Please use a PC Browser to access Register-Tadawul

A Look at Cleveland-Cliffs (CLF) Valuation Following New $275 Million Debt Issue and Balance Sheet Moves

Cliffs Natural Resources Inc. CLF | 12.71 | -5.22% |

Cleveland-Cliffs just wrapped up an upsized fixed-income deal, adding $275 million of new 7.625% Senior Guaranteed Notes due 2034. This fresh round of debt aims to streamline the company’s balance sheet by repaying existing borrowings.

Following this debt raise, Cleveland-Cliffs has attracted attention as its recent flurry of capital moves coincided with a notable rebound in the stock. The company posted a robust 14.7% one-month share price return and its year-to-date gain now sits at 39.6%. Meanwhile, the one-year total shareholder return remains slightly negative. Recent momentum suggests investors are starting to look past last year’s struggles and may be recalibrating their outlook as management takes steps to strengthen the balance sheet.

If you’re watching these kinds of recovery stories, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

The big question now is whether Cleveland-Cliffs shares are undervalued, with fresh debt fueling optimism, or if the recent rally has already baked future growth into the price and is limiting upside for new buyers.

Most Popular Narrative: 9% Overvalued

Compared to Cleveland-Cliffs' last closing price of $13.32, the most popular narrative puts fair value at just $12.17. The gap signals analysts see the stock trading ahead of projected fundamentals, raising the stakes for any investors betting on upside from here.

New investments in higher-margin stainless and specialty steels, buoyed by infrastructure investment, electrification, and clean-energy buildout, will expand Cleveland-Cliffs' addressable markets and support lasting product mix improvement. This is expected to increase revenue growth and support higher average selling prices.

Curious which numbers power this reach for premium valuation? The fair value hinges on bold profit rebound forecasts and higher-than-market earnings multiples. Want to know what’s really behind this fair value? Dive in for a look at the growth and margin assumptions the narrative counts on.

Result: Fair Value of $12.17 (OVERVALUED)

However, risks remain, especially if steel tariffs are eased or if global overcapacity continues to pressure prices and margins for Cleveland-Cliffs.

Another View: Multiples Tell a Different Story

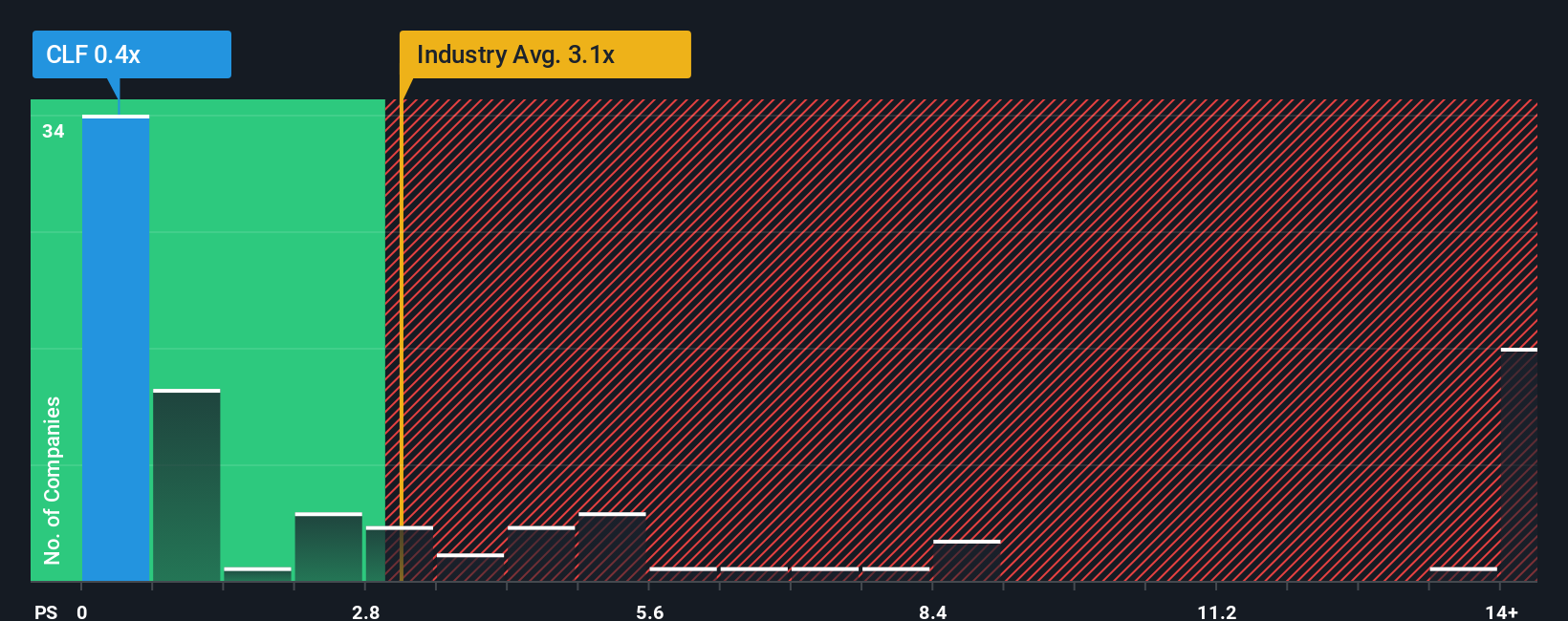

Looking at Cleveland-Cliffs through the lens of price-to-sales, the shares actually trade at just 0.4x sales. That is well below both the industry average of 3.1x and close peer levels of 1.3x. Even compared to a fair ratio of 0.8x, the current valuation appears cautious. Could the market be underestimating a rebound, or is this discount a warning sign?

Build Your Own Cleveland-Cliffs Narrative

If you’re not convinced by the consensus or want to test your own assumptions, you can shape the data into your own narrative in just a few minutes. Do it your way

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Unlock your edge by tapping into handpicked stocks and trends designed to keep your portfolio ahead of the pack.

- Maximize gains from up-and-coming trends by checking out these 24 AI penny stocks. Uncover companies with real artificial intelligence potential that are driving market momentum.

- Power your income strategy with these 18 dividend stocks with yields > 3%. Explore high-yielding picks that can boost cash flow without sacrificing financial reliability.

- Ride the wave of digital transformation when you browse these 79 cryptocurrency and blockchain stocks. Spot innovators leading advancements in secure payment networks and blockchain-driven solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.