Please use a PC Browser to access Register-Tadawul

3 Stocks Estimated To Be Trading Below Fair Value By Up To 26.4%

SPIMACO 2070.SA | 27.42 | -1.08% |

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a notable dispersion in sector returns, with financials and energy benefiting from deregulation hopes while healthcare faces headwinds. Amidst this volatility, identifying undervalued stocks becomes crucial as they offer potential opportunities for growth when trading below their intrinsic value. In this context, understanding what constitutes a good stock—such as strong fundamentals and resilience to market fluctuations—can be particularly advantageous for investors seeking value in today's complex economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.63 | CN¥33.16 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.20 | 50% |

| Insyde Software (TPEX:6231) | NT$464.50 | NT$927.39 | 49.9% |

| SeSa (BIT:SES) | €75.50 | €150.49 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.20 | SEK450.07 | 49.7% |

| Accent Group (ASX:AX1) | A$2.51 | A$5.00 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥12.90 | CN¥25.73 | 49.9% |

| Advanced Energy Industries (NasdaqGS:AEIS) | US$109.84 | US$219.25 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.82 | A$17.59 | 49.8% |

| St. James's Place (LSE:STJ) | £8.21 | £16.37 | 49.9% |

Let's explore several standout options from the results in the screener.

Saudi Pharmaceutical Industries and Medical Appliances (Saudi Pharmaceutical Industries and Medical Appliances Corp.(2070.SA) )

Overview: Saudi Pharmaceutical Industries and Medical Appliances Corporation develops, manufactures, and markets medicinal and pharmaceutical products in the Kingdom of Saudi Arabia, with a market cap of SAR3.79 billion.

Operations: The company generates revenue from the development, manufacturing, and marketing of medicinal and pharmaceutical products within Saudi Arabia.

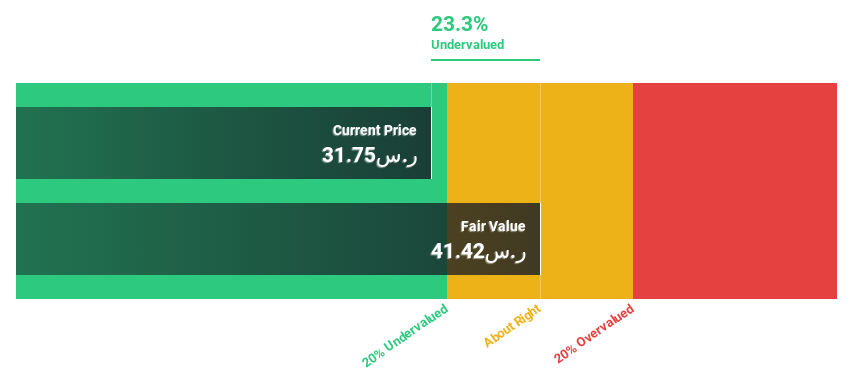

Estimated Discount To Fair Value: 23.8%

Saudi Pharmaceutical Industries and Medical Appliances Corporation is trading at approximately 23.8% below its estimated fair value of SAR 41.42, suggesting potential undervaluation based on cash flows. The company reported a significant improvement in net income for the nine months ended September 30, 2024, reaching SAR 68 million from SAR 18 million a year ago. Despite low forecasted return on equity, expected revenue growth of 9.6% annually outpaces the Saudi Arabian market's decline.

AEON FantasyLTD (TSE:4343)

Overview: AEON Fantasy Co., LTD. operates amusement facilities in Japan and has a market cap of ¥58.20 billion.

Operations: The company generates revenue from its amusement facility operations in Japan.

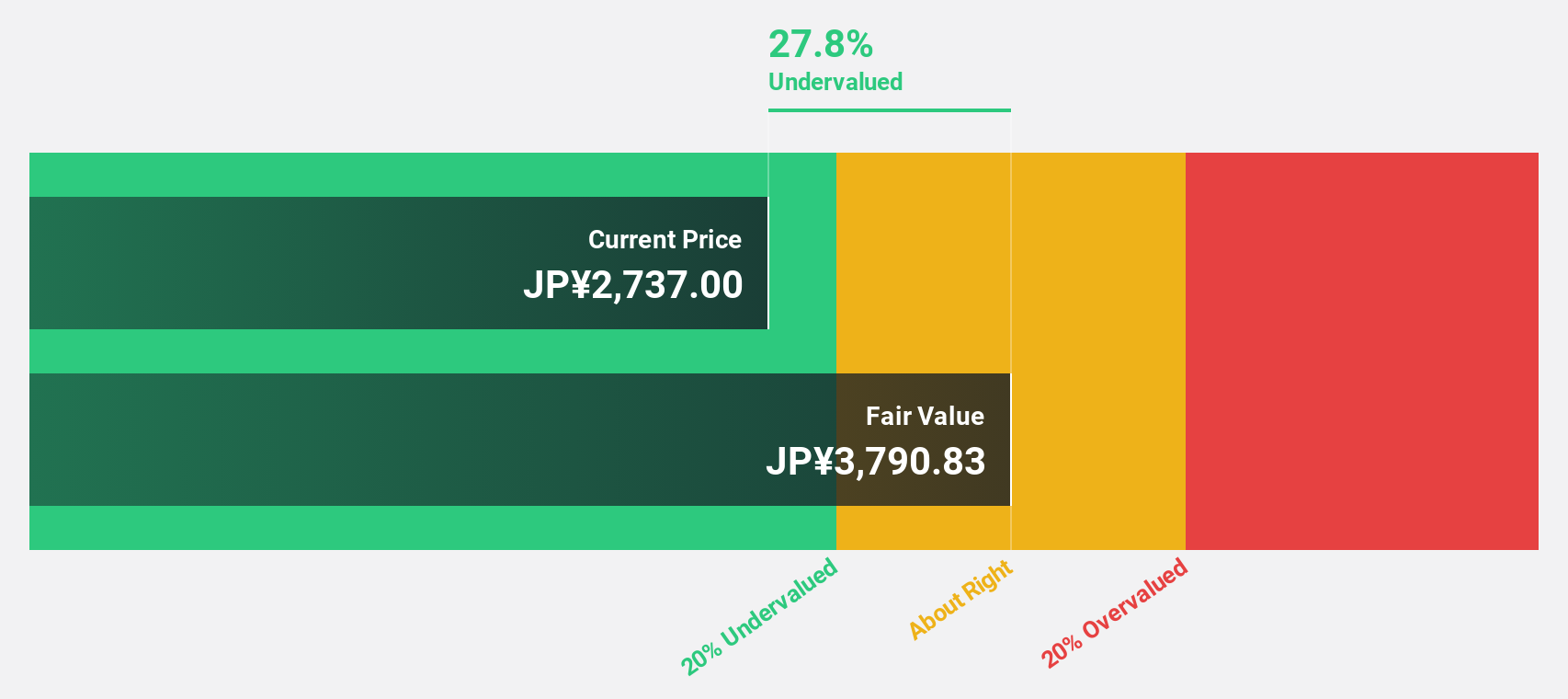

Estimated Discount To Fair Value: 21.3%

AEON FantasyLTD is trading at ¥2,943, over 20% below its estimated fair value of ¥3,739.41, indicating potential undervaluation based on cash flows. Despite a volatile share price recently and high debt levels, the company became profitable this year with earnings expected to grow significantly at 29.4% annually over the next three years—outpacing the Japanese market's average growth rate of 8%. Revenue growth remains slower than the market average.

Capstone Copper (TSX:CS)

Overview: Capstone Copper Corp. is a copper mining company with operations in the United States, Chile, and Mexico, and has a market cap of CA$7.59 billion.

Operations: The company's revenue is derived from its operations at Cozamin ($236.80 million), Mantoverde ($388.12 million), Pinto Valley ($528.75 million), and Mantos Blancos ($369.21 million).

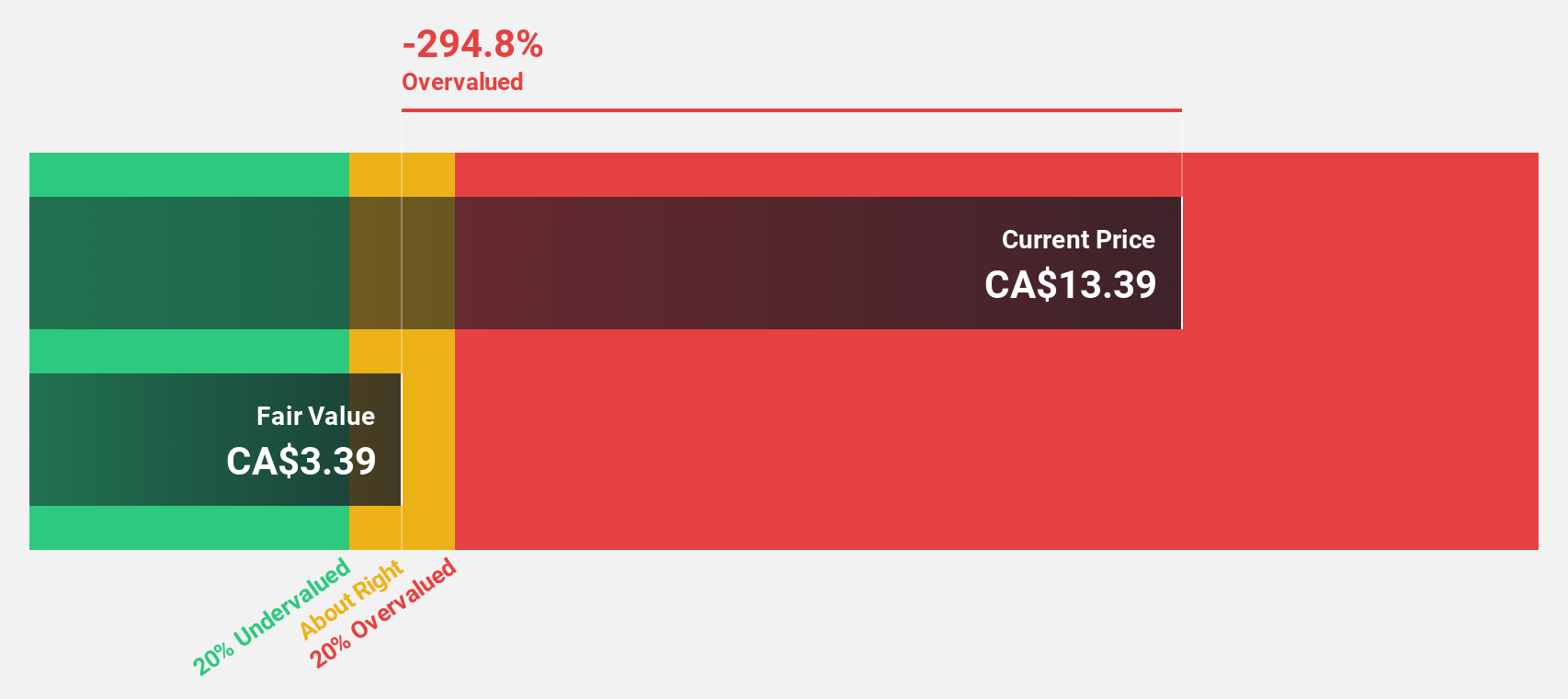

Estimated Discount To Fair Value: 26.4%

Capstone Copper is trading at CA$9.96, 26.4% below its estimated fair value of CA$13.54, highlighting potential undervaluation based on cash flows. Recent earnings showed a turnaround with a net income of US$12.5 million compared to a loss last year, and sales increased to US$419.4 million from US$322.24 million year-over-year. Despite significant insider selling and shareholder dilution, earnings are projected to grow significantly at 44.6% annually over the next three years, surpassing market averages.

Seize The Opportunity

- Click this link to deep-dive into the 935 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.