Please use a PC Browser to access Register-Tadawul

A Look At Casella Waste Systems (CWST) Valuation After Landfill Developments And New CEO Appointment

Casella Waste Systems, Inc. Class A CWST | 102.64 | +1.74% |

Legislative shift and new CEO put Casella Waste Systems (CWST) in focus

Recent legislative moves in New Hampshire that could extend the life of Casella Waste Systems’ North Country Landfill, combined with Ned Coletta’s appointment as CEO, have put the stock back on many investors’ radar.

The recent legislative progress around the North Country Landfill and the leadership change at the top come as Casella Waste Systems’ share price has a 90 day return of 15.32%, while its 1 year total shareholder return is a 6.39% decline. This mix suggests short term momentum has picked up even as longer term holders have had a tougher run.

If you are looking beyond waste services and thinking about where else capital could work, this could be a good moment to scan fast growing stocks with high insider ownership and see what stands out next.

With a recent 15.32% 90 day return, a 1 year total shareholder return decline of 6.39%, and new leadership plus landfill momentum in play, is Casella Waste Systems still mispriced or is the market already baking in future growth?

Price-to-Sales of 3.7x: Is it justified?

Casella Waste Systems last closed at US$103.78, and on a P/S of 3.7x it is flagged as expensive relative to both peers and the wider US Commercial Services space.

The P/S ratio compares the company’s market value to its annual revenue, so at 3.7x you are effectively paying US$3.70 for every US$1 of sales. For a solid waste services business, this often reflects how strongly the market rates its current revenue base and future earnings power, rather than profits today.

Here, several data points sit behind that higher multiple. Earnings are forecast to grow by 68.5% per year and are expected to grow faster than the US market, yet reported net profit over the past five years has declined by 36.5% per year and Return on Equity is 1%, which is considered low. That mix of fast forecast earnings growth and currently thin 0.8% net margins helps explain why some investors may be willing to accept a richer revenue multiple, while others might question how much optimism is already reflected in the price.

Compared with its direct peers on a P/S of 3.2x and the broader US Commercial Services industry on 1.3x, Casella Waste Systems is priced at a clear premium. Against an estimated fair P/S of 1.7x, the current 3.7x level also sits well above what regression based analysis suggests the ratio could move toward if pricing lined up more closely with fundamentals.

Result: Price-to-Sales of 3.7x (OVERVALUED)

However, if forecast earnings growth, margin improvement, or the New Hampshire landfill outcome disappoints, that premium 3.7x P/S could start to look exposed.

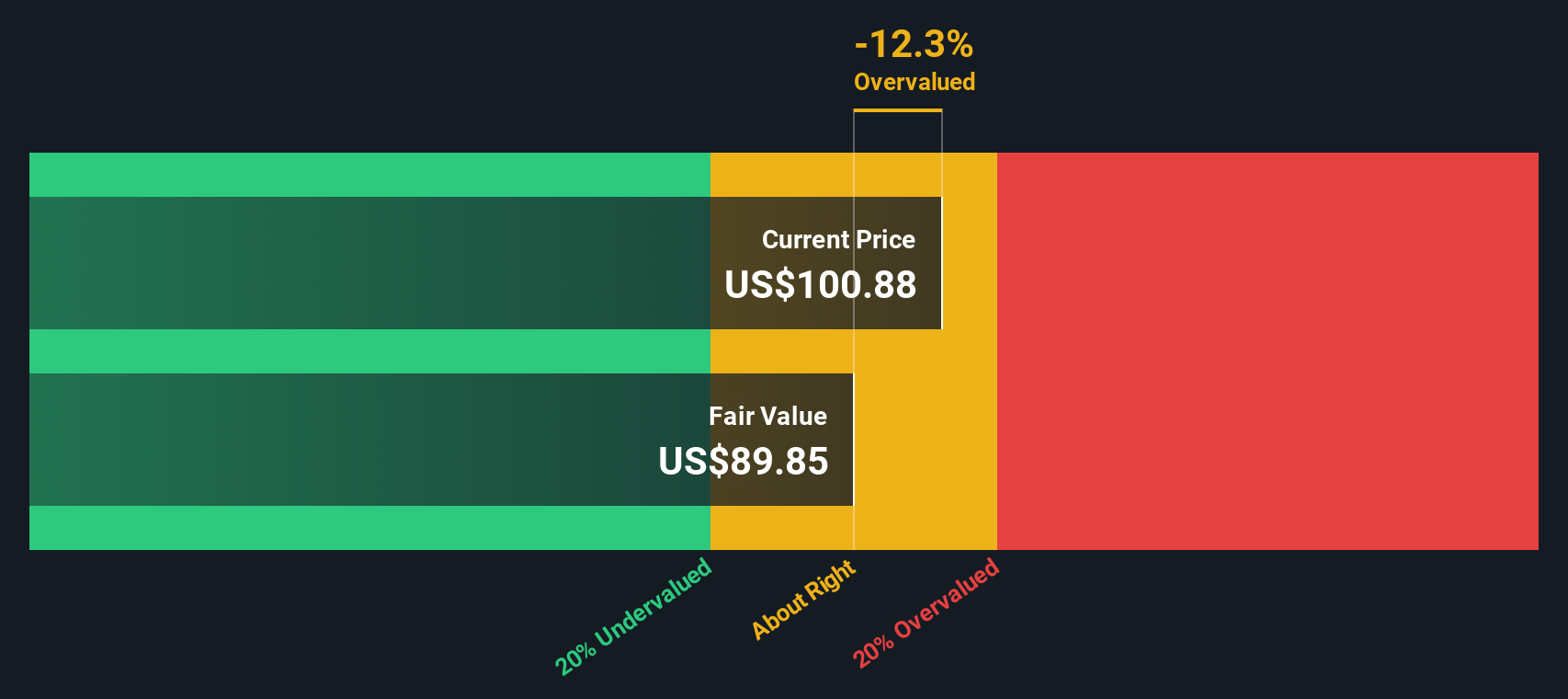

Another angle: SWS DCF points to overvaluation too

Our DCF model estimates Casella Waste Systems’ fair value at US$90.01 per share, compared with the current US$103.78. That implies the stock is trading at a premium on both sales and cash flow based methods. The question for you is whether the earnings forecasts justify paying above this DCF line.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Casella Waste Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Casella Waste Systems Narrative

If this take does not quite match your view, or you prefer to test the numbers yourself, you can build a tailored Casella story in just a few minutes. To get started, use Do it your way.

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at just one company, you might miss opportunities that fit your style even better, so consider adding a few more quality ideas to your radar today.

- Target potential bargains by scanning these 874 undervalued stocks based on cash flows that align with your view on price versus underlying cash flows.

- Explore future focused themes with these 23 AI penny stocks and see which names line up with your expectations for the sector.

- Add income focused ideas by reviewing these 13 dividend stocks with yields > 3% that offer yields above 3% alongside stock specific fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.