Please use a PC Browser to access Register-Tadawul

3 Middle Eastern Dividend Stocks With Up To 6.7% Yield

RIYADH CEMENT 3092.SA | 0.00 |

The Middle Eastern stock markets have recently faced pressure, with indices in Dubai and Abu Dhabi retreating due to firms trading ex-dividend amid broader global economic challenges. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.79% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.49% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.46% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.62% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.63% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.58% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 5.46% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.33% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.26% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.38% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

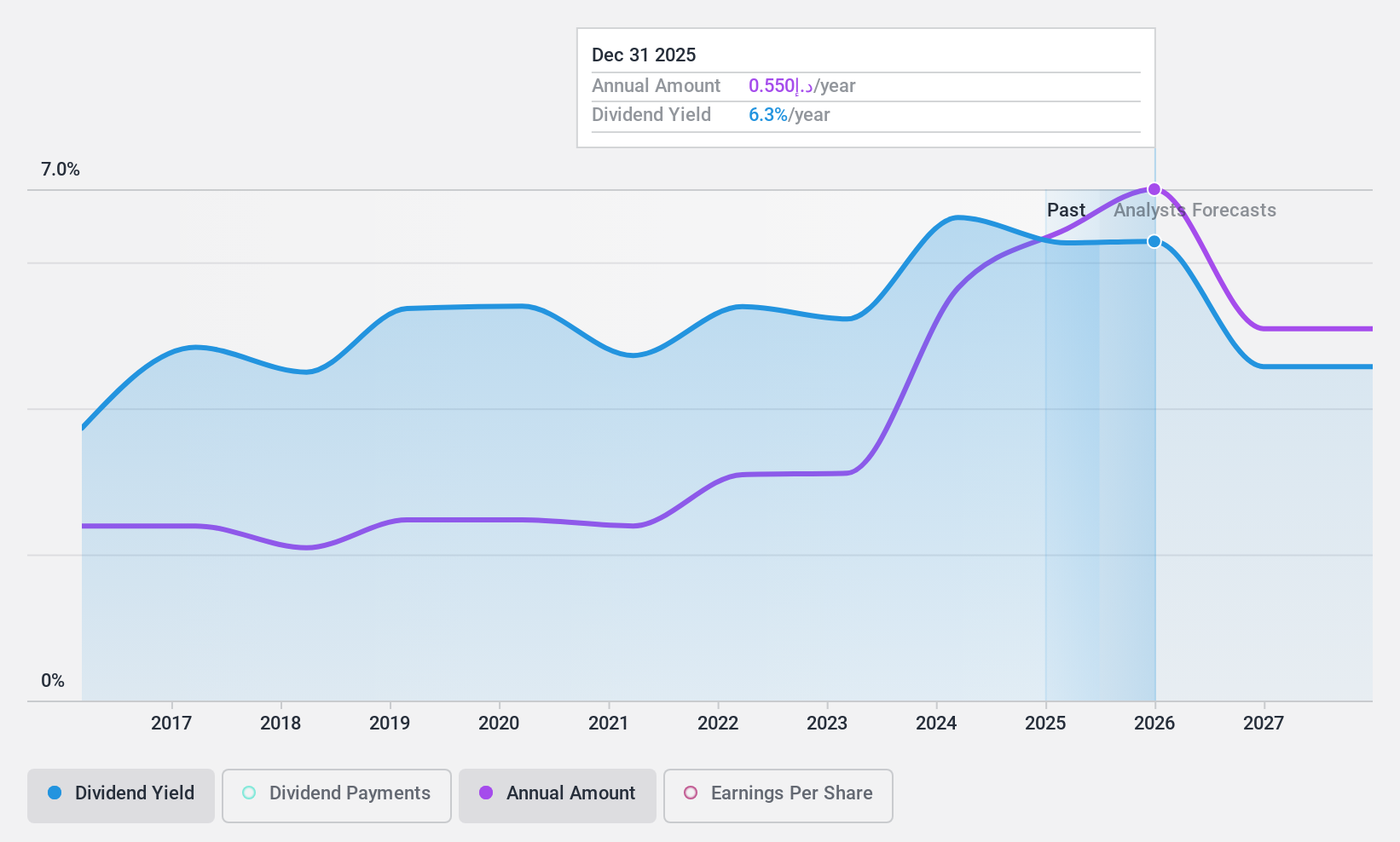

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market capitalization of AED22.30 billion.

Operations: Commercial Bank of Dubai PSC's revenue is primarily derived from Personal Banking (AED2.05 billion), Institutional Banking (AED1.27 billion), and Corporate Banking (AED1.11 billion).

Dividend Yield: 6.8%

Commercial Bank of Dubai PSC offers a compelling dividend profile with a high and reliable yield of 6.79%, placing it in the top 25% of dividend payers in the AE market. The dividends are well-covered by earnings, with a payout ratio currently at 52.3% and forecasted to improve to 40.8% in three years, ensuring sustainability. Despite stable dividend growth over the past decade, investors should note the bank's high level of bad loans (5.3%).

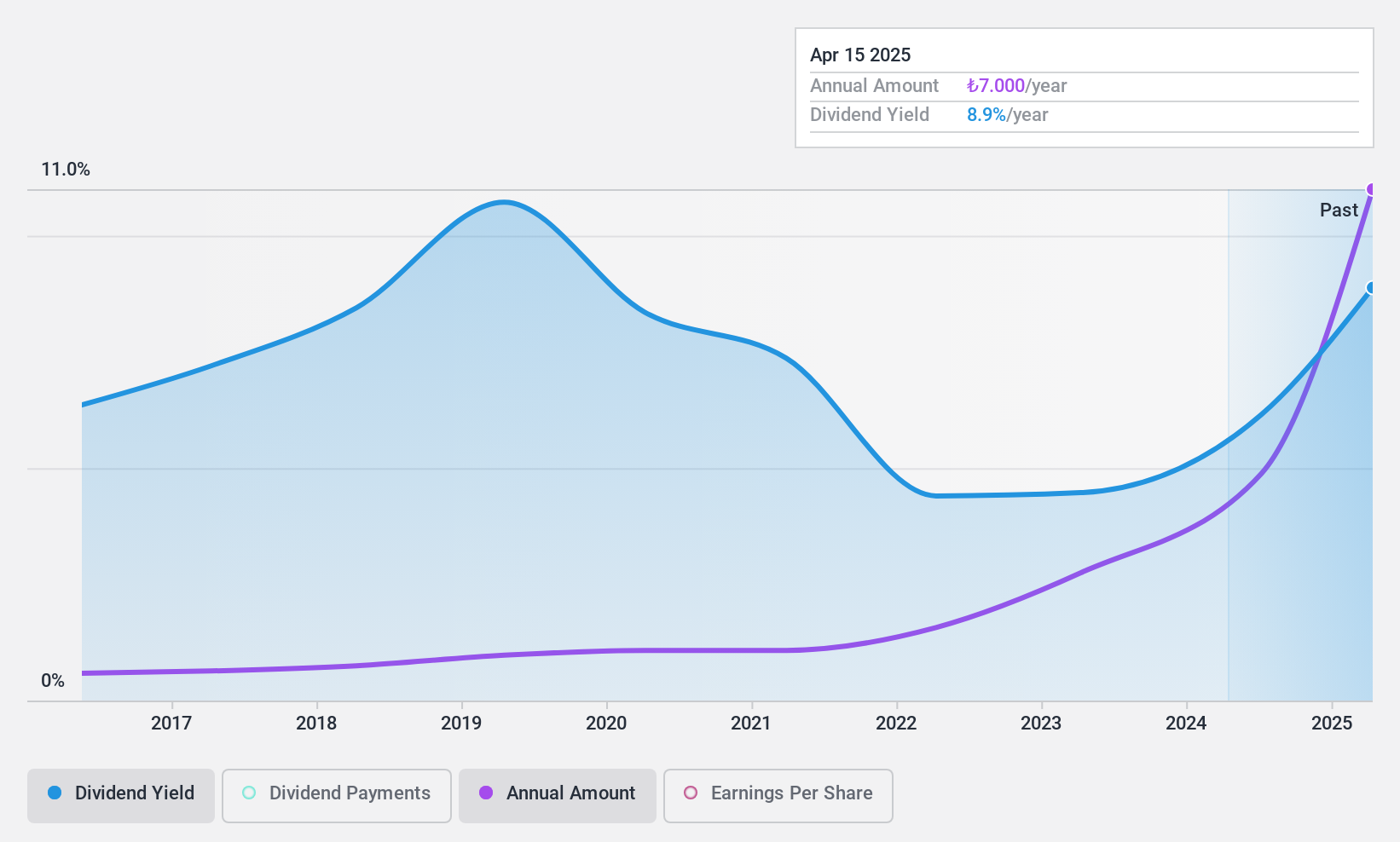

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector with a market capitalization of TRY18.63 billion.

Operations: Yeni Gimat Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from the Ankamall Shopping Mall (TRY2.04 billion), CP Ankara Hotel (TRY236.89 million), and a smaller contribution from the Energy segment (TRY0.37 million).

Dividend Yield: 4%

Yeni Gimat Gayrimenkul Yatirim Ortakligi offers a competitive dividend yield of 4%, ranking in the top 25% within the TR market. With a payout ratio of 36.3%, dividends are well-covered by earnings, and cash flows support this with a cash payout ratio of 68%. Although dividends have been stable and growing over nine years, recent financial results show a net loss of TRY 523.73 million, contrasting significantly with last year's profit.

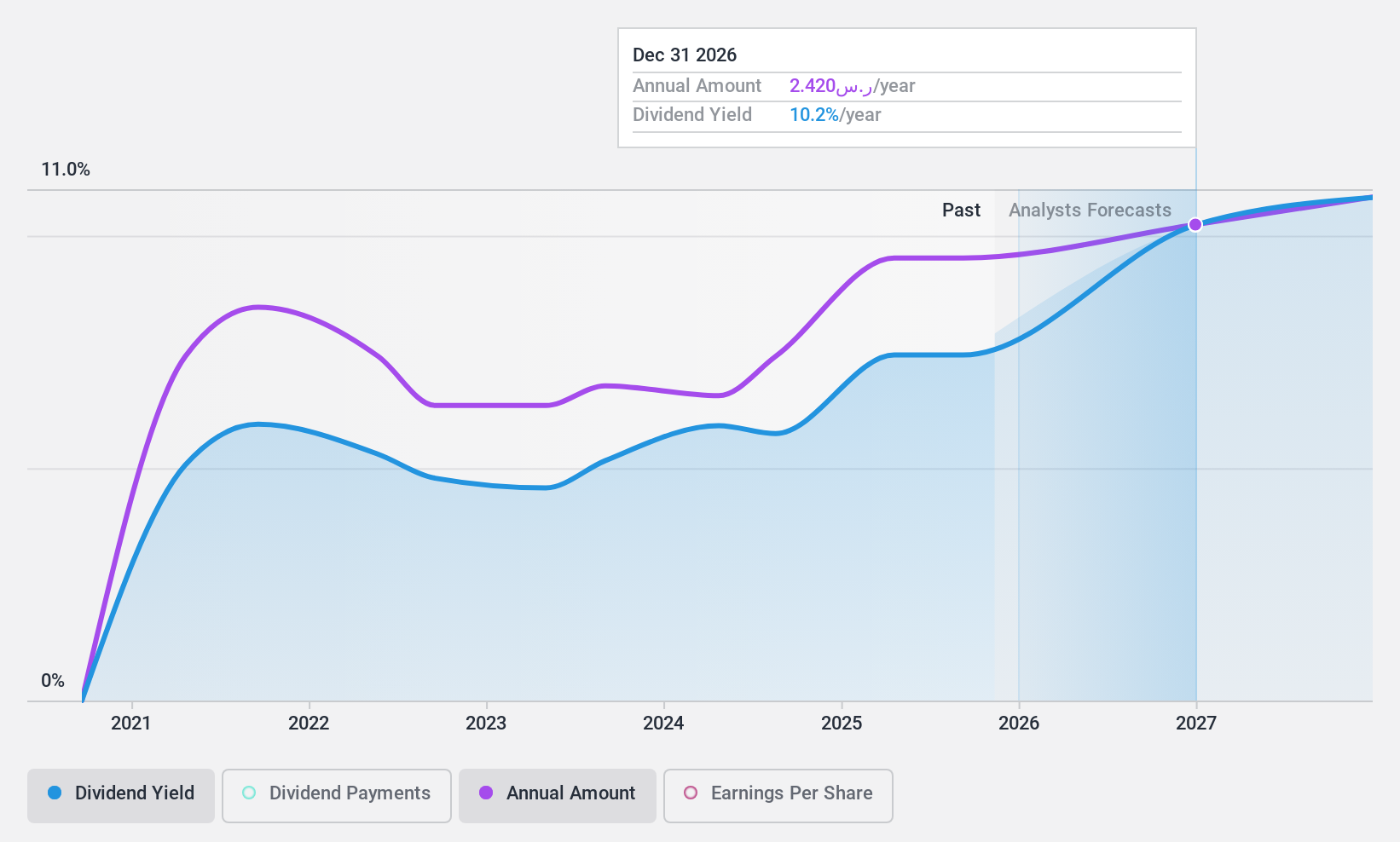

Riyadh Cement (SASE:3092)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riyadh Cement Company produces and sells cement across several Middle Eastern countries, including Saudi Arabia, Bahrain, Jordan, Kuwait, Qatar, and Oman; it has a market cap of SAR4.40 billion.

Operations: Riyadh Cement Company's revenue from cement manufacturing is SAR789.40 million.

Dividend Yield: 6.1%

Riyadh Cement's dividend yield of 6.13% places it among the top 25% of dividend payers in the Saudi market, supported by a payout ratio of 87%. Despite recent earnings growth to SAR 310.44 million, dividends have been volatile with a history of annual drops over 20%. The stock trades at a favorable P/E ratio of 14.2x compared to the broader market, but its short four-year dividend track record shows inconsistency and unreliability.

Taking Advantage

- Embark on your investment journey to our 61 Top Middle Eastern Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.