Please use a PC Browser to access Register-Tadawul

ZIM Integrated Shipping Services (NYSE:ZIM): Exploring the Stock’s Valuation After Recent Share Price Fluctuations

ZIM Integrated Shipping Services Ltd. ZIM | 18.76 20.11 | -5.40% +7.20% Pre |

ZIM Integrated Shipping Services (NYSE:ZIM) stock has seen swings in recent weeks, with shares currently trading at $13.78. Investors paying attention to the broader shipping industry may be wondering how ongoing market shifts could affect ZIM’s performance.

After a volatile year, ZIM’s share price is currently sitting well below its early 2024 highs, as recent swings have followed shifting global shipping trends and changes in investor risk appetite. The stock’s 1-year total shareholder return of -7% paints a less dramatic picture than its sharp year-to-date share price decline, while its three-year total shareholder return remains considerably positive. Momentum appears to have faded but not disappeared entirely.

If you’re curious about other companies riding different momentum waves, now’s the perfect time to see what’s happening among auto manufacturers with our full discovery list: See the full list for free.

With shares trading below recent highs and expectations for slower growth ahead, should investors be looking at ZIM as a potential bargain, or is the market already factoring in all its future prospects?

Most Popular Narrative: 3.9% Overvalued

ZIM Integrated Shipping Services’ current share price of $13.78 is just above the most popular narrative’s fair value of $13.26, with the analyst community signaling little gap between market expectations and future estimates.

The company's significant exposure to volatile Transpacific trade leaves earnings highly sensitive to tariff changes and geopolitical shifts. The current overhang of US and China tariffs, unpredictable regulatory moves, and alliance restructurings threaten both volume and rate stability, challenging assumptions that future earnings will be resilient or steadily expanding.

Ready to see the full picture? Behind this valuation, there is a bold bet on major profit margin swings and a daring future for earnings growth. These are numbers you won’t want to miss. If you want to know what makes this projection stand out, dive in and uncover the narrative’s financial blueprint.

Result: Fair Value of $13.26 (OVERVALUED)

However, if ZIM’s fleet modernization boosts efficiency or new trade lanes bring growth more quickly than expected, the outlook could materially improve.

Another View: Discounted Cash Flow Tells a Different Story

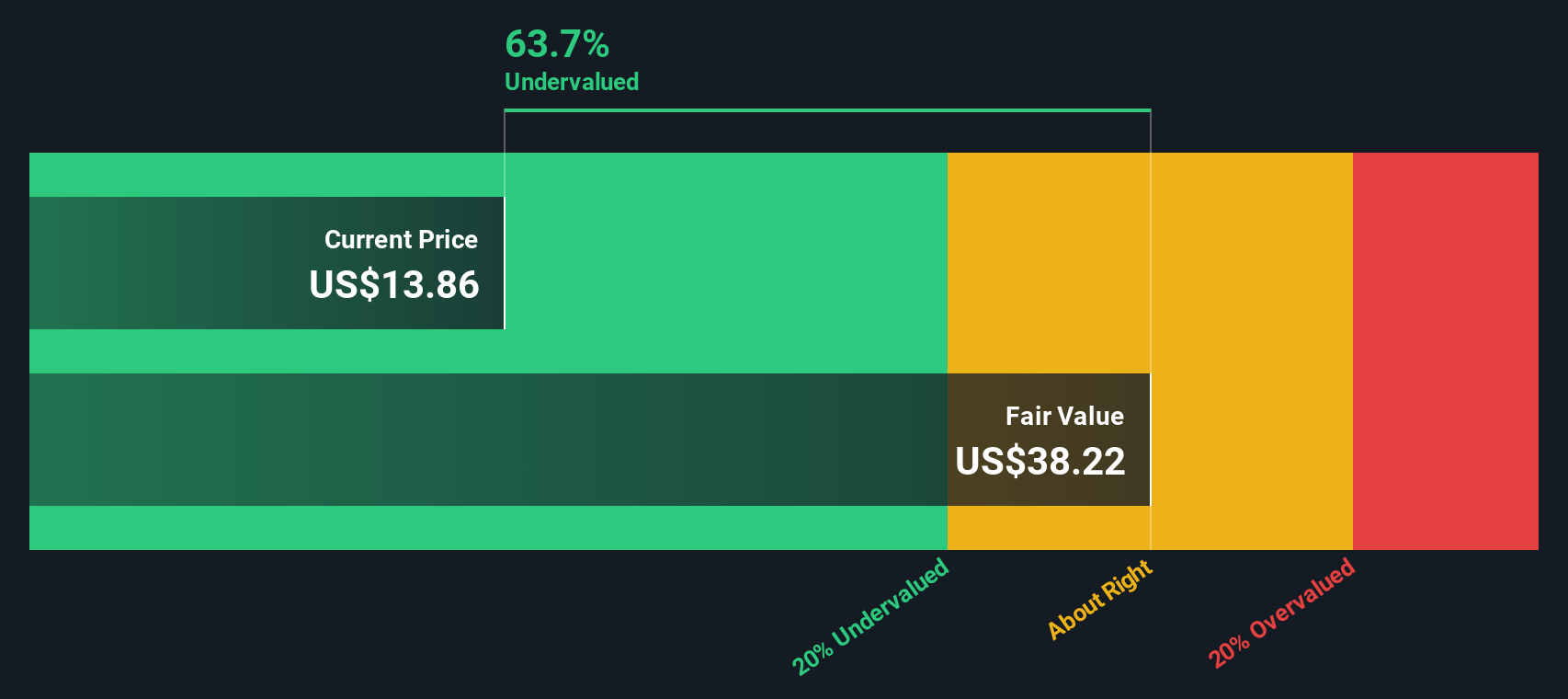

Stepping back from analyst targets and industry comparisons, the SWS DCF model values ZIM at $38.22, which is far above its current price. This suggests the shares may actually be trading at a steep discount. Is the market underestimating ZIM’s long-term cash potential, or are the risks simply too high to ignore?

Build Your Own ZIM Integrated Shipping Services Narrative

If you think there’s another angle or want to test your own ideas, you can piece together your version of the story in under three minutes. Do it your way

A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let great opportunities pass you by. Use the Simply Wall Street Screener now to uncover stocks shaping tomorrow’s market. Your next smart investment move could just be a click away.

- Tap into the possibilities of fast-growing sectors and see which companies are shaping the future of healthcare with these 33 healthcare AI stocks.

- Boost your portfolio with steady income by targeting strong yields through these 17 dividend stocks with yields > 3% that consistently deliver over 3%.

- Catch market momentum early by checking out these 80 cryptocurrency and blockchain stocks driving innovation in the rapidly expanding world of digital assets and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.