Please use a PC Browser to access Register-Tadawul

A Look At Chefs' Warehouse (CHEF) Valuation After Benchmark Outlook And Italco Deal

Chefs' Warehouse, Inc. CHEF | 70.02 | +0.81% |

Event driven interest in Chefs' Warehouse

Benchmark’s updated outlook on Chefs' Warehouse (CHEF), paired with the Italco Food Products acquisition and growth in the Middle East, has put the distributor’s expansion story back in focus for investors.

Chefs' Warehouse shares trade at US$63.60 after a 4.21% 1 month share price return and a 15.38% 1 year total shareholder return, suggesting recent news around acquisitions and Middle East growth has kept interest building rather than fading.

If recent moves in specialty food distribution have your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With shares at US$63.60 and an indicated intrinsic discount of about 29% versus some models, investors now have to decide whether Chefs' Warehouse still trades at a discount or if the market is already baking in future growth.

Most Popular Narrative: 16.5% Undervalued

With Chefs' Warehouse last closing at $63.60 against a widely followed fair value of about $76.13, the current setup hinges on how convincingly the premium foodservice story plays out.

Operational improvements, such as investments in procurement, digital ordering (now ~60% of specialty sales), predictive demand forecasting, and inventory optimization technology, are already contributing to margin efficiency and scalability, laying the groundwork for further net margin and earnings expansion as these initiatives mature.

Curious what kind of revenue trajectory, margin lift, and future earnings multiple are baked into that fair value around $76? The narrative leans on premium dining demand, a bigger mix of specialty products, and a richer profit profile than today. The key assumptions may surprise you.

Result: Fair Value of $76.13 (UNDERVALUED)

However, this hinges on premium foodservice holding up; ongoing labor cost pressure and acquisition integration issues could quickly challenge those margin and earnings assumptions.

Another View: Multiples Flash A Caution Sign

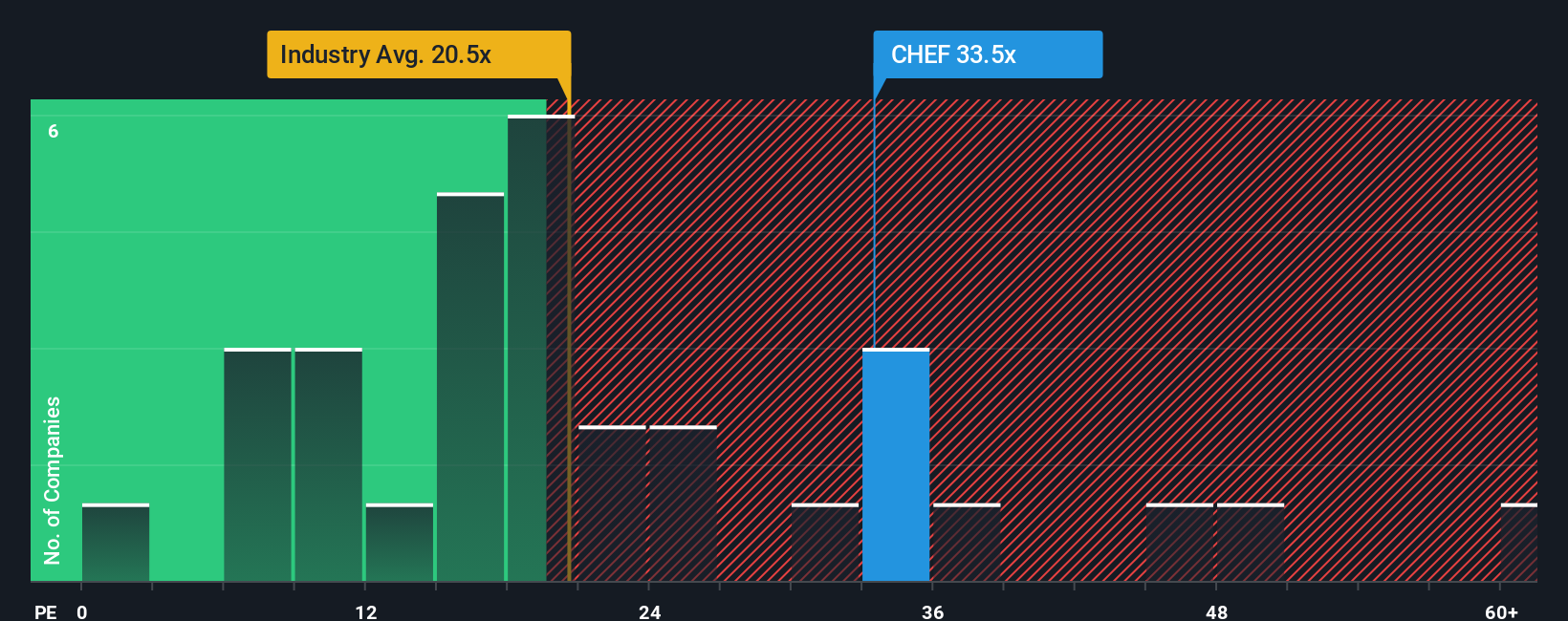

Our DCF model suggests Chefs' Warehouse is trading at a discount to estimated future cash flows, yet the current P/E of 34.7x sits well above both the Consumer Retailing industry at 21.8x and an 18.1x fair ratio. That gap points to valuation risk if sentiment cools.

Build Your Own Chefs' Warehouse Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view of Chefs' Warehouse in just a few minutes, starting with Do it your way.

A great starting point for your Chefs' Warehouse research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Chefs' Warehouse has sharpened your focus, do not stop here. Broaden your opportunity set with a few targeted screens that can surface very different types of ideas.

- Scan for potential income payers by reviewing these 11 dividend stocks with yields > 3%, which might complement a growth focused portfolio.

- Spot potential mispricings by checking these 868 undervalued stocks based on cash flows, which currently look cheap based on their cash flows.

- Get ahead of sector shifts by tracking these 19 cryptocurrency and blockchain stocks, which are tied to blockchain and digital asset themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.