Please use a PC Browser to access Register-Tadawul

Zillow Ruling Clarifies Listing Rules And Competition With Compass And Anywhere

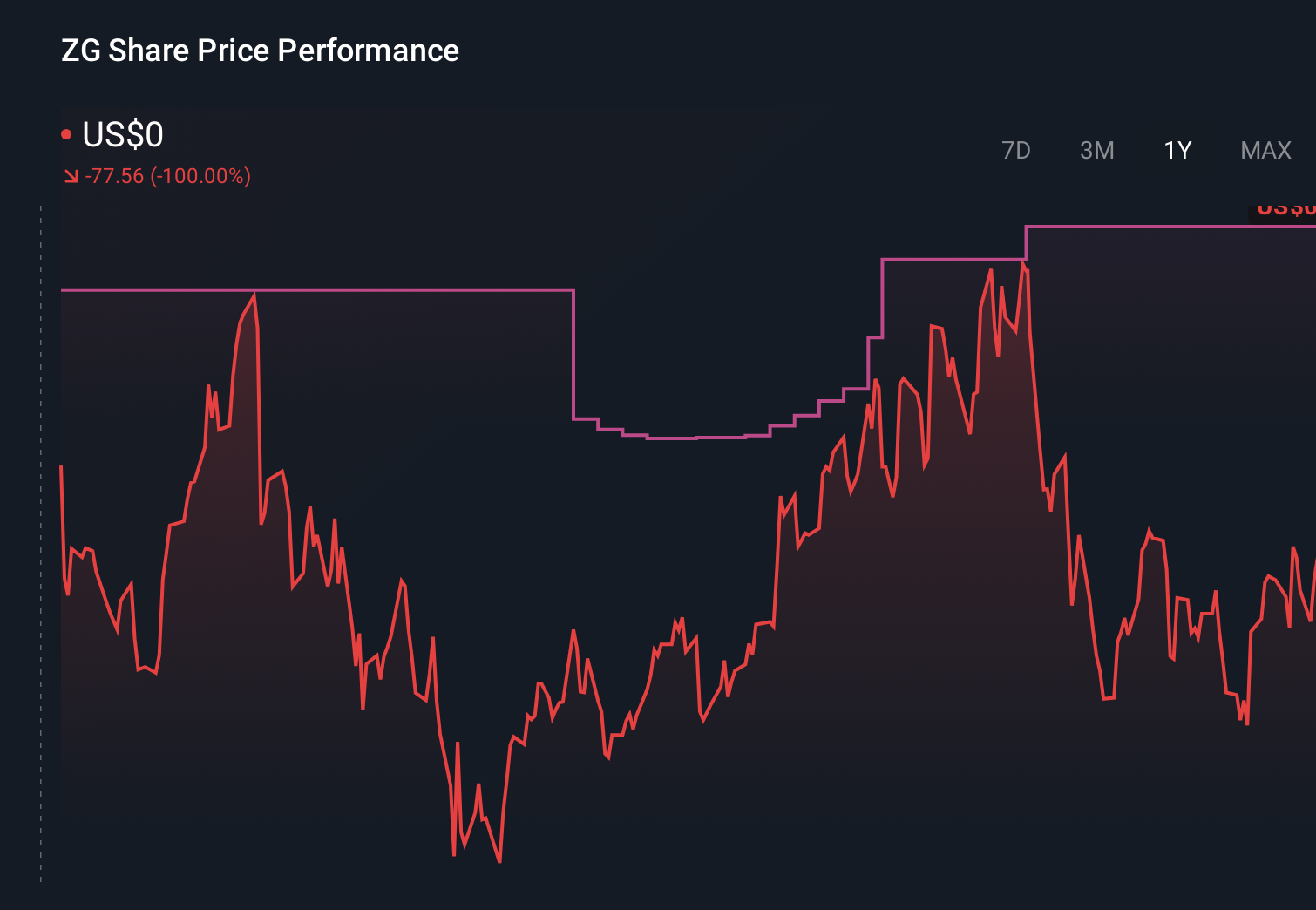

Zillow Group, Inc. Class A ZG | 45.42 | -0.26% |

- Federal judge upholds Zillow Group's listing policy in Compass litigation.

- Ruling affirms Zillow's ban on private home listings on its platform.

- Decision arrives as exclusive and private listings face increased industry scrutiny.

- Case unfolds against the backdrop of Compass's merger with Anywhere.

Zillow Group, traded as NasdaqGS:ZG, runs one of the most widely used online real estate platforms, connecting homebuyers, sellers, renters, and agents. The court's backing of its policy against private listings reinforces Zillow's preference for broad, public exposure of listings at a time when some brokerages have leaned into more exclusive approaches. With Compass and Anywhere combining, competitive tensions around how and where listings appear online remain in focus for investors watching digital real estate portals.

For you, the ruling helps clarify how Zillow intends to position its marketplace in relation to traditional brokerages and exclusive listing models. The long term impact on traffic, agent relationships, or revenue mix is uncertain, but the legal outcome sets a clear boundary for how listings may be displayed on Zillow's platform going forward.

Stay updated on the most important news stories for Zillow Group by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Zillow Group.

The court decision supports Zillow Group’s choice to keep private listings off its platform, which reinforces a model built around open, broadly marketed inventory rather than invite only deals. For you as an investor, that clarifies how Zillow is likely to compete with broker driven networks such as Compass and Anywhere, and with other portals like CoStar’s Homes.com and Redfin that are also vying to be the default place where buyers and sellers first look.

Zillow Group narrative, listing rules and growth ambitions

This ruling ties directly into the existing narratives that focus on listing structure risk and Zillow’s role in the real estate transaction funnel, because it reduces one legal overhang around how inventory is displayed while the company pushes deeper into end to end services like rentals, mortgages and software. The outcome also sits alongside a new US$500m revolving credit facility that can be upsized by US$250m, giving Zillow extra financial flexibility if it wants to keep investing in its integrated platform while the industry debates how exclusive listings and commissions should work.

Risks and rewards investors should weigh

- ⚠️ Legal and regulatory frameworks around listings and commissions are still evolving, so future rules or challenges could affect how Zillow, Compass, Redfin and others are allowed to market homes.

- ⚠️ The credit agreement includes leverage based covenants, so heavy use of the US$500m facility could introduce constraints if earnings soften or housing activity slows.

- 🎁 A clear win on this policy may help Zillow keep its value proposition centered on transparency and reach, which can matter for agents deciding where to focus their online spend.

- 🎁 Access to a revolving facility of up to US$750m, if fully expanded, provides optional funding capacity for product investment or acquisitions without locking in long term debt immediately.

What to watch next

From here, you may want to watch whether brokers adjust their listing behavior in response to the ruling, how quickly the Compass and Anywhere merger reshapes competition, and whether Zillow starts drawing on its revolving facility as it pursues rentals, mortgage and software initiatives. If you want a broader view of how this legal outcome fits into the longer term story, take a look at the community narratives for Zillow Group by heading to the latest community views and narratives on Zillow Group.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.