Please use a PC Browser to access Register-Tadawul

ZoomInfo Technologies (ZI) Margin Breakout Reinforces Bullish Profitability Narratives

ZoomInfo Technologies Inc GTM | 6.45 | +0.31% |

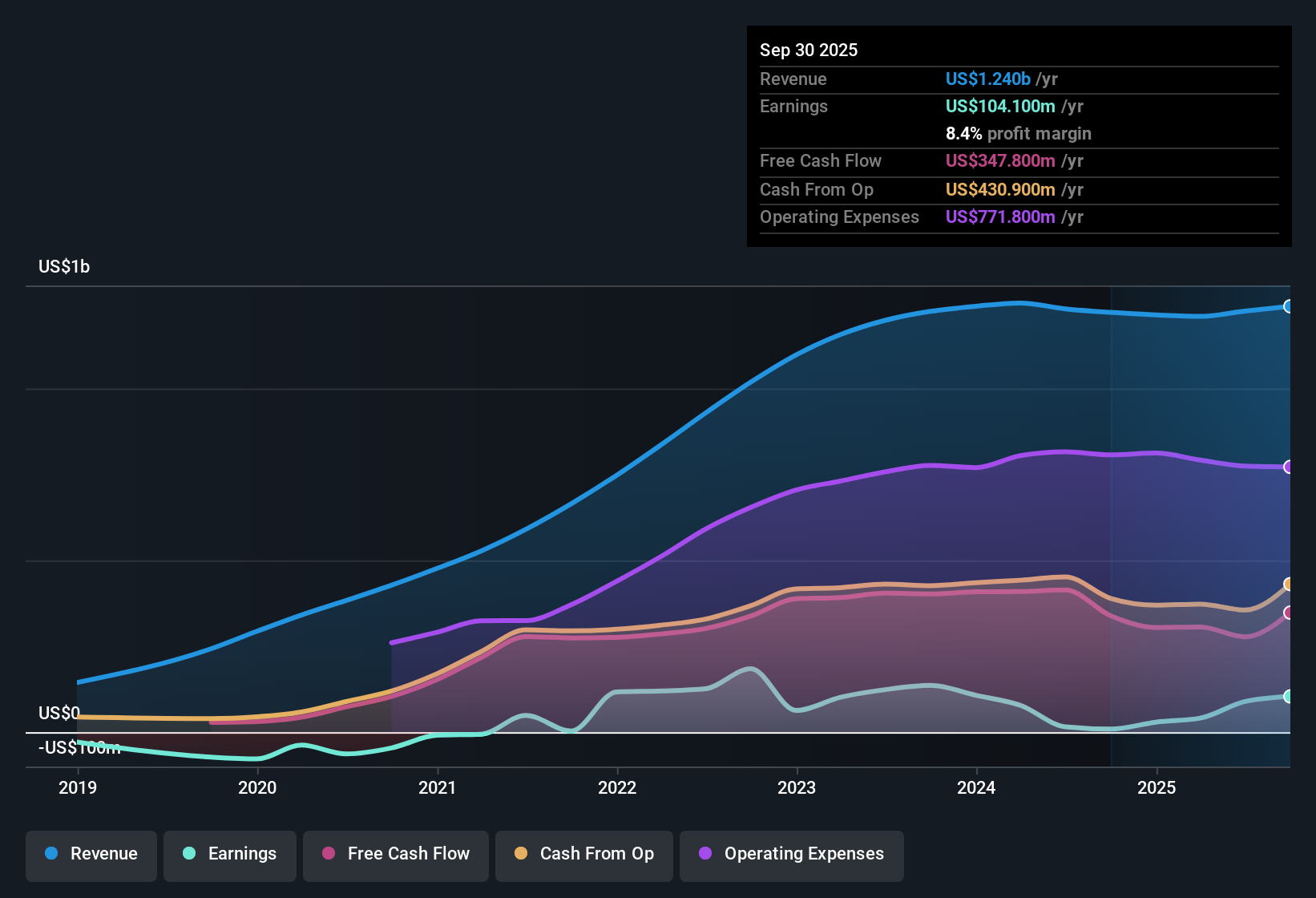

ZoomInfo Technologies (ZI) closed FY 2025 with Q4 revenue of US$319.1 million and basic EPS of US$0.11. Trailing 12 month revenue was US$1.25 billion and EPS was US$0.38, alongside a 326.8% year over year earnings increase. The company’s quarterly revenue moved from US$309.1 million and EPS of US$0.04 in Q4 2024 to US$319.1 million and EPS of US$0.11 in Q4 2025. Trailing 12 month net profit margin was 9.9% compared with 2.4% a year earlier, placing improving profitability at the center of the latest results.

See our full analysis for ZoomInfo Technologies.With the headline numbers on the table, the next step is to see how this earnings run rate aligns with widely held narratives around ZoomInfo, and where the new data may challenge those views.

Margins Climb With 9.9% Net Profit

- On a trailing 12 month basis, ZoomInfo earned US$124.2 million of net income on US$1.25b of revenue, for a 9.9% net profit margin compared with 2.4% a year earlier.

- Consensus narrative talks about higher value, AI driven products and more upmarket customers supporting margins, and the current 9.9% margin and 326.8% year over year earnings growth show that profitability has already moved meaningfully, even though revenue growth of about 2.3% a year is described as modest.

- Supporters of the bullish view point to growing adoption of tools like Copilot and operations solutions, and the margin shift suggests these higher value use cases are translating into more of each US$ of sales dropping to the bottom line.

- At the same time, the improvement in net margin alongside modest top line growth means the recent earnings strength has leaned heavily on profitability gains, which could be a key assumption investors need to test in their own models.

Earnings Growth Outpaces Revenue Trend

- Over the last year, trailing 12 month earnings grew very strongly at 326.8%, while revenue growth is referenced at about 2.3% per year and is described as below the broader US market benchmark of 10.3% revenue growth.

- Bears highlight the risk that a slower revenue path and a shift away from smaller customers could weigh on future earnings, and the current mix of modest revenue expansion with very strong recent earnings growth gives them some footing to argue that future growth may depend on how much of this margin profile proves repeatable.

- The cautious narrative points out that moving upmarket while downmarket revenue declines 11% year over year could limit the customer base, which becomes more relevant when revenue growth is already described as below the market’s 10.3% pace.

- Forecast earnings growth of about 14.1% a year from this higher profit base would need either steadier revenue growth than the recent 2.3% trend or further margin improvement, both of which are key watchpoints for investors leaning toward the bearish case.

Valuation Split Between DCF And P/E

- At a share price of US$6.63, ZoomInfo is described as trading about 61.5% below a DCF fair value of roughly US$17.21, while its trailing P/E of 16.6x sits above both the industry average of 11.5x and a peer average of 11.6x.

- Bulls argue that the gap to the DCF fair value plus a 14.1% forecast earnings growth rate support an appealing setup, and the current combination of a lower price than the US$17.21 DCF fair value with a premium P/E multiple shows why supporters see upside potential while critics focus on what needs to go right to justify paying more than industry averages for this earnings profile.

- The reward side of the thesis leans on the idea that a company earning US$124.2 million over the last 12 months, with a 9.9% margin and earnings growth well over 3x, does not need rapid revenue growth to close some of the gap to DCF fair value.

- On the risk side, the premium P/E alongside an elevated debt level means any disappointment versus the roughly 14.1% earnings growth outlook, or any pressure on margins from higher costs, could matter more for valuation than it would for a lower multiple, lower leverage name.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ZoomInfo Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own angle against the data and shape it into a clear story, then Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

ZoomInfo’s modest revenue growth of about 2.3% a year, premium 16.6x P/E, and elevated debt together leave limited room for disappointment against earnings expectations.

If that mix of slower growth and higher valuation makes you cautious, run your eye over 83 resilient stocks with low risk scores to quickly focus on companies where risk scores and fundamentals look more resilient.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.