Please use a PC Browser to access Register-Tadawul

A Look At AppFolio (APPF) Valuation As Board Refresh And Earnings Date Draw Investor Focus

AppFolio Inc Class A APPF | 172.23 | -2.35% |

AppFolio (APPF) is back on investor radars after the company reshaped its board and appointed experienced finance executive Saori Casey, while also lining up its next earnings release for late January.

Those board changes and the upcoming January 29 earnings update come as AppFolio’s US$219.67 share price shows mixed momentum, with a 3.16% 1 day share price return but a 30 day share price decline of 4.93%. Its 3 year total shareholder return of 92.81% contrasts with a 1 year total shareholder return decline of 12.93%, indicating that long term holders have fared better than more recent entrants.

If this kind of leadership shift has you thinking about what else might be setting up for the next leg higher, it could be worth scanning high growth tech and AI stocks as a starting point.

With revenue of US$906.29m, net income of US$203.75m and a share price that has cooled over the past year, the key question is whether AppFolio is now undervalued or if the market is already factoring in its future growth.

Most Popular Narrative: 30.7% Undervalued

AppFolio’s most followed narrative points to a fair value of US$317.20 per share, compared with the last close at US$219.67. This frames a sizable value gap that hinges on specific growth and margin expectations.

Expansion of integrated ecosystem partnerships (e.g., AppFolio Stack, fintech solutions, and third-party partner integrations) provides customers with more seamless, end-to-end experiences, increasing the platform's stickiness, ARPU, and recurring revenue potential.

Curious what kind of revenue growth, profit margins and future earnings multiple are built into that gap, and how they stack up against sector norms? The full narrative lays out the exact assumptions behind that US$317.20 fair value call, and how projected cash generation is being weighed against execution challenges.

Result: Fair Value of $317.20 (UNDERVALUED)

However, the narrative could be tested if domestic growth slows in a crowded US property tech space, or if rising compliance and data privacy demands squeeze profitability.

Another Angle On Valuation

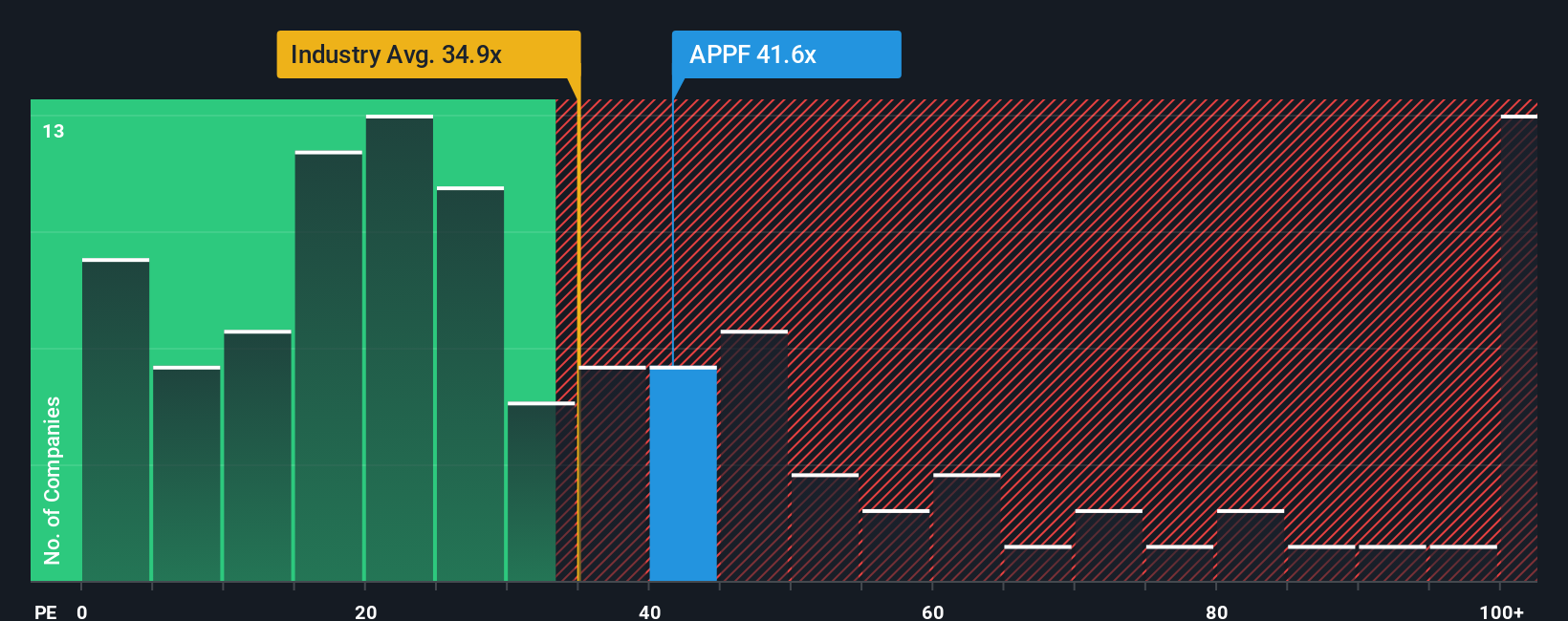

That 30.7% undervalued narrative contrasts sharply with how the market is pricing AppFolio using earnings. The current P/E of 38.7x is higher than the US Software industry at 31.8x, the peer average at 15x, and the fair ratio of 26.8x. This points to meaningful valuation risk if sentiment cools.

Build Your Own AppFolio Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding AppFolio.

Ready to hunt for your next idea?

If AppFolio has sharpened your thinking, do not stop here. Use the screeners below to quickly surface other ideas that could fit your approach.

- Spot potential value gaps by scanning these 865 undervalued stocks based on cash flows that line up with the kind of fundamentals and pricing setup you want to focus on next.

- Target growth stories at earlier stages by checking out these 3530 penny stocks with strong financials where the financials and business models match your risk tolerance.

- Ride powerful tech themes by zeroing in on these 24 AI penny stocks that connect real revenue with artificial intelligence rather than just hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.