Please use a PC Browser to access Register-Tadawul

A Look At Acushnet Holdings (GOLF) Valuation After KeyBanc’s Recent Downgrade To Hold

Acushnet Holdings Corp. GOLF | 102.17 | +2.21% |

KeyBanc’s recent downgrade of Acushnet Holdings (GOLF) to a Hold rating has become the main talking point around the stock, shaping short term sentiment in an otherwise quiet news period.

At a share price of US$90.56, Acushnet’s recent 1 day share price decline of 1.44% sits against a much stronger backdrop, with a 30 day share price return of 9.84% and a 1 year total shareholder return of 21.03%. This suggests that near term sentiment has cooled a little even as longer term momentum remains constructive.

If this kind of sentiment shift has you reviewing your watchlist, it might be a good moment to broaden your search with fast growing stocks with high insider ownership.

So with the stock trading around US$90.56, a consensus analyst price target closer to US$81.29, and an estimated intrinsic value implying a 37% discount, is there hidden value here or is the market already factoring in the growth story?

Price to Earnings of 23.9x: Is it justified?

At a P/E of 23.9x and a last close of US$90.56, Acushnet looks more expensive than some benchmarks, even as other metrics point to potential value.

The P/E ratio compares the share price with earnings per share, so a higher multiple usually means investors are paying more today for each dollar of current earnings. For a branded consumer company like Acushnet, that often reflects expectations around the strength and durability of its golf franchises.

Here, the picture is mixed. On one hand, the company is described as trading at a 37.3% discount to an estimated fair value of US$144.32 according to the SWS DCF model, and its P/E of 23.9x is below a peer average of 30.4x. This suggests some investors might see room for upside if those assumptions play out. On the other hand, that same 23.9x multiple is higher than both the Global Leisure industry average of 23.1x and an estimated fair P/E of 14.2x. This points to a level that the market could move toward if expectations cool.

Against the industry, Acushnet is trading at a richer P/E than the Global Leisure average of 23.1x, which implies the market is assigning a premium to its earnings. Compared with the estimated fair P/E of 14.2x, the current multiple is materially higher, which is a strong signal that the present valuation is well above the level the fair ratio suggests.

Result: Price-to-Earnings of 23.9x (OVERVALUED)

However, the premium to the Global Leisure P/E and a share price above the consensus US$81.29 target could leave the stock sensitive to any wobble in sentiment.

Another View: DCF Points the Other Way

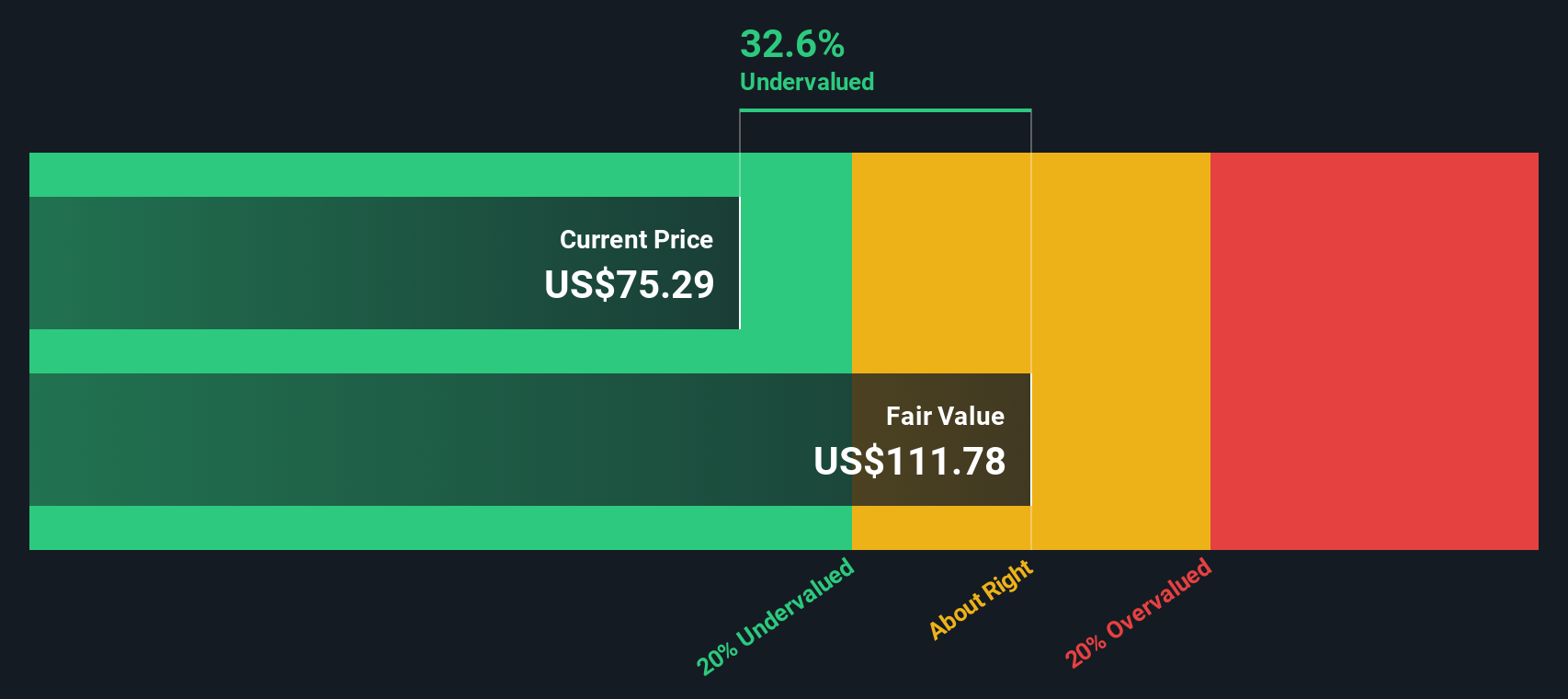

Here is where things get interesting. While the current P/E of 23.9x looks rich against a fair ratio of 14.2x, the SWS DCF model points in the opposite direction, suggesting Acushnet is trading around 37% below an estimated fair value of US$144.32.

That kind of gap can either hint at a potential opportunity if the cash flow assumptions hold up, or signal that the market is more cautious about future earnings than the model. Which side you lean toward will likely come down to how confident you are in those long term cash flow forecasts.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acushnet Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acushnet Holdings Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a fresh, data driven view in just a few minutes with Do it your way.

A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Acushnet has caught your attention, do not stop here. Use the Simply Wall St Screener to quickly surface other stocks that fit the kind of opportunities you care about.

- Kick start your hunt for value by checking out these 876 undervalued stocks based on cash flows that may align with your return expectations and risk comfort.

- Tap into trends in digital assets through these 19 cryptocurrency and blockchain stocks that focus on companies linked to cryptocurrencies and blockchain.

- Zero in on income focused opportunities using these 13 dividend stocks with yields > 3% that highlight companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.