Please use a PC Browser to access Register-Tadawul

A Fresh Look at Super Micro Computer (SMCI) Valuation Following Earnings Miss and Leadership Shifts

Super Micro Computer, Inc. SMCI | 34.38 | +11.44% |

Super Micro Computer (SMCI) saw its stock draw increased attention after quarterly earnings came in below expectations. The miss was attributed to profit and sales pressures related to ongoing supply chain issues and rising competition.

After a year that saw Super Micro Computer post a stunning 96% total shareholder return, recent volatility has taken hold with the share price dropping over 30% in the last month. Wall Street’s reaction to earnings shortfalls, margin pressures, and prominent insider sales has weighed on momentum, even as the company signals confidence by raising revenue guidance for the next year. While the long-term story still boasts exceptional gains, short-term sentiment has shifted as risk perceptions catch up with rapid past growth.

If you’re weighing what’s next in tech after Super Micro’s wild ride, it is a great chance to explore high-growth opportunities. See the full list of innovators in our See the full list for free..

With shares down sharply but long-term forecasts remaining upbeat, the big question emerges: Is Super Micro Computer trading at an attractive discount, or are all future growth prospects already reflected in the current price?

Most Popular Narrative: 28.5% Undervalued

With Super Micro Computer trading at $36.42 compared to a fair value estimate of $50.94, the prevailing narrative suggests a significant gap remains between market price and future potential. This sets the stage for an outlook heavily influenced by sector demand and the company’s innovation efforts.

The accelerating global adoption of AI and analytics continues to drive demand for high-performance, scalable server and data center solutions, positioning Super Micro for strong multi-year revenue growth as enterprises and nations build out AI infrastructure, directly supporting projected revenue outperformance. The company's launch and rapid expansion of its Data Center Building Block Solution (DCBBS) enables customers to deploy turnkey, energy-efficient, and customized AI data centers faster than traditional solutions. This supports a higher-margin product mix and improves gross and operating margins over time.

Curious what makes this valuation tick? The narrative rests on bold forecasts for explosive profit growth, margin expansion, and a market-defying future P/E that most tech companies can only dream of. Find out which assumptions could tilt the scales.

Result: Fair Value of $50.94 (UNDERVALUED)

However, ongoing price wars in the AI server market and heavy reliance on a handful of major customers could still disrupt Super Micro’s growth trajectory.

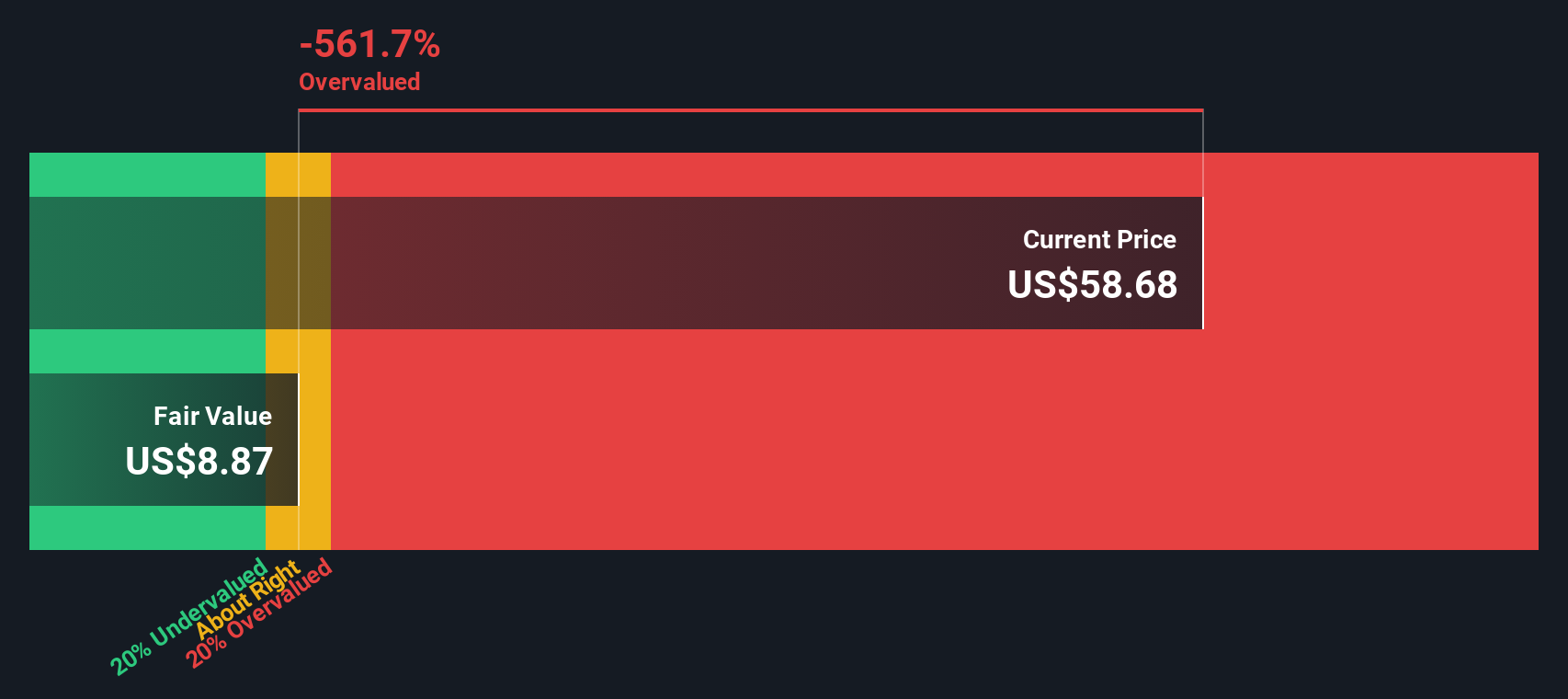

Another View: Discounted Cash Flow Tells a Different Story

While most analysts see significant upside based on earnings potential and industry demand, our DCF model paints a more cautious picture. This suggests Super Micro Computer is trading well above its intrinsic value at present. This raises the question: could future expectations already be fully priced in?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Super Micro Computer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Super Micro Computer Narrative

If you want to dig deeper or see things differently, you can use the data to build your own narrative in under three minutes. Do it your way.

A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Set yourself up for future wins by actively tracking investments that fit your goals. You might miss tomorrow’s standout performer if you stop at just one idea.

- Boost your portfolio’s resilience with steady income streams by tapping into these 16 dividend stocks with yields > 3%, which features attractive yields above 3%.

- Target growth potential at the leading edge of healthcare innovation by scanning these 32 healthcare AI stocks for companies transforming how medicine and AI intersect.

- Seize first-mover advantage in digital assets by reviewing these 82 cryptocurrency and blockchain stocks, highlighting firms pioneering cryptocurrency and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.