Please use a PC Browser to access Register-Tadawul

A Look At Cal-Maine Foods (CALM) Valuation After Q2 Results And Clean Egg Acquisition

Cal-Maine Foods, Inc. CALM | 83.59 | +0.01% |

Cal-Maine Foods (CALM) has just combined a softer second-quarter fiscal 2026 earnings update, as egg prices normalized from earlier highs, with the acquisition of Clean Egg LLC’s Texas production assets, which expands its specialty cage-free and free-range footprint.

The recent second quarter update and Clean Egg acquisition come after a mixed run for investors, with a 9.61% 1 month share price return and a 10.45% year to date share price return contrasting with an 11.79% 1 year total shareholder return decline. At the same time, the 3 year and 5 year total shareholder returns of 97.55% and 184.14% highlight how longer term momentum has looked very different from the more recent pullback.

If Cal-Maine’s update has you thinking about where else capital could work hard in food and agriculture, it might be a good moment to widen the lens and consider fast growing stocks with high insider ownership.

With CALM trading near its US$87.75 analyst price target and showing a high intrinsic value score, yet coming off a 1-year total return decline, is there still a buying opportunity here, or is potential future growth already reflected in the current price?

Most Popular Narrative: 11.6% Undervalued

The most followed valuation narrative puts Cal-Maine Foods' fair value at $98, compared with the last close of $86.67, and anchors that view in specific long term earnings and margin assumptions.

Expanding specialty egg and prepared foods offerings, including high growth cage free, pasture raised and ready to eat formats, is expected to lift average selling prices and shift the mix toward higher margin revenue streams, supporting net margin expansion and earnings growth.

Curious what earnings profile could justify that fair value gap, even with lower forecast margins and revenue? The narrative leans on a very specific path for sales mix, profitability and the multiple the market might be willing to pay.

Result: Fair Value of $98 (UNDERVALUED)

However, persistent avian influenza risk and potential oversupply from industry capacity rebuilds could quickly pressure egg pricing, margins, and the earnings profile underpinning that $98 view.

Another View: Earnings And Multiples Point In Different Directions

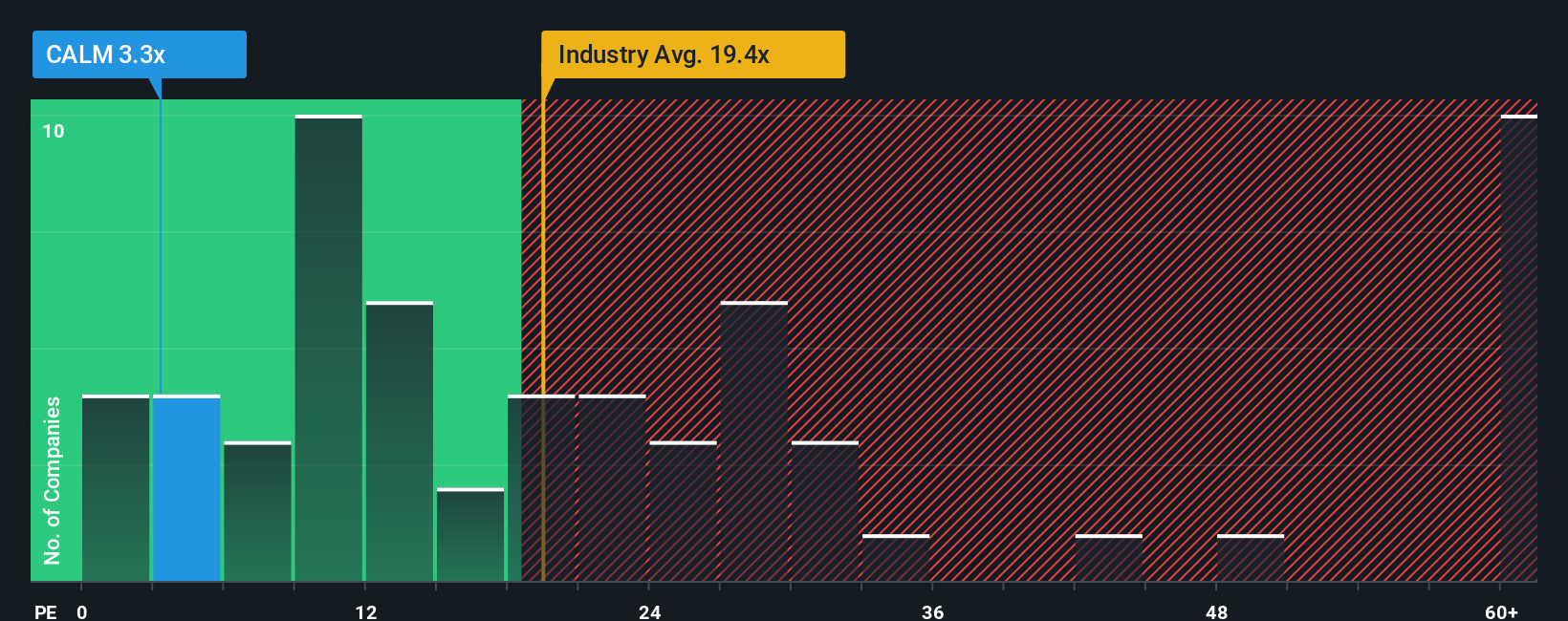

There is a twist when you look at Cal-Maine through its P/E. The shares trade on 3.6x earnings, far below the US Food industry at 22.8x and peers at 21x, yet above an estimated fair ratio of 2.7x. This combination hints at both value appeal and valuation risk.

That gap means the market price already sits above the level our fair ratio implies it could move toward, even though CALM appears inexpensive compared with the wider industry. For you, the question is whether the low relative multiples or the richer fair ratio signal carries more weight.

Build Your Own Cal-Maine Foods Narrative

If you look at the numbers and come to a different conclusion, or just prefer to build your own view from scratch, you can pull the key inputs, test your assumptions, and create a full Cal Maine thesis in a few minutes, all on your terms, with Do it your way.

A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one company, you could miss opportunities that fit your style even better, so use the tools available and let the data work for you.

- Spot emerging themes early by scanning these 29 AI penny stocks that are building real businesses around artificial intelligence rather than hype alone.

- Boost your income hunt by checking out these 11 dividend stocks with yields > 3% that focus on companies sharing more than 3% of their value in yearly payouts.

- Raise your return potential by searching through these 867 undervalued stocks based on cash flows that highlight companies priced below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.