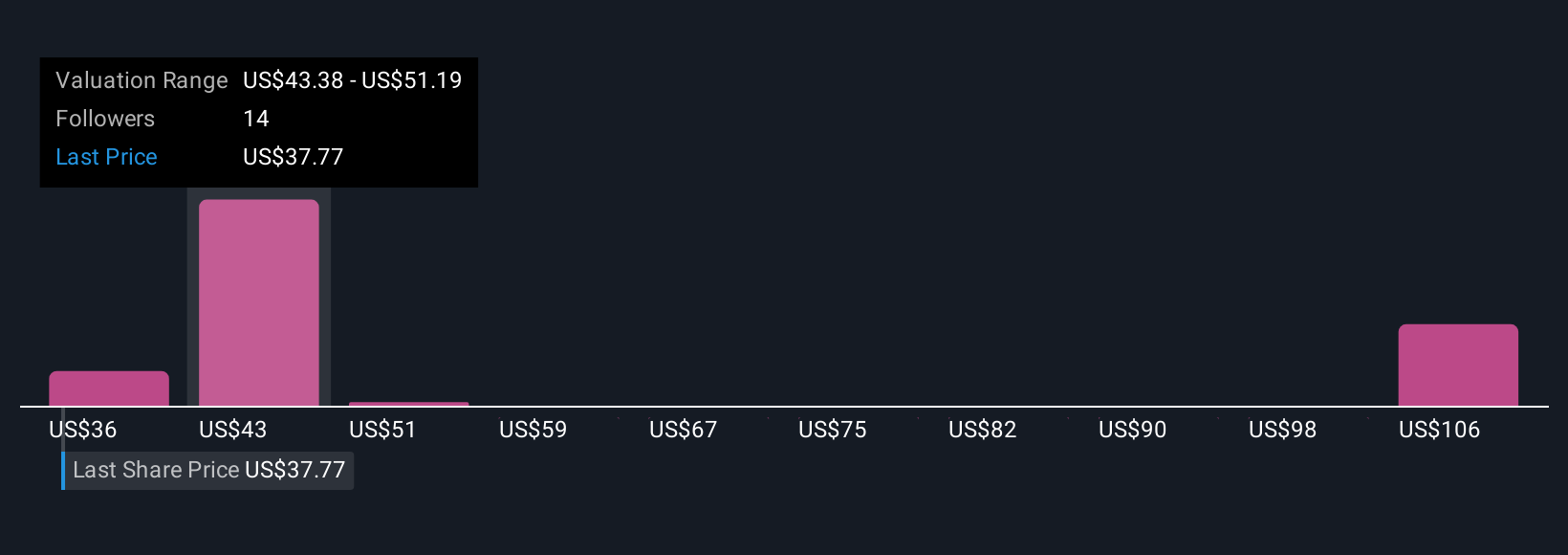

Six members of the Simply Wall St Community provided XPEL fair value estimates ranging from US$35.58 to US$116.79, highlighting diverging views. As competitive threats persist, it is worth considering how different perspectives may shape your own outlook on XPEL.

Explore 6 other fair value estimates on XPEL - why the stock might be worth 24% less than the current price!

Build Your Own XPEL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPEL research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free XPEL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPEL's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.