Please use a PC Browser to access Register-Tadawul

A Fresh Look at Eli Lilly (LLY) Valuation After Recent Share Price Gains

Eli Lilly and Company LLY | 1027.51 1038.53 | +1.80% +1.07% Pre |

Lilly’s share price has been heating up lately, with sharp gains this month helping to recover earlier ground lost over the year. Despite a standout 11.3% 1-month share price return, the company’s total shareholder return is still down 6.8% for the past twelve months. Still, momentum appears to be gathering pace once more as investors look for signs of sustained growth after prior earnings and approvals, which helped propel the 3-year total return to an impressive 135%.

If Eli Lilly’s resurgence has you curious about what else is on the move, broaden your search and discover other healthcare leaders using See the full list for free.

But after a strong recovery and with shares nearing price targets, is Eli Lilly’s stock still undervalued compared to its growth? Or have investors already priced in all the company’s future potential?

Most Popular Narrative: 30.6% Undervalued

Eli Lilly’s latest narrative, shared by user eat_dis_watermelon, points to a fair value meaningfully above today’s share price. As excitement mounts after a surge in revenue and net profits, this story focuses on future blockbuster growth drivers rather than simply past financial performance.

Mounjaro/Zepbound: Lilly’s tirzepatide franchise is the engine of growth. Mounjaro (for type 2 diabetes) and Zepbound (obesity) each grew rapidly in 2024. Analysts project Mounjaro sales of $18.4 B in 2025 and $22.8B in 2026, and Zepbound jumping from $4.9B (2024) to $12.5 B in 2025 (and $18.1B in 2026). In other words, Lilly’s tirzepatide sales are expected to surpass Novo’s by 2026.

What’s the secret behind this narrative’s high price target? The story is packed with bold assumptions about explosive growth, unprecedented exclusivity, and a future profit engine unlike any in pharma today. Want a glimpse at the projections driving such a premium valuation? Don’t miss the full breakdown. It just might change how you see the market leader.

Result: Fair Value of $1200 (UNDERVALUED)

However, ongoing supply bottlenecks and the possibility of new competition entering the GLP-1 market could quickly shift Eli Lilly’s outlook.

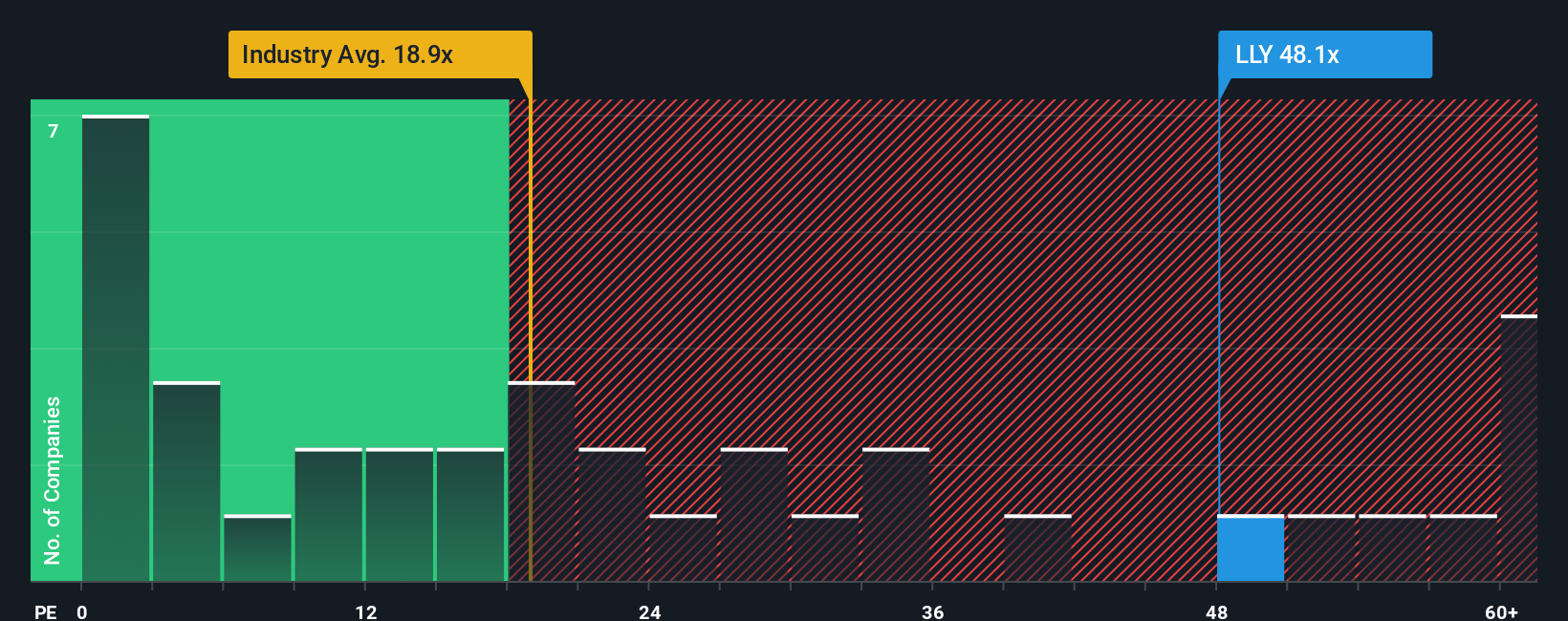

Another View: Looking at Multiples

While the user’s fair value suggests Eli Lilly is undervalued, the price-to-earnings ratio tells a different story. Eli Lilly is trading at 53.7 times earnings, which is much higher than the industry average of 17.7 or peers at 15.6. Even compared to its fair ratio of 39.8, the shares look expensive. Does this mean the market is already pricing in those bold growth assumptions, or is there more upside ahead?

Build Your Own Eli Lilly Narrative

If you see things differently or want to test your own assumptions, you can dig into the numbers and craft your own perspective in just a few minutes. Start with Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity. Unlock fresh ideas and see what else is surging. These markets move fast and you do not want to be left behind.

- Amplify your portfolio with regular income by targeting stable companies offering yields above 3% using these 17 dividend stocks with yields > 3%.

- Tap into the future of healthcare and seize early opportunities with these 33 healthcare AI stocks advancing medicine through artificial intelligence.

- Capitalize on market inefficiencies by tracking promising businesses currently priced below their fundamental worth with these 881 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.