Please use a PC Browser to access Register-Tadawul

A Look At AAR (AIR) Valuation As Oklahoma City MRO Expansion Supports Ongoing Growth Narrative

AAR CORP. AIR | 116.97 | +1.23% |

AAR (AIR) is back in focus after substantially completing an 80,000+ square foot expansion of its Oklahoma City airframe MRO facility, adding three 737 capable bays and deepening its long term Alaska Airlines relationship.

AAR’s latest Oklahoma City expansion comes after a strong run, with a 30 day share price return of 19.46% and a 1 year total shareholder return of 57.05% suggesting momentum has been building rather than fading.

If this expansion has you thinking about where else growth may be taking off, it could be a good time to broaden your search and check out 22 top founder-led companies.

With AAR trading at US$106.87 and sitting only about 4% below the average analyst price target of US$110.67, the key question now is whether there is still potential upside or if the market is already pricing in future growth.

Most Popular Narrative: 3.4% Undervalued

AAR's most followed narrative pegs fair value at about $110.67, just above the last close of $106.87, which puts recent share price strength into context.

The commercialization of additional MRO capacity in Oklahoma City and Miami, both already sold out before opening, positions AAR to capitalize on the expected long term rise in global air travel and the need for ongoing maintenance of aging aircraft fleets, supporting robust revenue growth and improved earnings visibility.

Curious what kind of revenue run rate, margin lift, and future earnings multiple need to line up for that fair value to make sense? The full narrative lays out a detailed earnings trajectory, an assumed profitability reset, and a future valuation level that together underpin the $110.67 figure. It connects expansion, software, and government exposure into one valuation story, without assuming the current share price has the final word.

Result: Fair Value of $110.67 (UNDERVALUED)

However, the story can change quickly if commercial aviation spending softens, or if OEMs and automation squeeze AAR's MRO and parts margins harder than expected.

Another Angle On Valuation

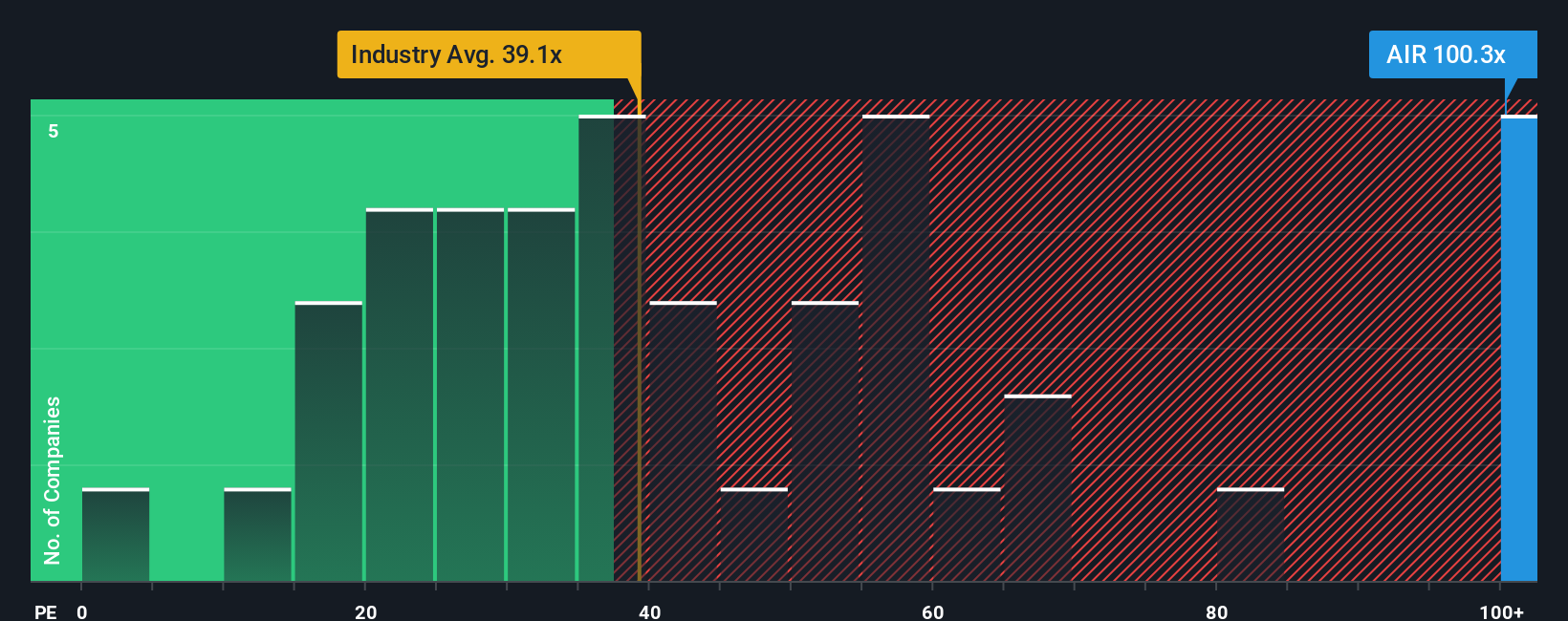

The fair value story estimates AAR as about 3.4% undervalued at $110.67, but the current P/E of 44.3x tells a tougher story. It is higher than the US Aerospace & Defense industry at 39.7x and above the fair ratio of 38.4x, so there is a question of whether enthusiasm is running ahead of itself.

Build Your Own AAR Narrative

If you want to stress test these assumptions yourself and lean on your own homework instead, you can spin up a tailored AAR thesis in just a few minutes by starting with Do it your way.

A great starting point for your AAR research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If AAR has sharpened your thinking, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Spot potential value setups first by scanning our list of 55 high quality undervalued stocks before they attract wider attention.

- Prioritize resilience by reviewing solid balance sheet and fundamentals stocks screener (46 results) that put balance sheet strength and fundamentals front and center.

- Hunt for tomorrow’s potential standouts by checking our screener containing 25 high quality undiscovered gems that are not yet on many radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.