Please use a PC Browser to access Register-Tadawul

Xylem Sharpens 80 20 Focus As Evoqua Deal Closes And Dividend Rises

Xylem Inc. XYL | 128.67 | -0.42% |

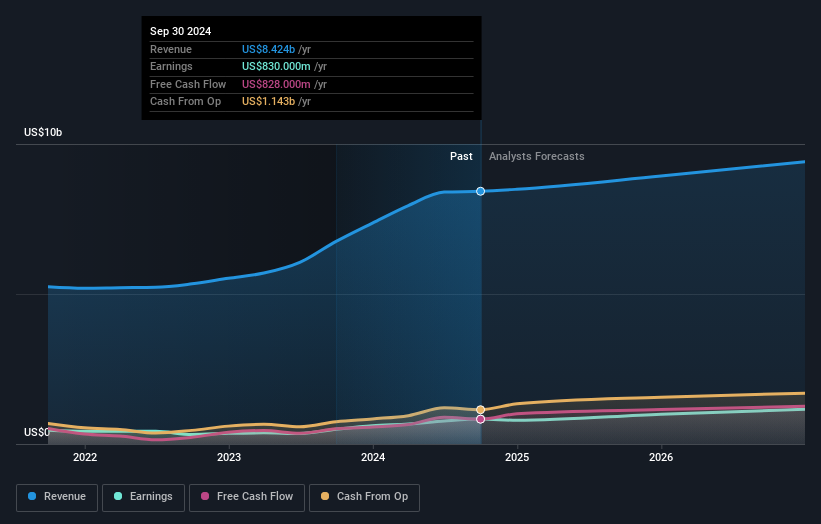

- Xylem (NYSE:XYL) has completed the integration of its US$7.5b Evoqua acquisition ahead of schedule.

- The company is launching Phase 2 of its transformation plan with an "80/20" focus on higher quality earnings.

- Xylem plans to exit certain lower margin and selected international operations, including a retreat from the Chinese market.

- The board approved an 8% increase in the quarterly dividend, reflecting confidence in financial resilience.

Xylem, trading at $126.77, is reshaping its portfolio around businesses it identifies as higher quality and more profitable over time. The company is moving away from lower margin lines and some international exposure, including China, while bedding down the completed Evoqua integration. For shareholders, the 8% dividend increase adds a cash return element in addition to any movement in the share price.

For you as an investor, the key question is whether this tighter "80/20" focus and smaller geographic footprint align with your view of risk and opportunity in the water sector. The ahead of schedule integration and dividend uplift indicate that management is comfortable with the balance sheet impact of the Evoqua deal. At the same time, the exit from China and other areas introduces execution and transition risk that is worth watching closely.

Stay updated on the most important news stories for Xylem by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Xylem.

The 8% increase in the quarterly dividend to US$0.43 per share sits alongside record 2025 results, with revenue of US$9,035 million and net income of US$957 million. That combination suggests the board is comfortable that cash generation can support a higher cash return even as Xylem works through a self imposed reset from its 80/20 pivot and retreat from China. Management is guiding 2026 revenue to a range of US$9.1 billion to US$9.2 billion, which is only 1% to 3% above 2025 on a reported basis. As a result, the higher payout comes at a time when top line growth is expected to be relatively modest.

How This Fits Into The Xylem Narrative

- The dividend uplift, together with record revenue and earnings, supports the existing narrative that business optimization and integration of Evoqua are improving margins and earnings visibility over time.

- The decision to walk away from low margin volume and exit markets such as China could challenge earlier growth assumptions in the narrative, which leans on broad end market demand and expanding addressable markets.

- The sharper 80/20 focus and retreat from certain regions may not be fully reflected in older narrative expectations around geographic diversification and exposure to developing markets.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Xylem to help decide what it is worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ The 80/20 pivot and retreat from China and other lower margin operations could lead to revenue pressure if replacement opportunities in core markets do not materialize as planned.

- ⚠️ Cautious 2026 guidance and weaker than expected demand for water treatment equipment introduce the risk that dividend growth outpaces earnings growth if conditions stay soft.

- 🎁 Record 2025 revenue and earnings, together with the ahead of schedule Evoqua integration, point to an operating model that is already supporting higher quality earnings.

- 🎁 The 8% dividend increase signals management confidence in future cash flows and may appeal if you are seeking a growing income stream from a water technology provider competing with names such as Pentair, A. O. Smith, or Danaher’s water related businesses.

What To Watch Going Forward

From here, it is worth tracking whether Xylem can hold or expand margins in 2026 as it exits low margin contracts and reduces exposure to China, while still delivering on its revenue guidance range. Keep an eye on free cash flow relative to dividend commitments, progress on Phase 2 initiatives such as sales force effectiveness and product refresh, and any updates to guidance as demand for water treatment equipment evolves. Analyst reactions and changes to consensus expectations will also help you judge whether the market views the 80/20 pivot and higher dividend as disciplined capital allocation or as a stretch against a softer near term outlook.

To ensure you are always in the loop on how the latest news impacts the investment narrative for Xylem, head to the community page for Xylem to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.