Please use a PC Browser to access Register-Tadawul

A Fresh Look at Smithfield Foods (SFD) Valuation After $454 Million Equity Raise

Smithfield Foods, Inc. SFD | 22.70 | +0.35% |

If you have been eyeing Smithfield Foods (SFD), the latest move might have caught your attention. The company has just completed a substantial follow-on equity offering, raising over $454 million through the sale of nearly 20 million common shares at $23.25 each. While these offerings can be a mixed signal for existing shareholders, they often indicate management has bold plans and sees room to put new capital to work. The rapid completion right after the filing points to confident execution and a market open to new shares. Both factors are worth considering if you are weighing your next step with the stock.

This fresh equity raise comes as Smithfield Foods has already shown decent momentum this year, with shares climbing roughly 24% year-to-date. Recent weeks have been more volatile, with a mild dip over the past month but modest gains in the past three months. With annual revenue growth around 2% and net income up 6%, the business fundamentals appear sturdy. The completion of this large offering stands out from more routine newsflow and invites a closer look at whether the company is gearing up for expansion or simply fortifying its finances against future uncertainty.

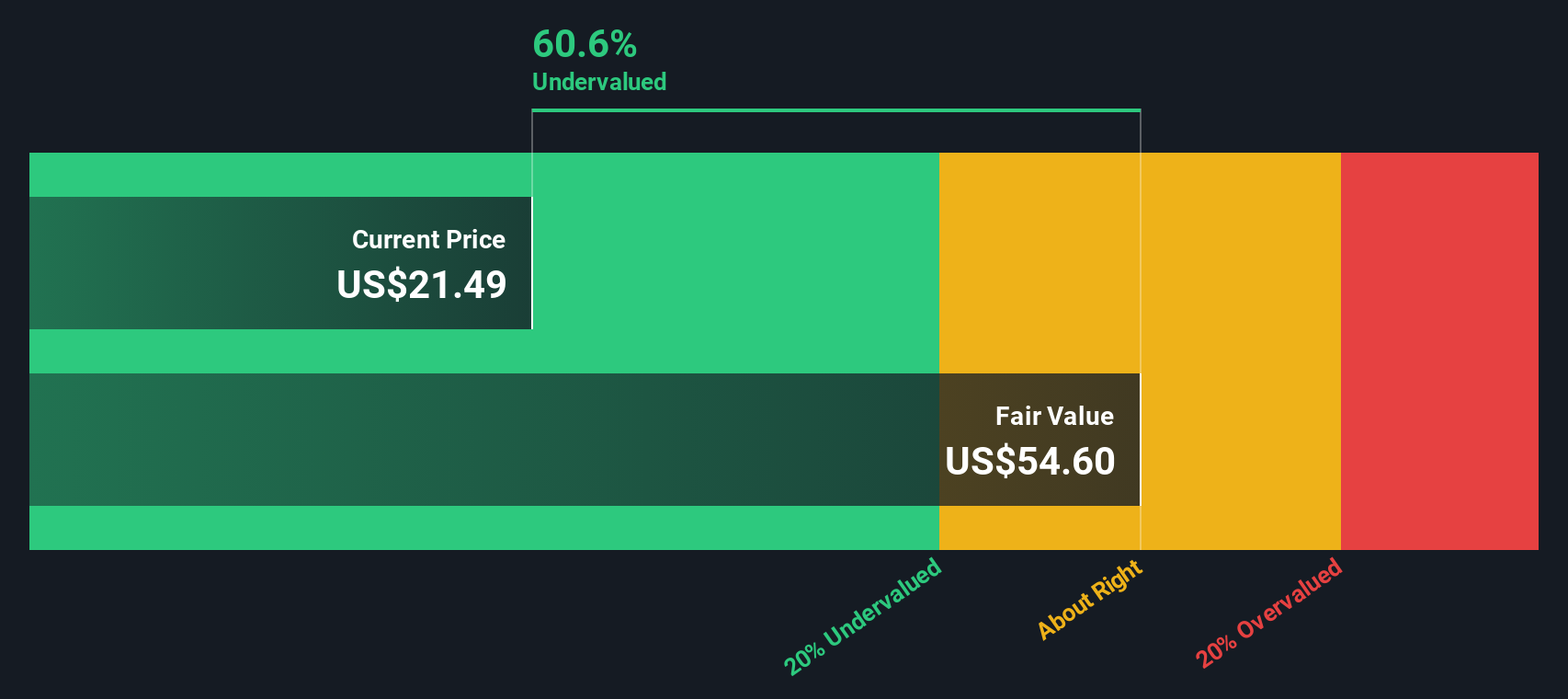

After this sizeable capital raise and a year of upward price movement, is there still value to be found in Smithfield Foods, or are investors already baking in all the expected growth?

Price-to-Earnings of 11.7x: Is it justified?

Smithfield Foods currently trades at a price-to-earnings (P/E) ratio of 11.7, which suggests the market values its earnings lower than both its industry peers and historical averages. This figure implies the stock is undervalued on this metric compared to sector benchmarks.

The P/E ratio measures what investors are willing to pay for each dollar of a company’s earnings. In the food industry, this is a useful metric because of the steady nature of earnings and modest growth expectations, making it easier to compare direct competitors. A lower P/E relative to peers can indicate the market is either overlooking future growth potential or is cautious about risks.

For Smithfield Foods, the relatively low P/E signals that investors may be underestimating its ability to generate ongoing profits, especially in the context of recent earnings growth and improved profit margins. However, this discount could also reflect lingering market skepticism about the company’s growth trajectory or corporate governance.

Result: Fair Value of $56.46 (UNDERVALUED)

See our latest analysis for Smithfield Foods.However, a softening revenue growth rate and recent price volatility could challenge the upbeat outlook if market sentiment shifts or fundamentals weaken in coming quarters.

Find out about the key risks to this Smithfield Foods narrative.Another View: What Does the DCF Say?

Taking a step back from market ratios, our DCF model tells a similar story. This method considers future cash flows instead of just earnings multiples and still points to the stock being undervalued. However, could both approaches be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Smithfield Foods Narrative

If you have a different perspective or prefer to form an independent view, it's quick and simple to analyze the numbers for yourself. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Smithfield Foods.

Looking for more investment ideas?

Take the initiative to find your next winning stock by searching what else the market has to offer. Don’t let the best opportunities pass you by. Leverage these expert-curated shortlists, handpicked by our Simply Wall Street Screener:

- Find potential bargains fast and spot value hidden in plain sight by checking out undervalued stocks based on cash flows.

- Fuel your portfolio with cutting-edge companies driving breakthroughs in machine learning, precision medicine, and health analytics by exploring healthcare AI stocks.

- Unlock growth by seeking out up-and-coming businesses with solid fundamentals using our list of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.