Please use a PC Browser to access Register-Tadawul

A 115% Daily Gain? Before You Buy the Next Meme Stock, Read This Analyst's Warning

OpenDoor Technologies OPEN | 6.58 | +1.71% |

Kohl's Corporation KSS | 22.74 | +2.52% |

Krispy Kreme, Inc. DNUT | 4.37 | -2.08% |

HEALTHCARE TRIANGLE, INC. HCTI | 2.04 | -9.91% |

GameStop Corp. Class A GME | 22.09 | 0.00% |

For investors seeking explosive, short-term gains, the market just served up a dramatic reminder of 2021's meme stock mania.

In mid-July, a handful of heavily shorted stocks, including OpenDoor Technologies, Inc.(OPEN.US), Kohl's Corporation(KSS.US), and Krispy Kreme, Inc.(DNUT.US), suddenly skyrocketed, driven by a surge of retail investor interest on social media.

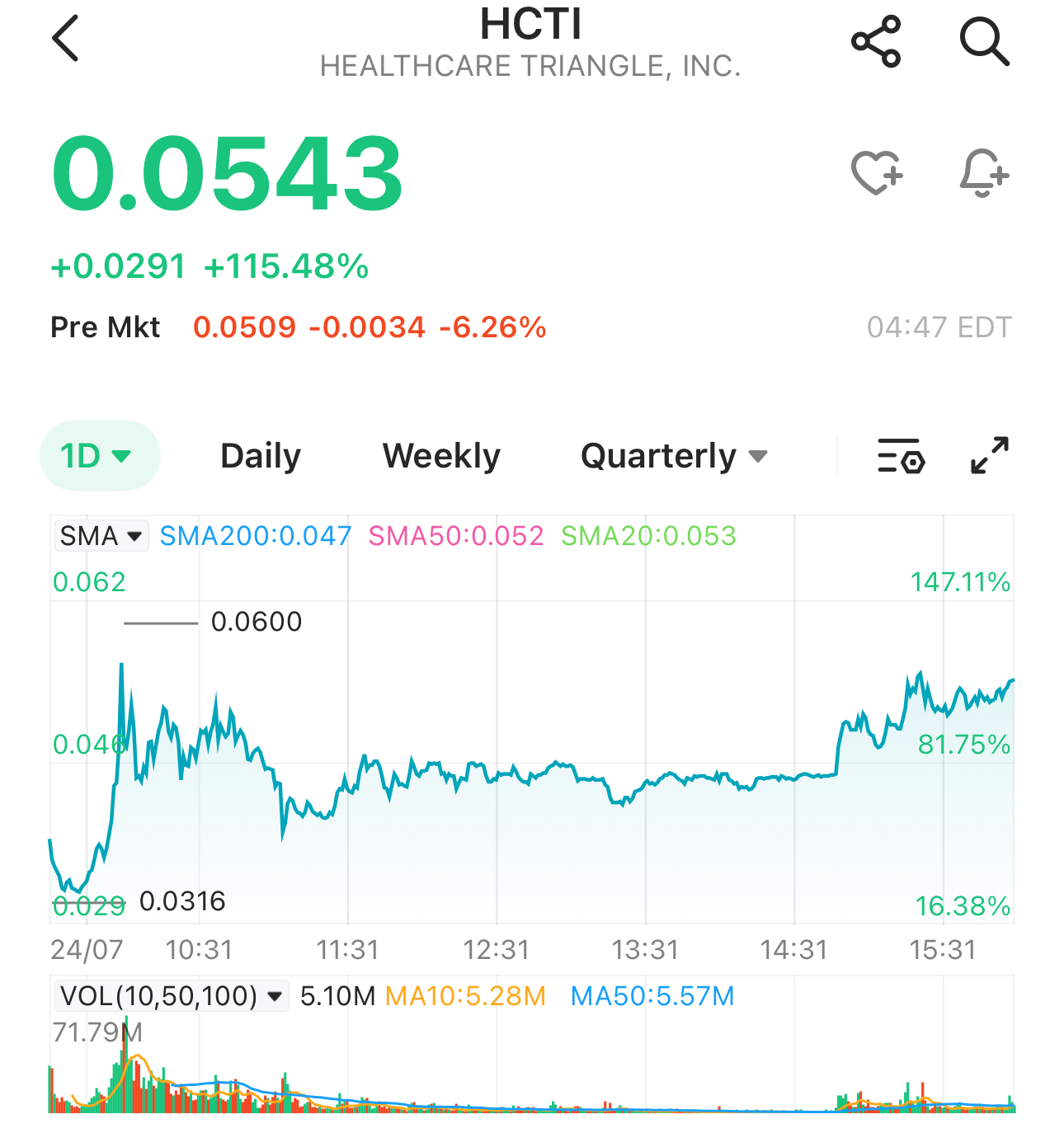

The frenzy reached a fever pitch on July 24th, when the little-known medical IT firm HEALTHCARE TRIANGLE, INC.(HCTI.US) soared 115% in a single day, accounting for roughly 15% of the entire U.S. stock market's trading volume.

This wasn't a fluke. Just days earlier, Opendoor experienced a 43% single-day surge on trading volume of 1.9 billion shares. But are these fleeting, high-risk plays worth the attention? The answer lies in understanding who is driving the trend and why the party always ends.

Analyst Insight: It's the Influencer, Not the Fundamentals

For those looking to navigate this volatility, the key is to recognize that traditional metrics don't apply. According to Max Gokhman, Deputy CIO of Franklin Templeton Investment Solutions, amateur investors are tuning out fundamentals and tuning into social media influencers.

"For meme stocks, the company's business is often less important than the person behind it," Gokhman explains. "When a financial influencer posts a bullish video on TikTok, it can instantly attract hundreds of thousands of investors to follow suit."

This phenomenon was clearly visible with OpenDoor Technologies, Inc.(OPEN.US). The rally ignited after Eric Jackson, founder of the hedge fund EMJ Capital, posted a series of bullish comments on the X platform. His posts sparked a firestorm of discussion among retail investors, launching the stock to the top of StockTwits' trending charts and making it a hot topic on Reddit's WallStreetBets forum.

The Meme Stock Playbook: A Familiar Pattern

This new wave of meme stocks follows a well-worn path, sharing key traits with the 2021 GameStop Corp. Class A(GME.US) and AMC Entertainment Holdings, Inc. Class A(AMC.US) saga:

- High Short Interest: The targets are often companies that professional investors are betting against, creating the potential for a "short squeeze" where short-sellers are forced to buy back shares, driving the price even higher.

- Brand Recognition: The companies are typically well-known consumer brands, making them easy to rally around (e.g., Krispy Kreme, Kohl's, GoPro).

- The "Underdog" Narrative: Buying these stocks is often framed as a battle against Wall Street elites, fostering a sense of community and a collective mission to "fight the suits."

However, the market of 2025 is not the market of 2021. The era of stimulus checks and lockdown-fueled day trading is over, replaced by high interest rates and economic uncertainty. As a result, today's rallies are proving to be far more volatile and short-lived. Krispy Kreme, Inc.(DNUT.US), for example, opened 39% higher on July 23rd but ended the day with a gain of just 4.6%—a stark warning for those who arrive late.

The Inherent Risk: Why Most Meme Investors Lose

While the allure of quick profits is powerful, the risks are immense. These trades are almost entirely disconnected from a company's actual performance or value. The extreme volatility makes timing the market nearly impossible, especially for inexperienced investors.

History provides a sobering lesson. Since its peak in January 2021, GameStop Corp. Class A(GME.US) stock has fallen by more than 70%. AMC Entertainment Holdings, Inc. Class A(AMC.US) has plummeted nearly 99% from its June 2021 high.

The core issue is that a meme stock rally requires a constant stream of new investors to keep pushing the price up. This model is unsustainable. Wall Street institutions have also become adept at identifying these surges and developing strategies to counter them, causing the rallies to fizzle out faster than ever before.

While the emotional thrill of betting against Wall Street is the engine of the meme stock craze, the story always ends the same way: corporate fundamentals eventually reassert their dominance, and the party comes to an abrupt end.

For investors, the question is not just whether they can get in, but whether they can get out in time.