Please use a PC Browser to access Register-Tadawul

A Look At Baldwin Insurance Group (BWIN) Valuation After Mixed Share Performance And 32.6% Undervaluation Narrative

Baldwin Insurance Group, Inc. Class A BWIN | 16.53 | 0.00% |

Baldwin Insurance Group (BWIN) has drawn investor attention after a period of mixed share performance, with the stock roughly flat over the past 3 months and showing a 45% decline over the past year.

At a share price of $22.83, Baldwin Insurance Group has seen a 13.29% 7 day share price decline and a 10.29% 30 day share price decline, while its 90 day share price return of 3.30% contrasts with a 45% 1 year total shareholder return decline. This suggests that recent momentum has softened against a much weaker longer term picture.

If this kind of mixed performance has you reassessing your watchlist, it may be worth broadening your search with fast growing stocks with high insider ownership.

With the share price at $22.83, a 45% 1 year total return decline and analyst targets sitting higher, the key question is whether Baldwin Insurance Group is now trading below its worth or if the market is already factoring in future growth.

Most Popular Narrative: 32.6% Undervalued

Against Baldwin Insurance Group's last close of $22.83, the most followed narrative points to a fair value of $33.88. This frames the current share price as materially below that estimate and puts the long term growth story under the spotlight.

The demographic shift toward an aging U.S. population, paired with government-confirmed growth in Medicare Advantage funding, positions Baldwin's Medicare and health-related offerings for a return to double-digit organic revenue growth and margin recovery beyond current temporary headwinds.

Curious what kind of revenue path, margin rebuild, and future earnings multiple are baked into that fair value? The narrative leans on ambitious growth, a sharp profitability swing, and a premium valuation usually reserved for faster growing sectors. If you want to see exactly which assumptions have to line up to support that $33.88 figure, the full narrative lays it out in detail.

Result: Fair Value of $33.88 (UNDERVALUED)

However, higher leverage at 4.17x and pricing pressure in property and construction lines could quickly challenge the optimistic growth and margin assumptions behind that 32.6% gap.

Another Take On Valuation

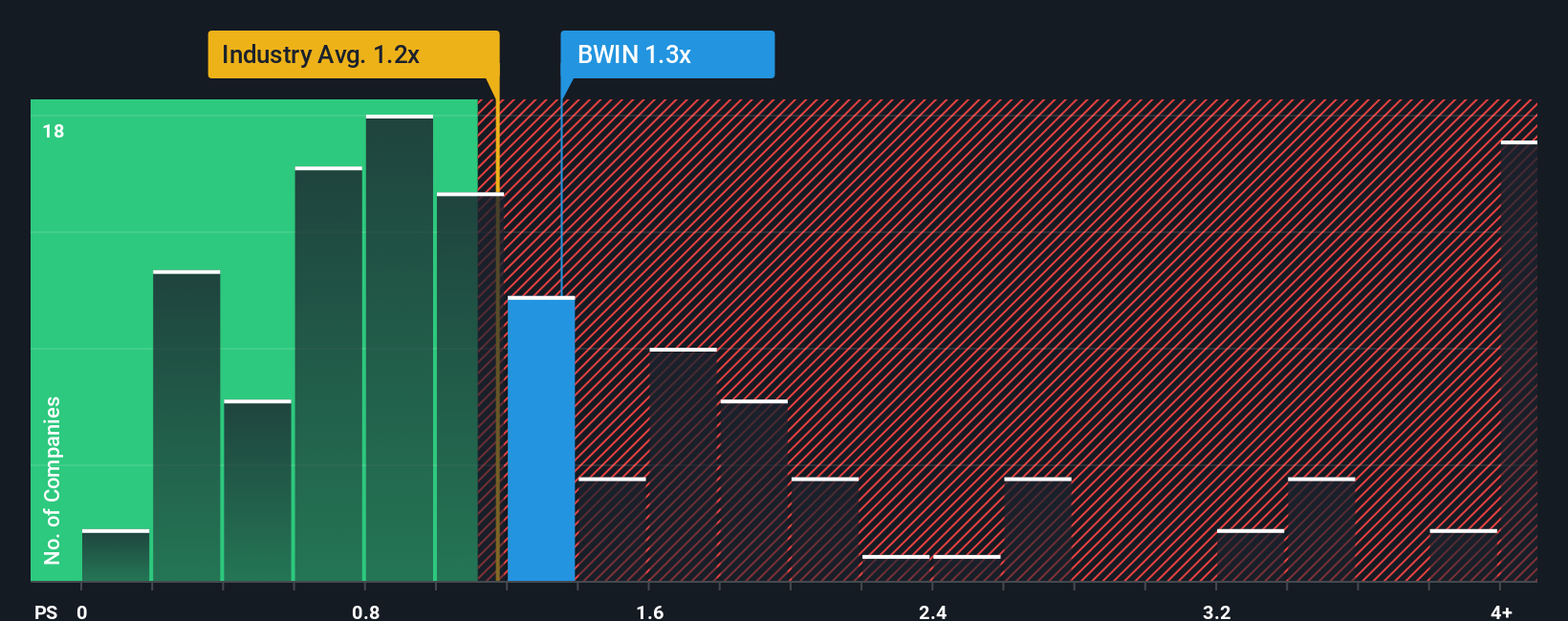

The popular narrative points to a fair value of $33.88, yet the current P/S of 1.5x tells a different story. It sits above the Insurance industry at 1.1x and the fair ratio of 1.1x, but below peers at 2.7x. Is that a margin of safety or a warning sign?

Build Your Own Baldwin Insurance Group Narrative

If you look at the numbers and reach a different conclusion or simply prefer to run your own checks, you can build a fresh view in just a few minutes with Do it your way.

A great starting point for your Baldwin Insurance Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Baldwin Insurance Group is on your radar, do not stop there. Casting a wider net across other opportunities can help you build a more resilient portfolio.

- Spot potential value plays early by scanning these 866 undervalued stocks based on cash flows that may be priced below what their cash flows suggest.

- Tap into emerging themes in digital assets through these 18 cryptocurrency and blockchain stocks that focus on cryptocurrency and blockchain exposure.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% and could complement your core holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.