Please use a PC Browser to access Register-Tadawul

A Fresh Look at Ardagh Metal Packaging (NYSE:AMBP) Valuation Following 2024 Sustainability Report Achievements

Ardagh Metal Packaging S.A. Ordinary Shares AMBP | 4.11 | -2.38% |

Ardagh Metal Packaging (NYSE:AMBP) has just released its 2024 Sustainability Report, and it is already making waves among investors. The company’s achievement of a 10% reduction in direct emissions and an increase in renewable electricity usage to 30% globally stands out in an industry where environmental impact is under a microscope. With nearly four out of five cans now made from recycled aluminum and most facilities reaching Zero Waste to Landfill status, Ardagh is putting its sustainability narrative front and center. The company is also investing $5 million into STEM education initiatives that have reached more than 75,000 students.

This update comes as Ardagh Metal Packaging’s stock has delivered a 10% return for shareholders over the past year and nearly 20% growth since the start of the year, even as the share price declined 7% in the past month. Momentum built up earlier in the year has started to slow, raising questions about whether recent gains reflect these latest achievements or if the market is reassessing the company's risk profile given its ongoing losses and long-term underperformance. Short-term fluctuations aside, management’s ability to maintain a 3% sales volume growth gives investors something to watch as they consider what comes next.

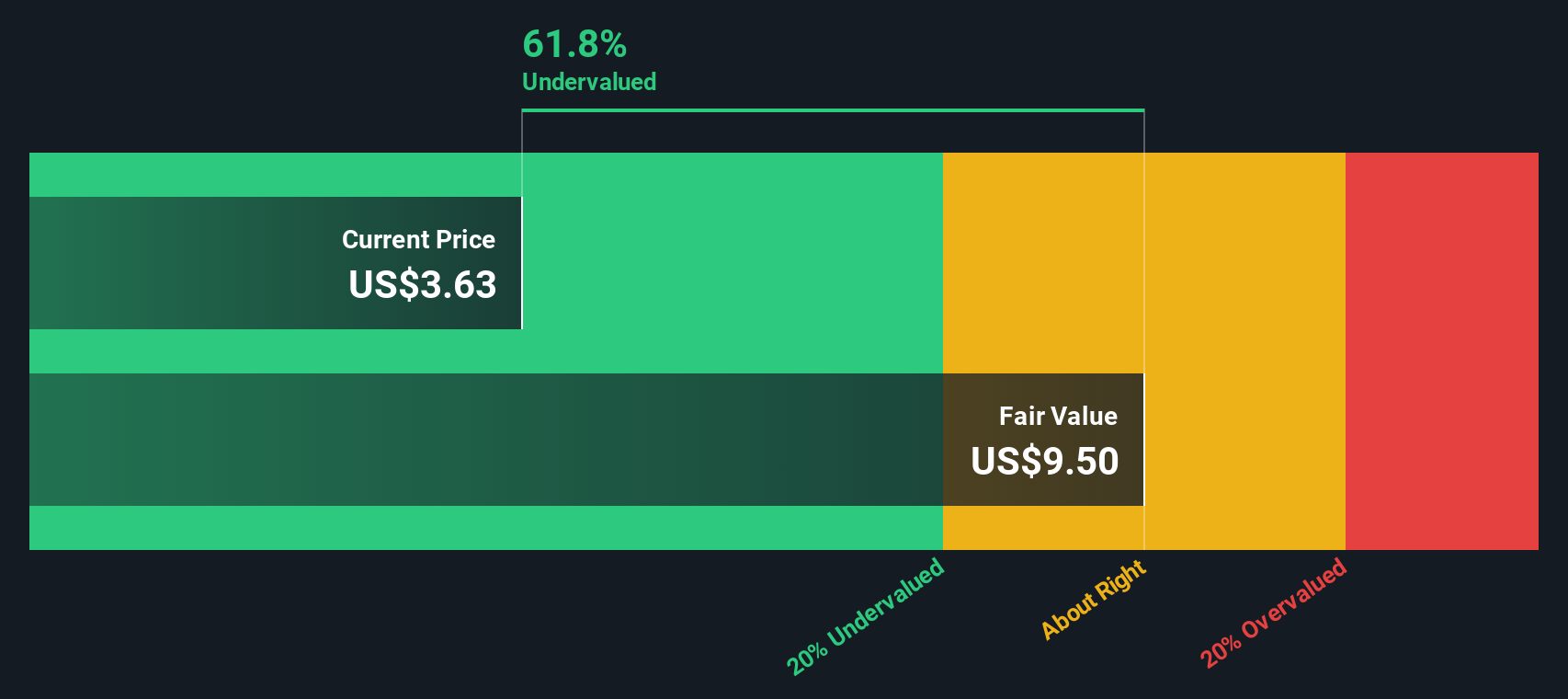

Does the sustainability-driven rally leave Ardagh Metal Packaging undervalued, or has the market already priced in future growth and operational improvements?

Most Popular Narrative: 18.8% Undervalued

The most widely followed narrative believes Ardagh Metal Packaging is nearly 19% undervalued. Supporters of this view point to a significant gap between the current market price and fair value based on future growth assumptions.

Demand for beverage cans continues to outpace other packaging substrates due to both consumer preference for sustainable, recyclable packaging and regulatory pressures favoring metal over plastic. This positions Ardagh to achieve sustainable volume and revenue growth, particularly in North America and Europe.

Curious about what’s driving this bullish outlook? There is a strategic plan behind the numbers, involving rapid growth in key profit drivers and a pricing approach that could influence the company’s financial trajectory. The final fair value is based on projections that might surprise you. Be sure to review the underlying assumptions that could influence this valuation.

Result: Fair Value of $4.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high leverage and volatile aluminum prices could quickly change investor sentiment and weaken confidence in Ardagh Metal Packaging's expansion outlook.

Find out about the key risks to this Ardagh Metal Packaging narrative.Another View: The SWS DCF Model Perspective

The SWS DCF model, which focuses on projected cash flows rather than market multiples, also suggests the stock is undervalued. However, shifting assumptions around future profitability or market risks could potentially change this outlook.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ardagh Metal Packaging Narrative

If you have a different perspective or want to delve into the numbers on your own terms, you can craft your personalized narrative in just a few minutes with Do it your way.

A great starting point for your Ardagh Metal Packaging research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let the best stocks slip past you. Open new doors to growth and smarter investing by harnessing the power of our handpicked stock idea screens below.

- Capitalize on high-yielding income streams by checking out dividend stocks with steady payouts using dividend stocks with yields > 3%.

- Get ahead of tech advances in artificial intelligence and see which companies are pioneering the future through AI penny stocks.

- Spot exceptional value plays and identify stocks primed for upside by scanning undervalued market opportunities with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.