Please use a PC Browser to access Register-Tadawul

A Look At CAVA Group (CAVA) Valuation After Recent Share Price Weakness

CAVA Group, Inc. CAVA | 70.11 | +2.44% |

Context for CAVA Group’s Recent Trading

CAVA Group (CAVA) has drawn fresh attention after recent trading left the stock about 5.7% lower on the day and roughly 13.2% lower over the past week.

At a last close of US$62.55, the fast casual restaurant operator now sits modestly higher over the past month and slightly positive over the past 3 months. This performance invites closer inspection of its fundamentals.

Set against a 3.3% year to date share price return and a 49.1% one year total shareholder return decline, the recent pullback suggests that momentum has cooled as investors reassess CAVA’s growth profile and risk.

If CAVA’s swings have you thinking about where else growth could show up in your portfolio, it might be a good moment to scan fast growing stocks with high insider ownership for fresh ideas.

So, with a 49.1% one-year total return decline, double-digit annual revenue and net income growth, and a last close below the average analyst price target, is CAVA now mispriced, or is the market already pricing in future growth?

Most Popular Narrative: 12.1% Undervalued

With CAVA Group’s most followed fair value estimate at $71.20 versus a last close of $62.55, the current market price sits below that narrative anchor.

Rapid geographic expansion into new and underserved markets, supported by strong new unit performance and a robust target of at least 1,000 restaurants by 2032, is likely to accelerate systemwide sales and drive higher topline revenue growth.

Curious what kind of revenue ramp, margin path and future earnings multiple need to line up for that valuation to hold up? The narrative leans on a tight set of growth, profitability and discount rate assumptions that paint a very specific picture of where CAVA could be a few years from now.

The most widely followed narrative applies an 8.40% discount rate and projects solid revenue expansion with more modest profit margins, then capitalizes those earnings at a future P/E that sits well above the wider US hospitality group. It also bakes in expectations around share count growth, restaurant openings and brand momentum that are more optimistic than the recent one year share price performance might suggest, which is why it lands above both the last close and the internal cash flow based estimate.

Result: Fair Value of $71.20 (UNDERVALUED)

However, there are real pressure points here, including slower same restaurant sales than some analysts expected and the risk that rapid expansion pushes costs higher than modeled.

Another Angle On CAVA’s Valuation

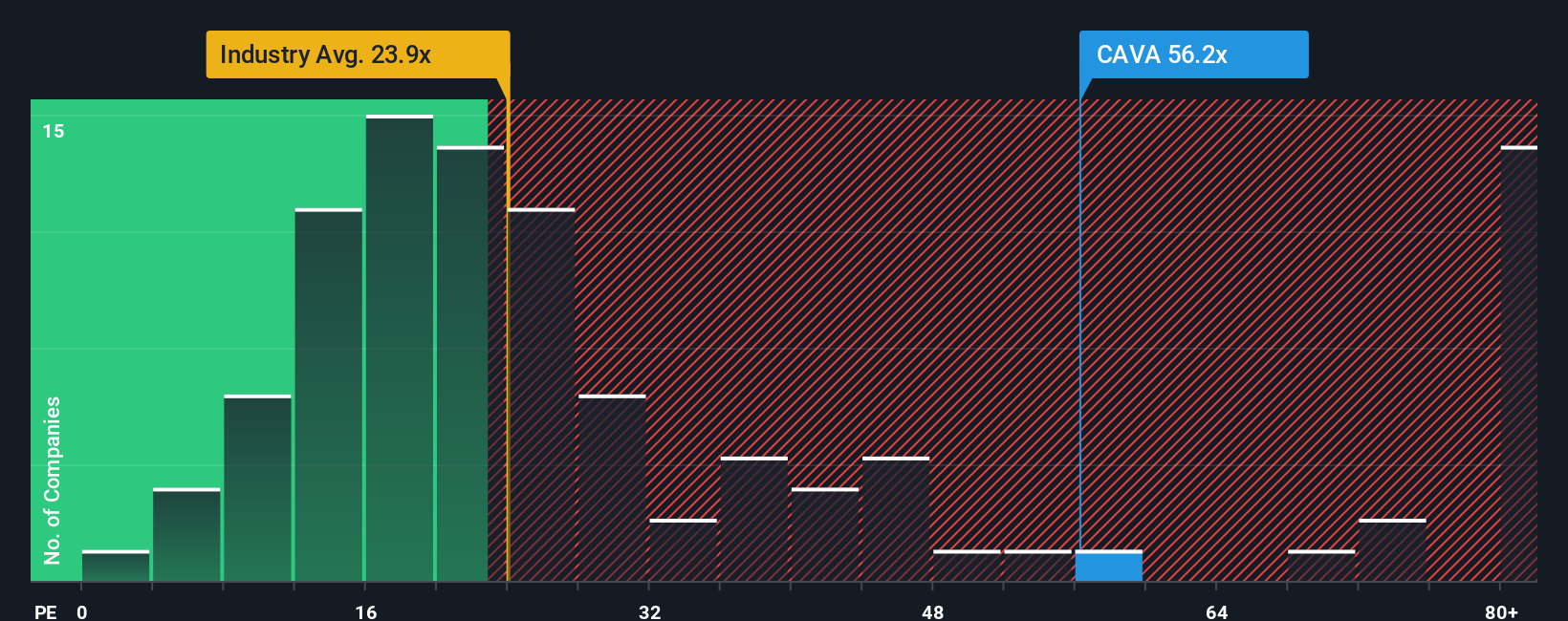

The fair value narrative paints CAVA as 12.1% undervalued, but the current P/E of 52.8x tells a different story. That is higher than the US Hospitality average of 21.4x, the peer average of 49.7x, and the SWS fair ratio of 20.3x. This points to meaningful valuation risk if sentiment cools.

Build Your Own CAVA Group Narrative

If you interpret the numbers differently or prefer to test your own assumptions, you can build a custom CAVA view in just a few minutes by starting with Do it your way.

A great starting point for your CAVA Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If CAVA is just one piece of your watchlist, do not stop here. Use focused stock ideas to pressure test your views and surface opportunities you might miss.

- Spot early growth stories with stronger balance sheets by checking out these 3514 penny stocks with strong financials that already show solid financial foundations.

- Ride the next wave of automation and data breakthroughs by scanning these 23 AI penny stocks for companies tied to real earnings and cash flow.

- Target potential value outliers by reviewing these 888 undervalued stocks based on cash flows that screen as below their estimated cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.