Please use a PC Browser to access Register-Tadawul

A Look At Centrus Energy (LEU) Valuation After Earnings Miss And $900 Million DOE Award

Centrus Energy Corp. Class A LEU | 203.73 | -2.47% |

Centrus Energy Corp. (LEU) set off a sharp market reaction after reporting fourth quarter 2025 earnings that missed analyst expectations, even as it highlighted a large government enrichment award and expanded centrifuge manufacturing plans.

The earnings miss has triggered a sharp reset in sentiment, with a 1 day share price return of 11.88% decline and a 30 day share price return of 37.91% decline. Total shareholder return over 1 year and 5 years remains very strong, suggesting recent momentum has faded while the longer term story is still intact.

If Centrus's pullback has you thinking more broadly about nuclear fuel and infrastructure, it could be a good time to see what else is out there with our 87 nuclear energy infrastructure stocks.

With the share price down sharply, full year revenue and net income still positive, and the stock trading at a discount to the average analyst target, you have to ask: is this a reset worth considering or is the market already baking in the growth story?

Most Popular Narrative: 33.8% Undervalued

The most followed narrative puts Centrus Energy’s fair value at $279.73 versus a last close of $185.20, framing a sizeable gap that rests heavily on long term nuclear fuel demand and funding assumptions.

The current valuation assumes Centrus will rapidly scale capacity to meet rising demand just as Russian supply exits the Western market. However, timelines for building new cascades are long (first cascade takes 42 months, subsequent cascades take months each) and highly dependent on the allocation and timing of DOE funding. Any holdup in these government awards or in private capital inflows could lead to prolonged periods of underutilized cash, lower revenue, and diminished operating leverage, thus pressuring future margins and earnings.

Want to see what sits behind that valuation gap? The most followed narrative leans on specific paths for revenue, margins, and future earnings multiples. The exact mix of growth and compression might surprise you.

Result: Fair Value of $279.73 (UNDERVALUED)

However, that gap relies on steady federal funding and timely reactor and enrichment projects, so delays or scaled back nuclear buildouts could quickly challenge the bullish case.

Another View: Rich Multiples Keep Expectations High

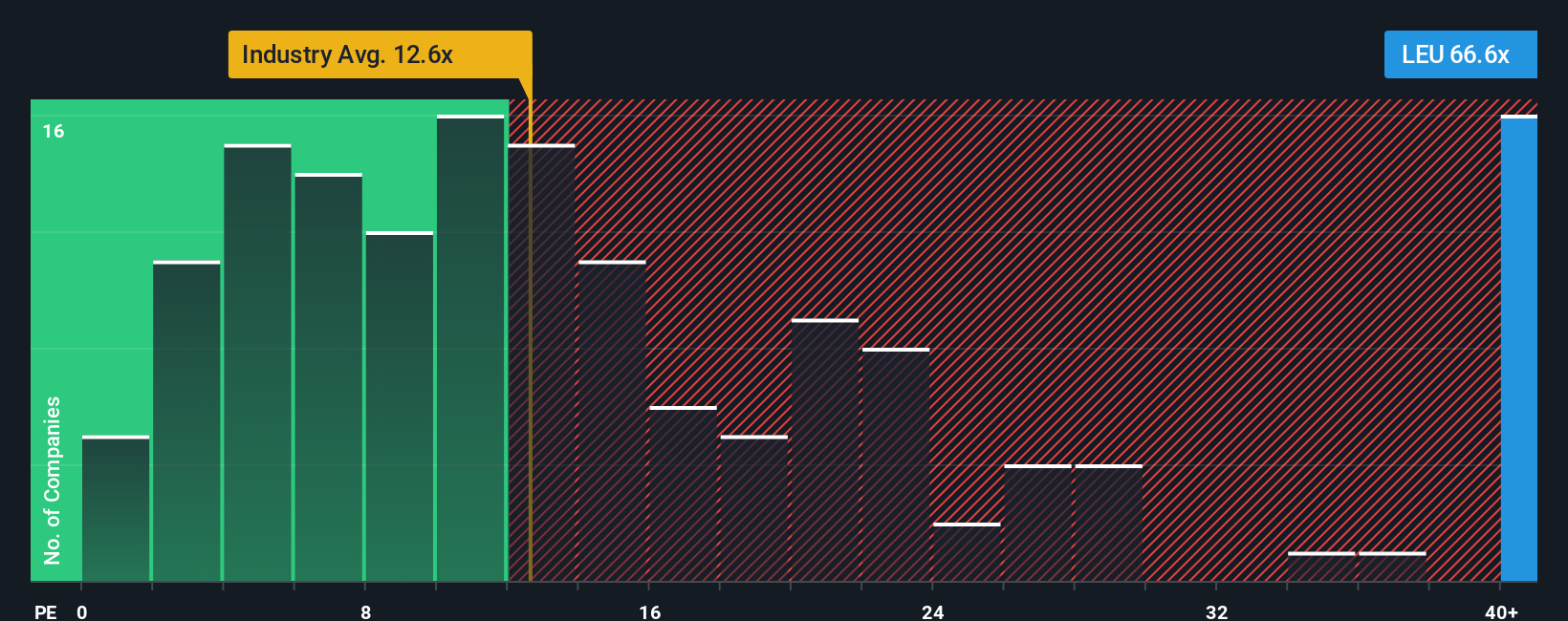

That 33.8% “undervalued” narrative sits alongside some punchy valuation signals. Centrus trades on a P/E of 46.8x, compared with 14.2x for the US Oil and Gas industry and a fair ratio of 13.2x that our model suggests the market could move toward. That kind of gap can mean either room for a reset or a long wait for earnings to catch up. Which side do you think the market is leaning toward?

Build Your Own Centrus Energy Narrative

If you see the numbers differently or simply want to test your own assumptions, it is easy to build a personal view in minutes. So why not Do it your way next and put your version on record.

A great starting point for your Centrus Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Centrus has you rethinking your portfolio, do not stop here. Use the screener to uncover fresh ideas you will wish you had found sooner.

- Spot potential mispricings early by checking out our list of 55 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect them.

- Strengthen your income stream by reviewing 16 dividend fortresses that aim to pair higher yields with resilient business models.

- Prioritise resilience by scanning 85 resilient stocks with low risk scores that our models flag with relatively lower overall risk scores.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.