Please use a PC Browser to access Register-Tadawul

A Fresh Look at Mirum Pharmaceuticals (MIRM) Valuation After Strong Q2 Earnings and Raised 2025 Guidance

Mirum Pharmaceuticals MIRM | 67.93 | +5.98% |

If you are looking at Mirum Pharmaceuticals (MIRM) right now, you are not alone. The company just delivered a 64% year-over-year jump in revenue and beat expectations on earnings per share for the second quarter of 2025. Management responded by raising their full-year outlook for 2025, a move that usually signals growing confidence in the business. While there was an insider sale and fresh regulatory filings this month, the uptick in performance is what seems to be catching investors’ attention.

Mirum shares have climbed steadily, gaining 81% over the past year, with momentum really building in recent months. The stock is up 76% year-to-date and nearly 47% over the past three months. Alongside operational updates such as the completion of a key drug trial enrollment and news of employee stock offerings, the upward stock move suggests the market may be reassessing both the company’s risk profile and its growth potential.

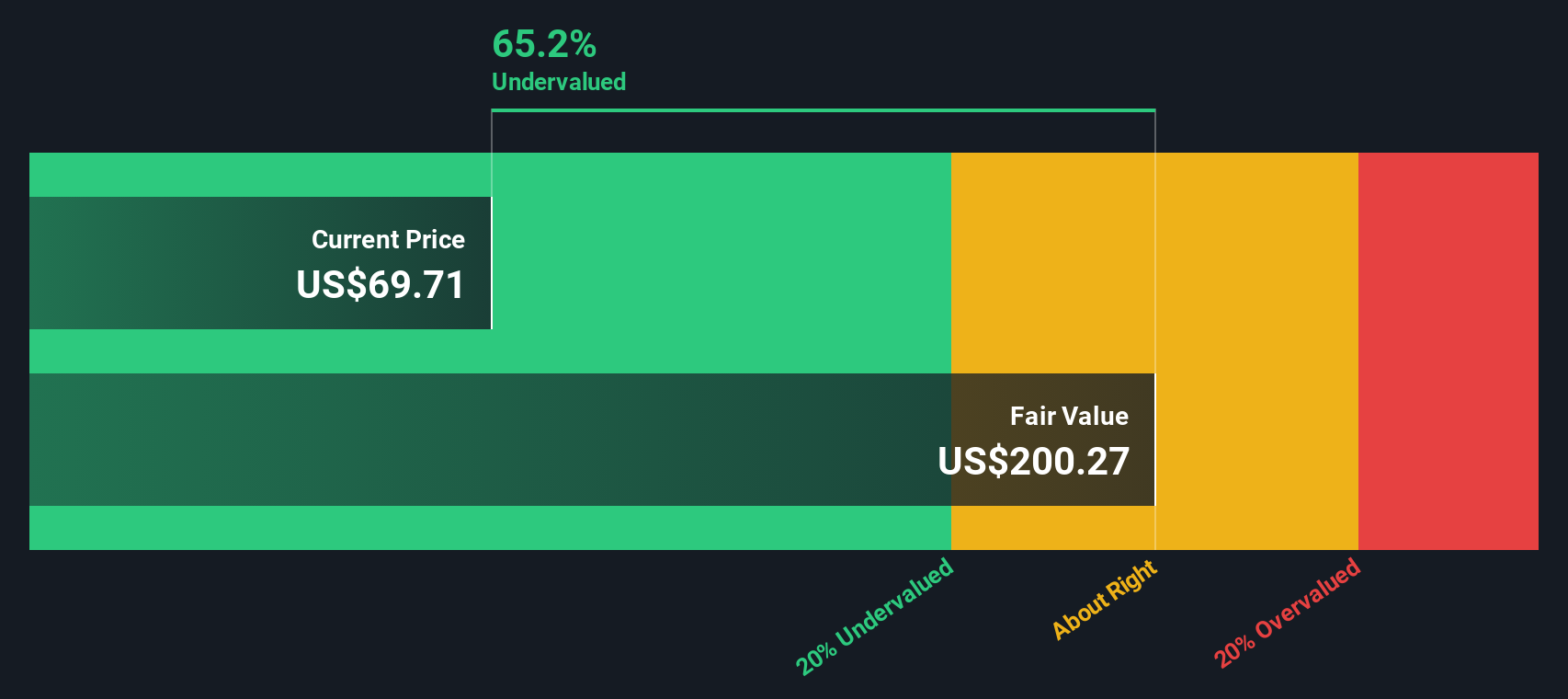

After such a strong run on impressive results, the real question for investors is whether Mirum is still undervalued, or if the market has already priced in most of the future growth.

Most Popular Narrative: 5% Undervalued

The most widely followed narrative sees Mirum Pharmaceuticals as modestly undervalued, suggesting that the current share price does not fully reflect its projected growth and risk profile.

"The expanding addressable patient population for Mirum's therapies, especially with the increased recognition and diagnosis of later-onset PFIC through broader use of genetic testing and heightened disease awareness, is driving higher-than-expected patient volumes. This growing patient base is expected to directly contribute to sustained top-line revenue growth."

What is the math behind this bullish stance? The analysts believe Mirum’s value hinges on a rare blend of rapid revenue acceleration and a profit trajectory that could soon outpace the industry. Want to see exactly what is fueling expectations of breakthrough margins and why the consensus sees further room to run? The full narrative unpacks the financial forecasts that shaped this price target.

Result: Fair Value of $78.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on one key therapy, as well as the risk of tougher competition or regulatory changes, could quickly challenge this bullish outlook.

Find out about the key risks to this Mirum Pharmaceuticals narrative.Another View: SWS DCF Model Puts It In Perspective

While analysts see Mirum Pharmaceuticals as undervalued based on future growth expectations, our DCF model, which looks at the company’s projected cash flows, also points to undervaluation. However, does this approach tell the full story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mirum Pharmaceuticals Narrative

If you come to a different conclusion or want to dig deeper into Mirum’s story, you can start your own analysis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Mirum Pharmaceuticals.

Looking for More Smart Investment Opportunities?

Staying ahead means always having new ideas at your fingertips. If you want to spot trends before everyone else, these handpicked themes will put you on the front foot.

- Capitalize on explosive digital disruption and track the movers behind tomorrow's artificial intelligence breakthroughs with AI penny stocks.

- Boost your portfolio’s passive income by finding companies that offer robust yields and a commitment to regular payouts via dividend stocks with yields > 3%.

- Uncover hidden gems trading below their true value when you use undervalued stocks based on cash flows and seize the advantage that others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.