Please use a PC Browser to access Register-Tadawul

Yum China (NYSE:YUMC): Evaluating Valuation After Bold 2025 Expansion and Technology Push

Yum China Holdings Inc YUMC | 57.16 | -1.37% |

Yum China Holdings (NYSE:YUMC) just laid out a bold roadmap to open as many as 1,800 net new stores next year, with most of these set to appear in smaller, previously untapped cities. Alongside these expansion plans, the company is doubling down on technology by introducing AI-powered tools and experimenting with flexible store designs to drive greater efficiency. For investors, these moves paint a clear picture: management is serious about capturing new growth, even as the competitive landscape continues to heat up.

In this context, Yum China’s shares have climbed 39% over the past year, rebounding from a sluggish start and demonstrating fresh momentum over the past three months. This improvement marks a turnaround, especially considering lackluster longer-term returns. Meanwhile, steady revenue and income growth suggest that the company’s efficiency efforts and digital platform investments are translating into real gains, not just headline excitement.

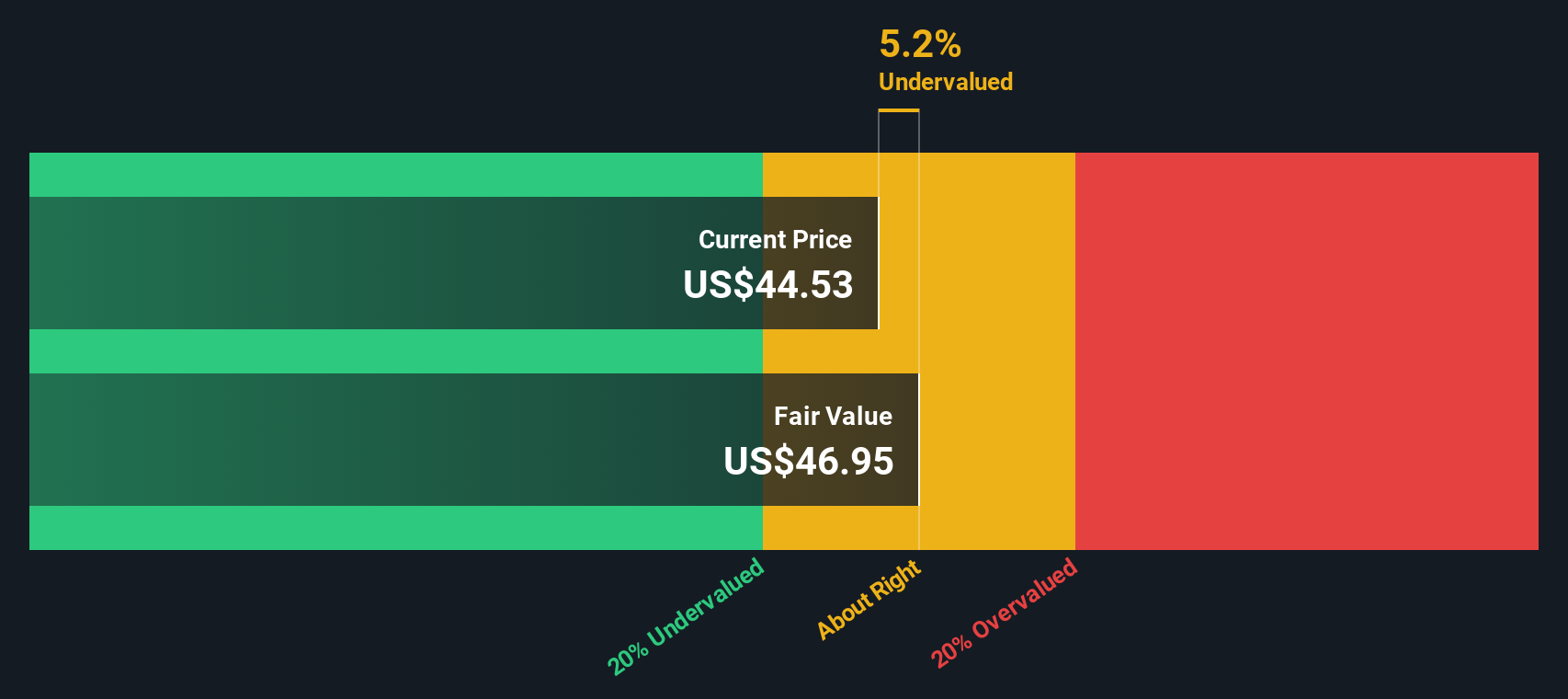

Still, with the stock rallying this year on ambitious plans and improved earnings, it is worth considering whether the market has already priced in all the good news about Yum China’s prospects at current levels.

Most Popular Narrative: 21.9% Undervalued

According to community narrative, Yum China Holdings appears significantly undervalued based on analyst expectations surrounding future growth and profitability versus today's share price.

“Deepening digital ecosystem investments (for example, Super App, Mini programs, AI-driven end-to-end digitization, and frontline innovation fund) enhance customer engagement, drive higher transaction frequency, and improve operational efficiencies, positively impacting both revenues and net margins.”

Want to know why the fair value is so much higher than today's price? Here is a hint: the bold numerical assumptions hiding behind the target involve steady growth, rising profits, and a future valuation multiple that suggests strong confidence. Wondering what really drives those numbers? The answer might surprise you.

Result: Fair Value of $58.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising labor costs and intensifying local competition could hinder margin expansion and slow Yum China’s ambitious growth trajectory in the coming years.

Find out about the key risks to this Yum China Holdings narrative.Another View: What Does the DCF Say?

Our DCF model, which considers Yum China’s future cash flows instead of market multiples, suggests shares are also below fair value. However, it raises the question: are long-term projections or today’s market signals more reliable?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Yum China Holdings Narrative

If you want to take a different angle or would rather dig into the numbers on your own, it is easy to create and share your own perspective. You can do this in just a few minutes, so why not do it your way?

A great starting point for your Yum China Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for the obvious when you can elevate your investment strategy? Maximize your chances to spot winning trends, resilient companies, and emerging sectors most investors might overlook. Here are three smart ways to energize your next move. Skip hesitation and get ahead of the crowd:

- Uncover robust income streams by targeting reliable companies with dividend stocks with yields > 3% and watch your portfolio benefit from attractive yields.

- Jump on the momentum of healthcare innovation with fresh picks among healthcare AI stocks already transforming patient care and diagnostics.

- Fuel your search for long-term value and stability with a curated selection of undervalued stocks based on cash flows that could present rare opportunities at today’s prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.