Please use a PC Browser to access Register-Tadawul

A Look At Cooper Companies (COO) Valuation After Its Term Loan Amendment And Extended Debt Maturities

Cooper Companies, Inc. COO | 82.99 | +1.58% |

Cooper Companies (COO) recently amended its 2021 term loan, extending the maturity of US$950 million of debt to 2031 and raising its capacity for additional term loans tied to consolidated EBITDA.

The term loan amendment arrives after a mixed stretch for investors, with a 15.75% 90 day share price return and a 1 year total shareholder return decline of 9.73%, suggesting recent momentum has picked up even as longer term returns remain weak.

If this debt move has you thinking about where growth and risk might look different, it could be a good moment to scan our 25 healthcare AI stocks for fresh healthcare ideas outside your usual watchlist.

With revenue at US$4,092.4m, net income at US$374.9m and shares trading at US$83.05, plus a modest discount to some intrinsic and analyst estimates, you have to ask: is Cooper quietly cheap or already pricing in its next chapter?

Most Popular Narrative: 8.7% Undervalued

With Cooper Companies at $83.05 against a widely followed fair value narrative of about $91, the story hinges on how future cash flows play out.

Free cash flow is poised to inflect higher as a multi-year capital expenditure cycle winds down following the ramp-up of MyDAY capacity, with management guiding for approximately $2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Curious what kind of revenue profile and profit margins have to sit behind that free cash flow path, and what future earnings multiple ties it all together? The full narrative breaks down those moving parts so you can judge whether that $91 fair value stacks up against your own expectations.

Result: Fair Value of $91 (UNDERVALUED)

However, you also need to weigh risks such as slower contact lens market growth and ongoing pressure in fertility and PARAGARD, which could potentially cap how that story plays out.

Another Angle On Valuation

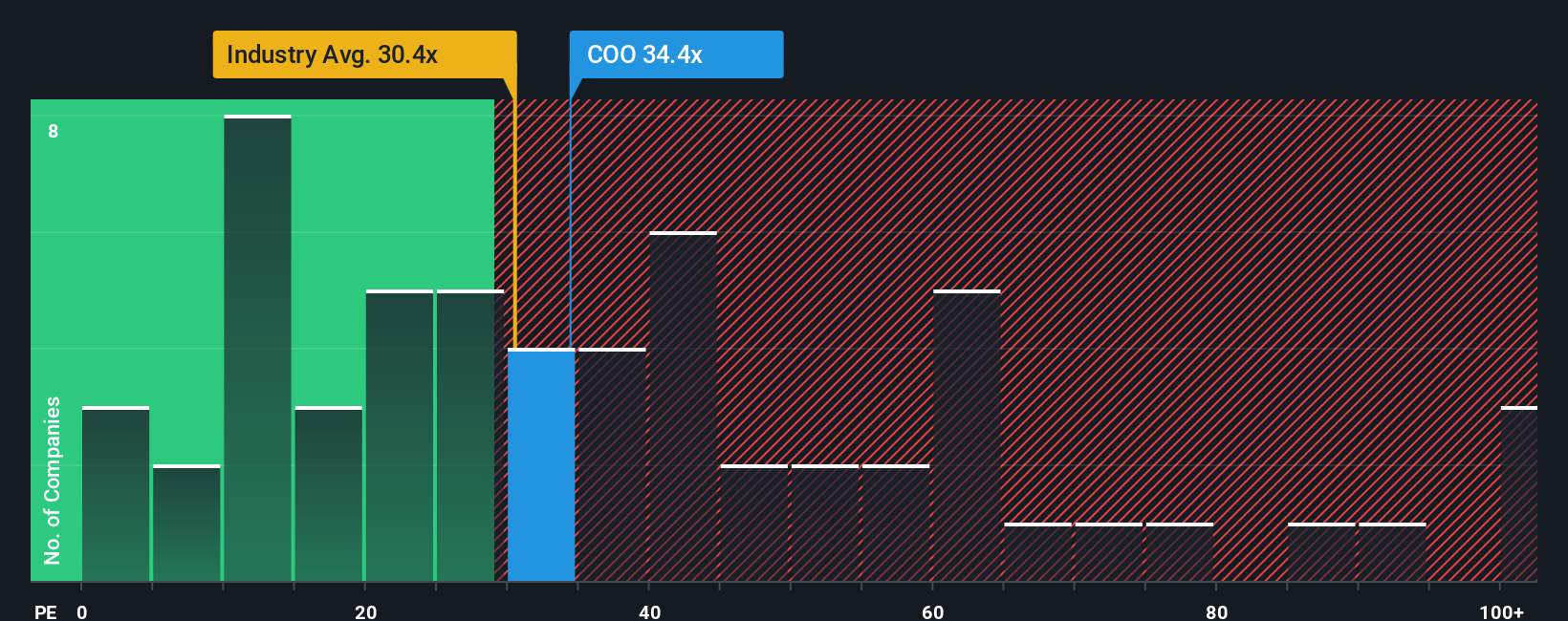

So far, the story leans on cash flow and fair value estimates that suggest Cooper Companies is about 8.3% below an implied $90.54 to $91 range. If you switch to the P/E lens instead, the picture is less comfortable.

On earnings, the stock trades at a P/E of 43.4x, compared with 30.9x for the wider US Medical Equipment industry and 28.5x for its peer group. Our fair ratio comes in even lower at 29.5x, implying the market is paying a premium that could unwind if sentiment or expectations cool. Which lens do you trust more when the signals do not quite line up?

Build Your Own Cooper Companies Narrative

If your view of Cooper’s future looks different, or you simply prefer to weigh the numbers yourself, you can build a custom thesis in minutes. Start with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Ready for more investment ideas?

If Cooper is just the starting point for you, do not stop here. Put the same focus on quality and risk into the rest of your watchlist.

- Target opportunities that look mispriced and see what stands out in our 51 high quality undervalued stocks, built from companies with stronger fundamentals than their tags suggest.

- Prioritise resilience in tougher markets by scanning our 85 resilient stocks with low risk scores, where balance sheets and risk scores do more of the heavy lifting.

- Hunt for tomorrow's potential standouts before the crowd turns up with our screener containing 24 high quality undiscovered gems, sourced from companies that often sit outside headline indexes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.