Please use a PC Browser to access Register-Tadawul

A Look At Capricor Therapeutics (CAPR) Valuation After Its New Shelf Registration Filing

Capricor Therapeutics, Inc. CAPR | 28.51 | -2.20% |

Capricor’s new shelf registration and what it might mean for shareholders

Capricor Therapeutics (CAPR) has filed a shelf registration of about US$64.9 million for 2,868,420 shares of common stock linked to an ESOP related offering, giving the company flexibility to issue equity over time.

For you as a shareholder or potential investor, this kind of filing often raises two immediate questions: how it might affect ownership dilution, and what it suggests about the company’s future funding plans.

Capricor’s latest shelf registration comes after a sharp 300% 90 day share price return and a very large 3 year total shareholder return, even though the 30 day share price return of 12.12% and year to date share price return of 12.12% are both declines. This suggests momentum has cooled recently as the market reassesses funding needs and risk around its pipeline.

If this funding move has you thinking about other biotech names, it could be a good moment to scan healthcare stocks for companies at different stages of their funding and clinical cycles.

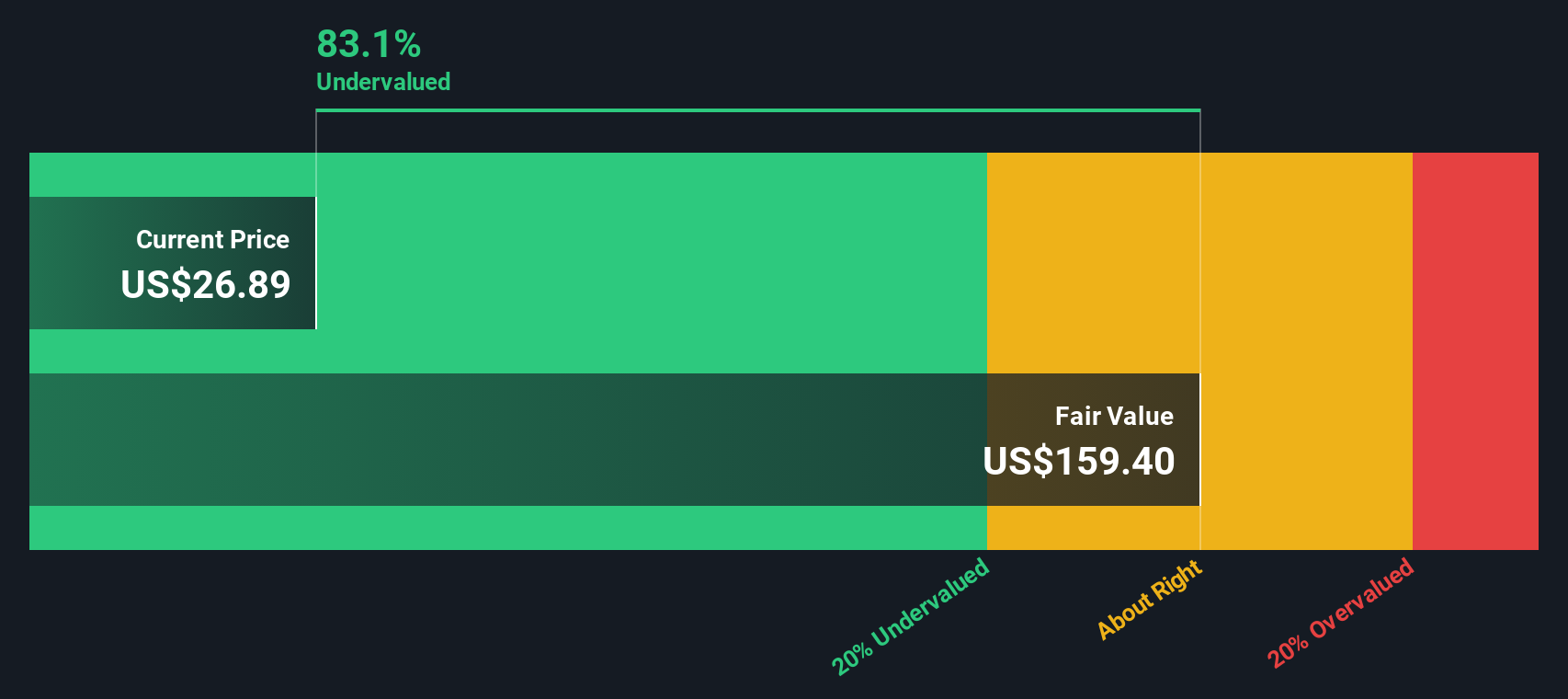

With Capricor posting a very large 3 year total return and trading at an estimated 90% intrinsic discount while also carrying an annual net loss of about US$82 million, are you looking at a genuine opportunity or a market already pricing in future growth?

Most Popular Narrative: 51% Undervalued

Capricor’s most followed narrative anchors on a fair value of about $50.80 per share versus the last close at $24.88, framing a wide valuation gap for investors to judge.

The analysts have a consensus price target of $20.6 for Capricor Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $12.0.

Curious what could underpin a fair value that sits well above even the highest target in that range? Revenue forecasts, margin shifts and future earnings assumptions are doing the heavy lifting here, and the narrative spells out how those ingredients connect.

Result: Fair Value of $50.80 (UNDERVALUED)

However, this story can change quickly if Deramiocel faces further regulatory setbacks or if ongoing losses and higher R&D spending force more equity raises earlier than anticipated.

Another Way to Look at Valuation

The first view leans heavily on future cash flows and suggests Capricor is trading at a very large discount to an implied value of $251.65 using our DCF model. That is a wide gap for any biotech, so the key question is how much faith you put in those long term cash flow assumptions.

Build Your Own Capricor Therapeutics Narrative

If you see the numbers differently or would rather test your own assumptions, you can build a complete view in just a few minutes, starting with Do it your way.

A great starting point for your Capricor Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Capricor has you thinking differently about risk and reward, do not stop here, broaden your watchlist so you are not missing other potential opportunities.

- Spot early-stage potential by checking out these 3532 penny stocks with strong financials that pair tiny market caps with stronger underlying financials than you might expect.

- Ride the AI wave more thoughtfully by scanning these 25 AI penny stocks that link artificial intelligence themes with companies already showing traction in their businesses.

- Target value opportunities more efficiently by reviewing these 867 undervalued stocks based on cash flows that screen for companies trading below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.