Please use a PC Browser to access Register-Tadawul

ZoomInfo Technologies Inc.'s (NASDAQ:GTM) 28% Share Price Plunge Could Signal Some Risk

ZoomInfo Technologies Inc GTM | 6.45 | +0.31% |

To the annoyance of some shareholders, ZoomInfo Technologies Inc. (NASDAQ:GTM) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

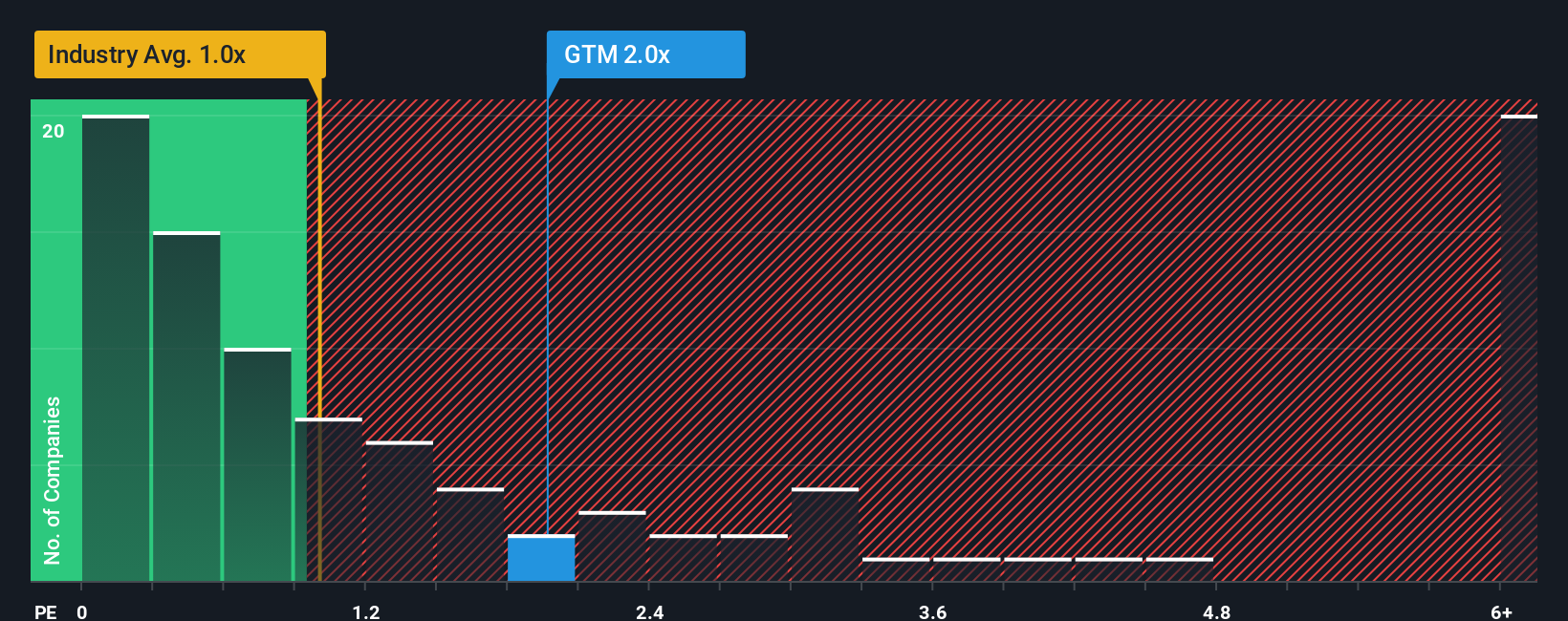

Although its price has dipped substantially, you could still be forgiven for thinking ZoomInfo Technologies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.7x, considering almost half the companies in the United States' Interactive Media and Services industry have P/S ratios below 1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does ZoomInfo Technologies' P/S Mean For Shareholders?

Recent times haven't been great for ZoomInfo Technologies as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ZoomInfo Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as ZoomInfo Technologies' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 22% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 3.9% per annum as estimated by the analysts watching the company. With the industry predicted to deliver 16% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that ZoomInfo Technologies' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

There's still some elevation in ZoomInfo Technologies' P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for ZoomInfo Technologies, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - ZoomInfo Technologies has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on ZoomInfo Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.