Please use a PC Browser to access Register-Tadawul

A Look At Century Aluminum (CENX) Valuation As Oklahoma Smelter Project Reshapes Growth Expectations

Century Aluminum Company CENX | 52.64 | +0.27% |

Century Aluminum’s Oklahoma smelter project and what it could mean for investors

The new multi billion dollar primary aluminum smelter project in Oklahoma, led by Century Aluminum (CENX) and Emirates Global Aluminium, is drawing fresh attention from investors assessing the company’s expanding role in U.S. production.

The Oklahoma smelter announcement comes as Century Aluminum’s share price sits at US$53.44, with strong recent momentum highlighted by a 12.43% 7 day share price return and an 84.02% 90 day share price return. The 1 year total shareholder return of 165.08% and 3 year total shareholder return of almost 4x suggest this project is unfolding against a backdrop of already very strong long term investor gains.

If this story has you thinking about where heavy industry and energy demand could head next, it might be a good time to scan 24 power grid technology and infrastructure stocks as a starting list of potential ideas.

With the stock already up sharply and trading only about 10% below the US$59 analyst target despite an indicated intrinsic discount of roughly 55%, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 9.4% Undervalued

At $53.44, the most followed narrative pegs Century Aluminum’s fair value at $59, implying some remaining upside based on its long term earnings potential.

The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production, capturing rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections. This is expected to support future revenue growth and improved fixed cost absorption, thus enhancing net margins.

Curious how this Oklahoma build out, margin reset, and revenue runway all feed into that fair value line? The narrative leans on ambitious earnings, richer profitability, and a future earnings multiple that is still lower than many peers. Want to see the exact mix that gets to $59?

Result: Fair Value of $59 (UNDERVALUED)

However, this depends on supportive tariffs and incentives, as well as on major projects like Mt. Holly and Oklahoma avoiding delays or cost overruns that could squeeze returns.

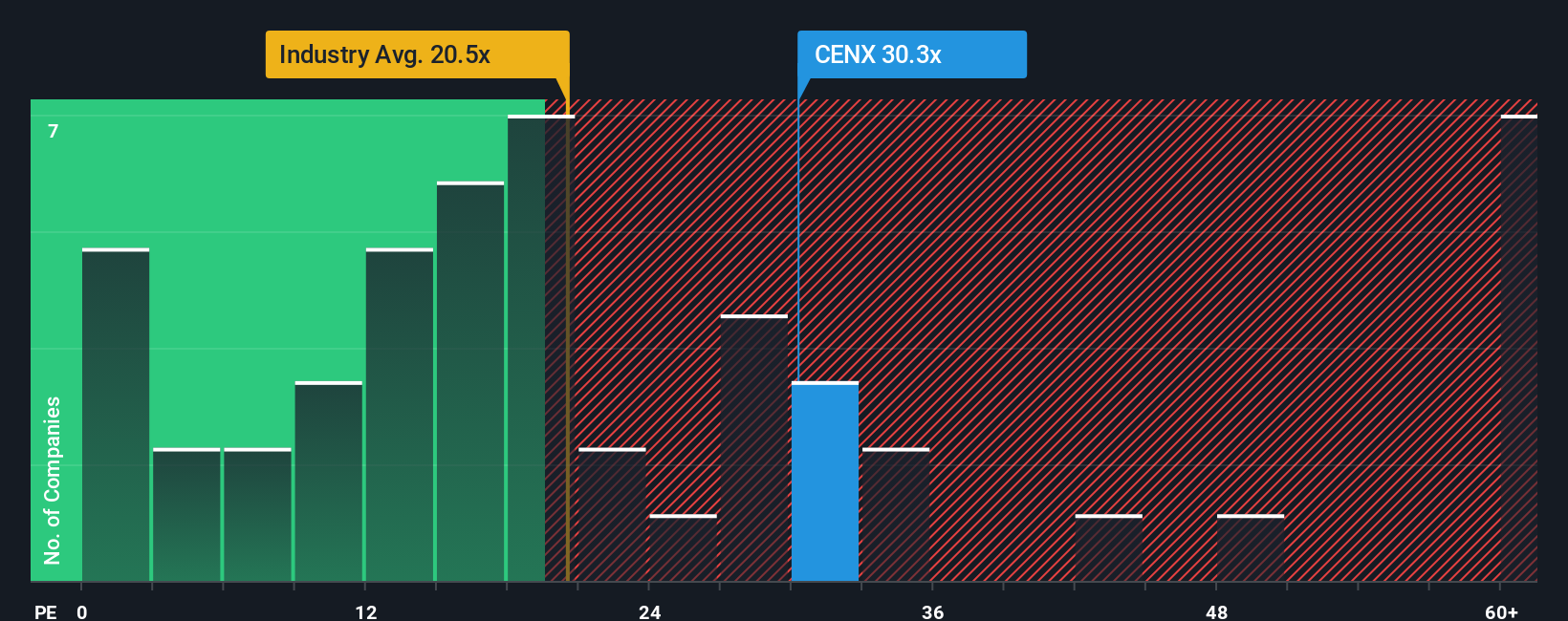

Another Angle: Earnings Multiple Sends A Different Signal

So far, the story leans on cash flow and earnings power to claim Century Aluminum looks undervalued. However, if you look at the simple P/E, the picture is less comfortable. CENX trades on a 61.7x P/E, compared with a fair ratio of 45.9x.

That is also higher than both the peer average P/E of 52x and the broader US Metals and Mining industry at 27x. Put plainly, the market is already paying up for CENX, which can mean less room for error if earnings or sentiment slip. Which lens do you trust more when the signals do not quite line up?

Build Your Own Century Aluminum Narrative

If parts of this story do not sit right with you, or you prefer to work from your own numbers and assumptions, you can build a custom view of Century Aluminum in just a few minutes, starting with Do it your way.

A great starting point for your Century Aluminum research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Century Aluminum is on your radar, do not stop there. Widening your search with a few focused stock lists now could surface opportunities you regret missing later.

- Zero in on potential mispriced names by scanning our list of 51 high quality undervalued stocks that combine robust fundamentals with room for a possible rerating.

- Prioritise resilience and sleep easier at night by reviewing companies in the 85 resilient stocks with low risk scores that score well on stability and downside protection.

- Hunt for fresh opportunities off the beaten path with a screener containing 24 high quality undiscovered gems that many investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.