Please use a PC Browser to access Register-Tadawul

ZIM Integrated Shipping Services (NYSE:ZIM): Assessing Valuation as Earnings Forecast Points to Sharp Decline

ZIM Integrated Shipping Services Ltd. ZIM | 18.76 | -5.40% |

Investors are turning their focus to ZIM Integrated Shipping Services (NYSE:ZIM) ahead of the company's next earnings release. Anticipation is running high because analysts are forecasting a steep drop in both earnings per share and revenue compared to last year.

ZIM Integrated Shipping Services’ share price has moved sideways in recent weeks, but the 1-year total shareholder return of 12.2% suggests that longer-term investors have still come out ahead. With the earnings outlook dimming, market momentum shows early signs of fading as traders weigh what is next for the company.

If you are curious about what other companies are capturing investor interest, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With price targets only slightly above current levels and a gloomy earnings forecast, investor sentiment appears cautious. However, does this create an undervalued entry point for ZIM shares, or is the market already bracing for slower growth?

Most Popular Narrative: 4.9% Overvalued

With ZIM Integrated Shipping Services closing at $13.91, the most widely followed narrative sees its fair value at $13.26, just below recent levels. A modest premium points to notable skepticism about the stock’s future growth drivers.

The company's significant exposure to volatile Transpacific trade leaves earnings highly sensitive to tariff changes and geopolitical shifts. The current overhang of U.S. and China tariffs, unpredictable regulatory moves, and alliance restructurings threaten both volume and rate stability. These factors challenge assumptions that future earnings will be resilient or steadily expanding.

What’s fueling this view? It’s not just about short-term shipping disruptions. The real intrigue is in the bold earnings forecast, margin compression, and a future profit multiple that’s more in line with hot-growth sectors than a cyclical shipping operator. Want to know the precise levers behind this surprisingly rich valuation? Dive in to see what’s driving these figures and why analysts are still split on the outcome.

Result: Fair Value of $13.26 (OVERVALUED)

However, ZIM’s move toward a modernized, cost-efficient fleet and expansion into Southeast Asia could help cushion against some of the expected earnings headwinds.

Another View: Earnings Outperform on Multiples

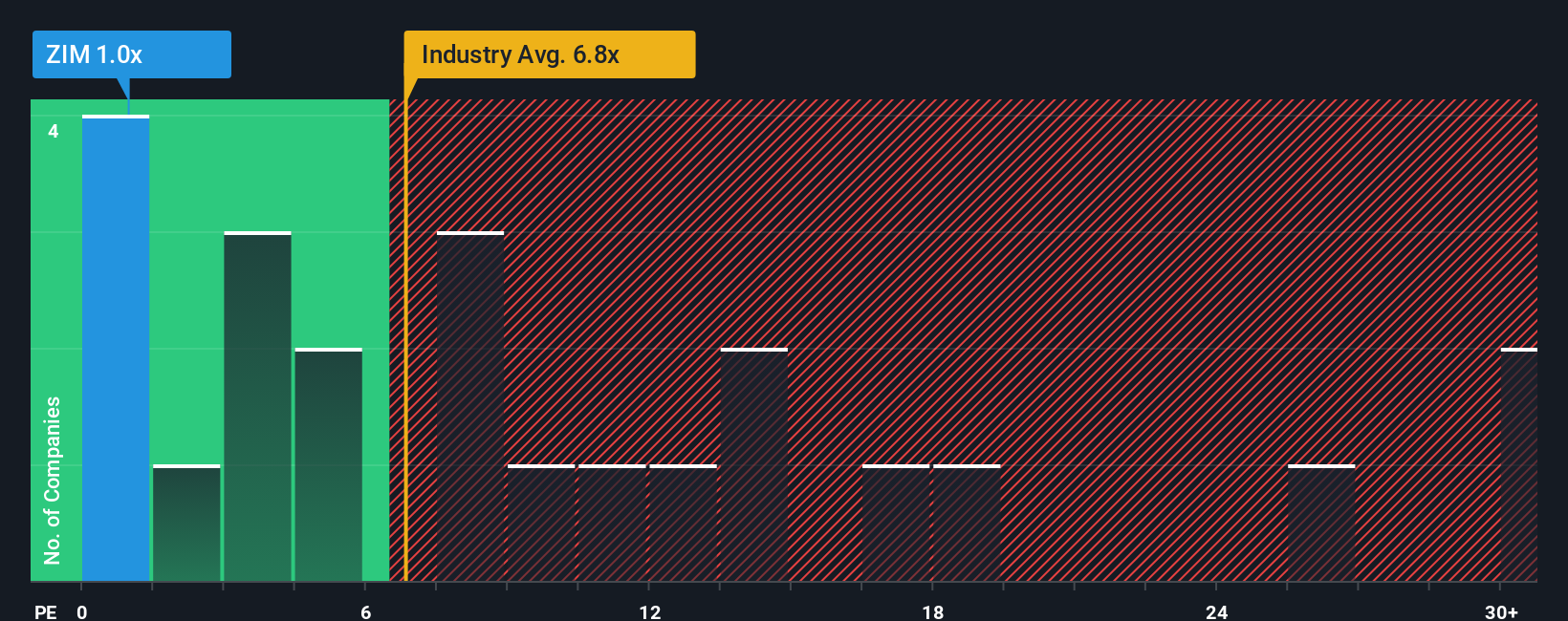

While the consensus narrative points to ZIM stock being slightly overvalued, the market’s usual yardstick, a price to earnings of just 0.8x, shows ZIM dramatically cheaper than the US shipping industry average of 6.5x and its peers at 7.8x. Even so, the fair ratio stands at 0.6x, meaning ZIM trades a touch above that but far below the rest of the sector. This deep discount hints at potential skepticism or a rare opportunity. Are skeptical investors missing the next wave, or are the low multiples warning of trouble ahead?

Build Your Own ZIM Integrated Shipping Services Narrative

If you have a different perspective or want to analyze the numbers on your own terms, building your unique viewpoint only takes a couple of minutes. Do it your way

A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one stock when you can give your portfolio an edge? Seize new opportunities by exploring carefully pre-screened stocks with standout characteristics tailored to today’s market trends.

- Unlock the potential for powerful returns by spotting these 896 undervalued stocks based on cash flows, primed for growth based on solid underlying cash flows and mispriced market sentiment.

- Ride the momentum of digital transformation and seek gain acceleration by targeting innovation leaders with these 24 AI penny stocks, positioned at the forefront of artificial intelligence breakthroughs.

- Secure dependable income streams by tapping into these 19 dividend stocks with yields > 3%, which consistently reward shareholders with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.