Please use a PC Browser to access Register-Tadawul

A Look At Cooper Companies (COO) Valuation As Business Review And Activist Pressure Refocus Attention

Cooper Companies, Inc. COO | 82.99 | +1.58% |

Why Cooper Companies is back in focus

Cooper Companies (COO) is back on investors’ radar after renewed analyst coverage at William Blair following activist investor pressure, alongside a company review of a potential separation of its CooperVision and CooperSurgical businesses.

Cooper Companies’ share price has been relatively muted in the short term, with a 90 day share price return of 16.75% contrasting with a 1 year total shareholder return decline of 15.41%. This suggests recent momentum has picked up as investors react to the business review, activist involvement, and board changes.

If this kind of corporate reshaping has your attention, it could be a good moment to look across other US healthcare names. You can use our healthcare stocks as a starting point for ideas.

With Cooper Companies trading at US$80.65, an indicated 9% discount to one intrinsic value estimate and around 13% below one analyst price target, you have to ask: is this a genuine opening, or is the market already baking in future growth?

Most Popular Narrative: 11.4% Undervalued

Against the last close of $80.65, the most followed narrative pegs Cooper Companies' fair value at about $91.06, framing the current review against long term cash generation.

Free cash flow is poised to inflect higher as a multi-year capital expenditure cycle winds down following the ramp-up of MyDAY capacity, with management guiding for approximately $2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Want to see what has to happen for that cash flow story to line up with this valuation? The narrative leans heavily on compounded revenue growth, wider margins and a lower future earnings multiple than the sector. Curious how those pieces interact over time and what discount rate pulls it all back to roughly $91 per share?

Result: Fair Value of $91.06 (UNDERVALUED)

However, this hinges on MyDAY and MiSight rollouts converting smoothly to sales, while contact lens market growth and pricing pressure do not squeeze margins more than expected.

Another View: Earnings Multiple Sends A Different Signal

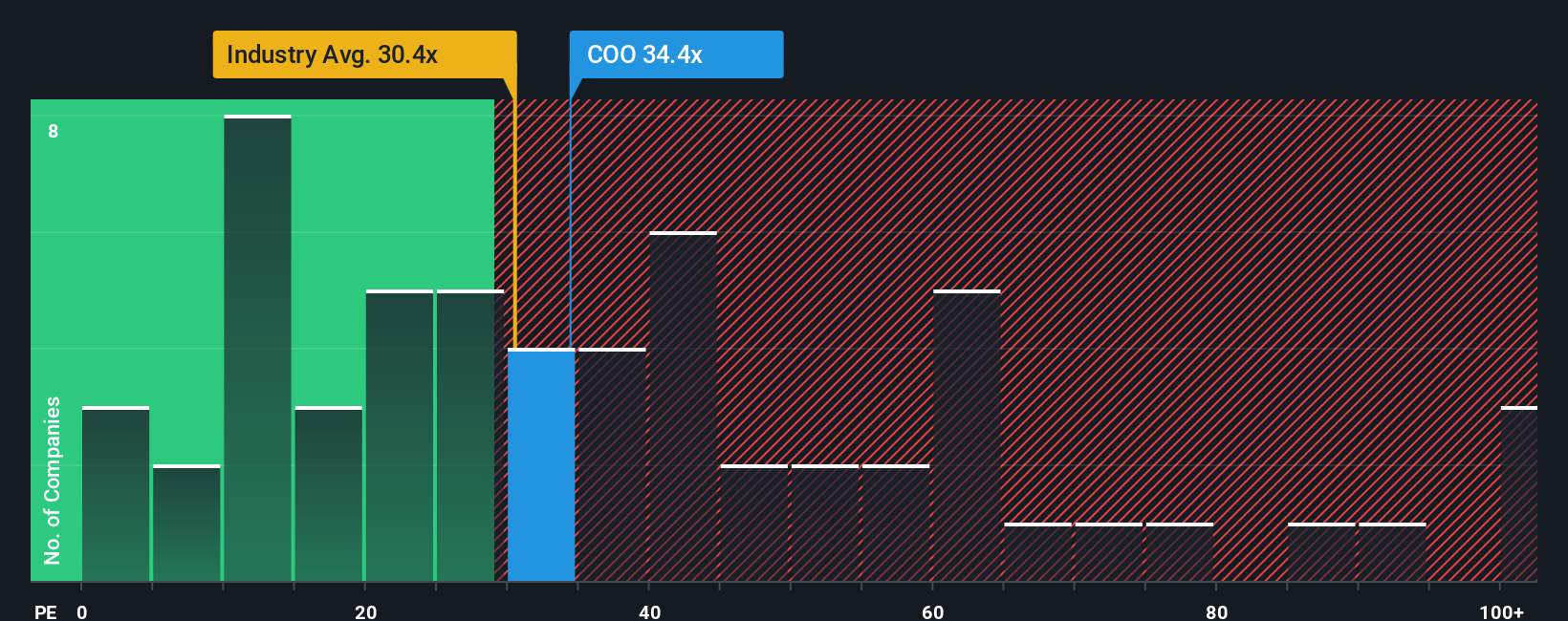

While one narrative frames Cooper Companies as about 11.4% undervalued, the current P/E of 42.2x is well above the US Medical Equipment industry at 31.1x and our fair ratio of 29.5x. That rich gap hints at valuation risk rather than a clear bargain. Which story do you put more weight on?

Build Your Own Cooper Companies Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a fresh view of Cooper Companies in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Looking for more investment ideas?

If Cooper Companies has sharpened your focus, do not stop here. Use the Simply Wall St Screener to spot other stocks that could fit your approach.

- Target reliable income by checking out these 13 dividend stocks with yields > 3% that may line up with your yield expectations and risk tolerance.

- Back potential long term growth by scanning these 24 AI penny stocks that are tied to real revenue and earnings profiles.

- Hunt for price gaps with these 876 undervalued stocks based on cash flows that might offer a more attractive entry point than widely followed names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.