Please use a PC Browser to access Register-Tadawul

3 Stocks Estimated To Be Undervalued In March 2025

REV Group, Inc. REVG | 60.03 | +1.40% |

As the U.S. stock market grapples with volatility driven by new tariff announcements and economic uncertainties, major indices like the Dow Jones and S&P 500 have seen significant declines, erasing recent gains. In this environment of fluctuating investor sentiment, identifying undervalued stocks can present opportunities for those seeking to navigate these turbulent times effectively.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (NasdaqGS:VLY) | $8.67 | $17.24 | 49.7% |

| Semrush Holdings (NYSE:SEMR) | $9.70 | $19.07 | 49.1% |

| German American Bancorp (NasdaqGS:GABC) | $38.08 | $75.38 | 49.5% |

| International Paper (NYSE:IP) | $49.90 | $98.54 | 49.4% |

| KBR (NYSE:KBR) | $51.16 | $101.61 | 49.7% |

| Cadre Holdings (NYSE:CDRE) | $33.85 | $67.34 | 49.7% |

| Array Technologies (NasdaqGM:ARRY) | $6.38 | $12.63 | 49.5% |

| Albemarle (NYSE:ALB) | $76.39 | $150.99 | 49.4% |

| Workiva (NYSE:WK) | $85.11 | $168.68 | 49.5% |

| TransMedics Group (NasdaqGM:TMDX) | $66.03 | $130.15 | 49.3% |

Let's review some notable picks from our screened stocks.

Blackbaud (NasdaqGS:BLKB)

Overview: Blackbaud, Inc. provides cloud software and services both in the United States and internationally, with a market cap of approximately $3.18 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $1.16 billion.

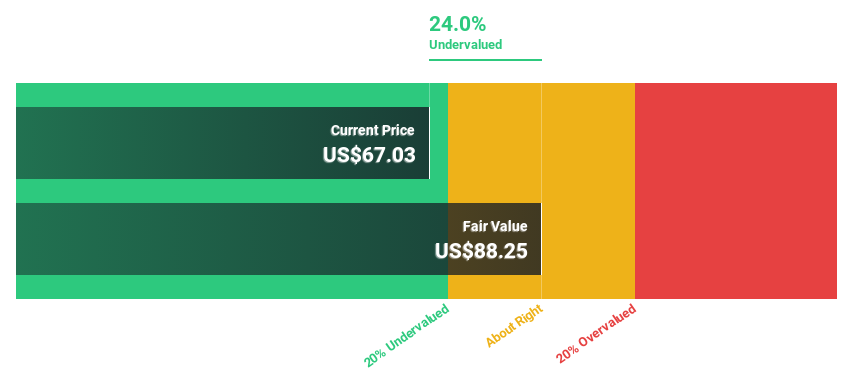

Estimated Discount To Fair Value: 23.7%

Blackbaud appears undervalued based on discounted cash flow analysis, trading at US$66.58, which is more than 20% below its estimated fair value of US$87.25. Despite a high level of debt and recent net losses of US$286.95 million for 2024, the company is expected to achieve profitability within three years with earnings forecasted to grow significantly annually. Recent initiatives like enabling cryptocurrency donations could enhance revenue streams and bolster future cash flows.

Cadre Holdings (NYSE:CDRE)

Overview: Cadre Holdings, Inc. manufactures and distributes safety equipment for protection in hazardous situations both in the United States and internationally, with a market cap of approximately $1.38 billion.

Operations: Cadre Holdings generates revenue through its Product segment, contributing $449.48 million, and its Distribution segment, adding $99.39 million.

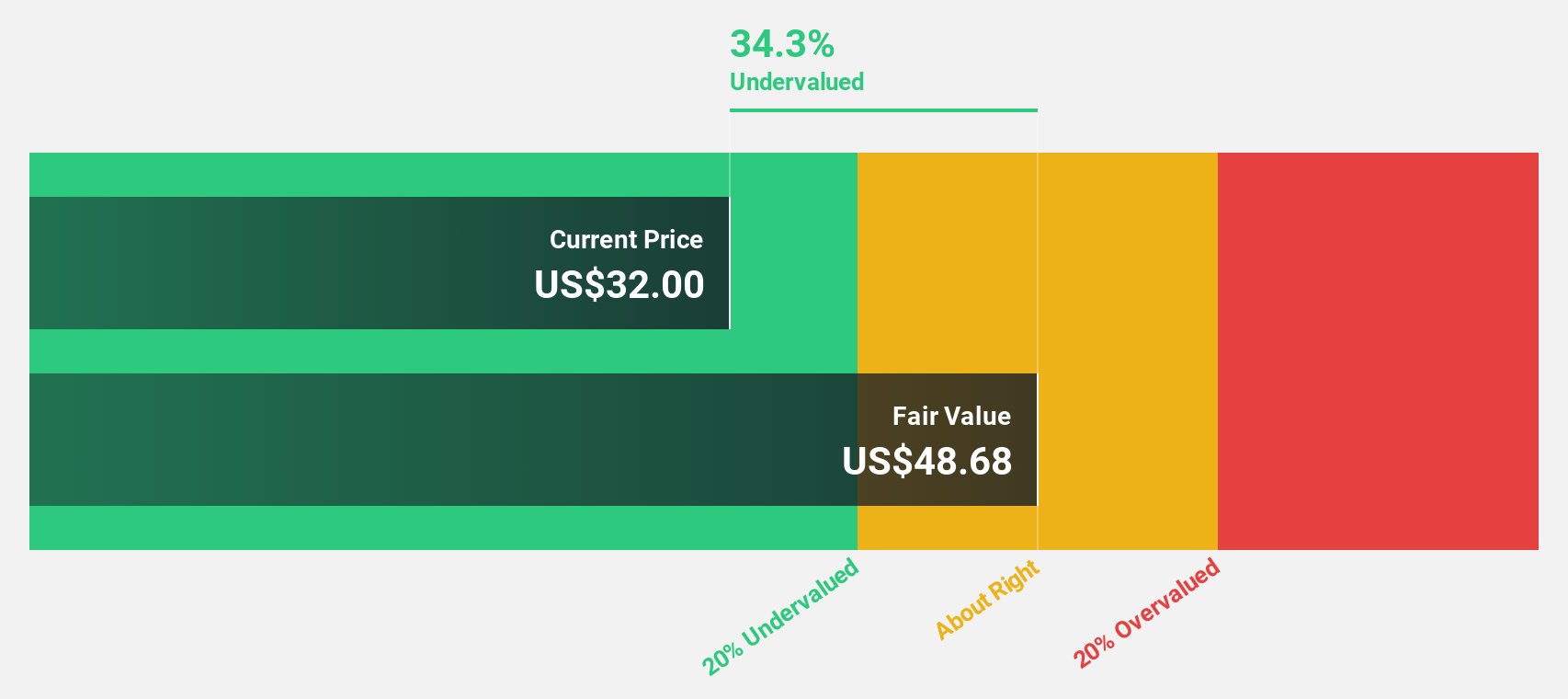

Estimated Discount To Fair Value: 49.7%

Cadre Holdings is trading at US$33.85, significantly below its estimated fair value of US$67.34, suggesting it may be undervalued based on discounted cash flow analysis. The company forecasts robust earnings growth of 30.1% annually, outpacing the broader market's growth rate. Despite recent insider selling and large one-off items affecting financial results, Cadre's strong capital position with approximately US$458 million supports its acquisition strategy and potential revenue expansion opportunities.

REV Group (NYSE:REVG)

Overview: REV Group, Inc. designs, manufactures, and distributes specialty vehicles and related aftermarket parts and services both in North America and internationally, with a market cap of approximately $1.60 billion.

Operations: The company's revenue segments include Specialty Vehicles, generating $1.68 billion, and Recreational Vehicles, contributing $640.20 million.

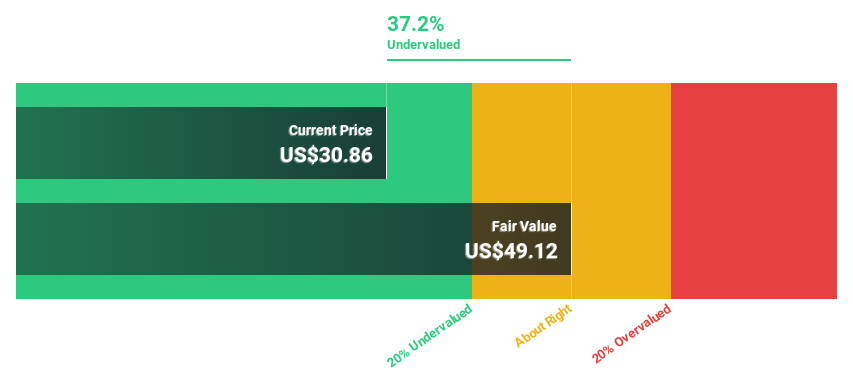

Estimated Discount To Fair Value: 37.8%

REV Group is trading at US$30.48, below its estimated fair value of US$48.99, indicating potential undervaluation based on cash flows. Despite a decline in profit margins from 9.1% to 4%, the company forecasts significant earnings growth of 23.8% annually, surpassing the broader market's growth rate. Recent financial results showed lower net income, yet operational execution remains strong with reaffirmed fiscal guidance and completed share repurchases totaling US$145 million since December 2024.

Where To Now?

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 189 more companies for you to explore.Click here to unveil our expertly curated list of 192 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.