Please use a PC Browser to access Register-Tadawul

A Look At Credo Technology Group Holding (CRDO) Valuation After The 3M Patent License Agreement

Credo Technology Group Holding Ltd. CRDO | 133.16 | -1.44% |

What the 3M patent license could mean for Credo

Credo Technology Group Holding (CRDO) has signed a patent license and mutual covenant agreement with 3M covering its active electrical cable technology, putting a fresh spotlight on how the stock reflects its connectivity patent portfolio.

For you as an investor, the agreement matters because it formalizes 3M's use of certain Credo patents and underscores the commercial relevance of Credo's HiWire active electrical cables that are already used in high speed data center environments.

The 3M agreement comes after a strong rise in total shareholder return, which is up 60.49% over the past year and significantly higher over three years. However, recent share price performance, including a 90 day share price return decline of 13.15% and a 7 day share price return decline of 9.4%, suggests cooling momentum at the latest share price of US$135.1.

If this kind of connectivity story has your attention, it could be a good time to see what else is moving in high growth tech and AI by checking out high growth tech and AI stocks.

So with Credo still showing strong revenue and net income growth, a 1 year total return above 60% but recent short term share price declines, is there genuine upside left here or is the market already pricing in future growth?

Most Popular Narrative: 36.9% Undervalued

At a last close of $135.1 versus a most-followed fair value estimate of about $214, the current price sits well below that narrative view of Credo.

The fair value estimate has risen meaningfully to about $214 from roughly $163, reflecting stronger growth and margin assumptions. The future P/E has declined to about 72.7 times from roughly 81.1 times, suggesting a slightly lower multiple despite higher earnings growth expectations.

Curious what earnings profile could justify such a gap between price and fair value? The narrative leans on brisk revenue expansion, fatter margins and a rich future earnings multiple. Want to see which specific growth paths, profitability targets and valuation hurdles need to line up for that number to hold up?

Result: Fair Value of $214 (UNDERVALUED)

However, those upbeat assumptions could be tested if hyperscaler spending slows, or if competition and pricing pressure weigh on the rich future P/E implied in the narrative.

Another View on Credo's Valuation

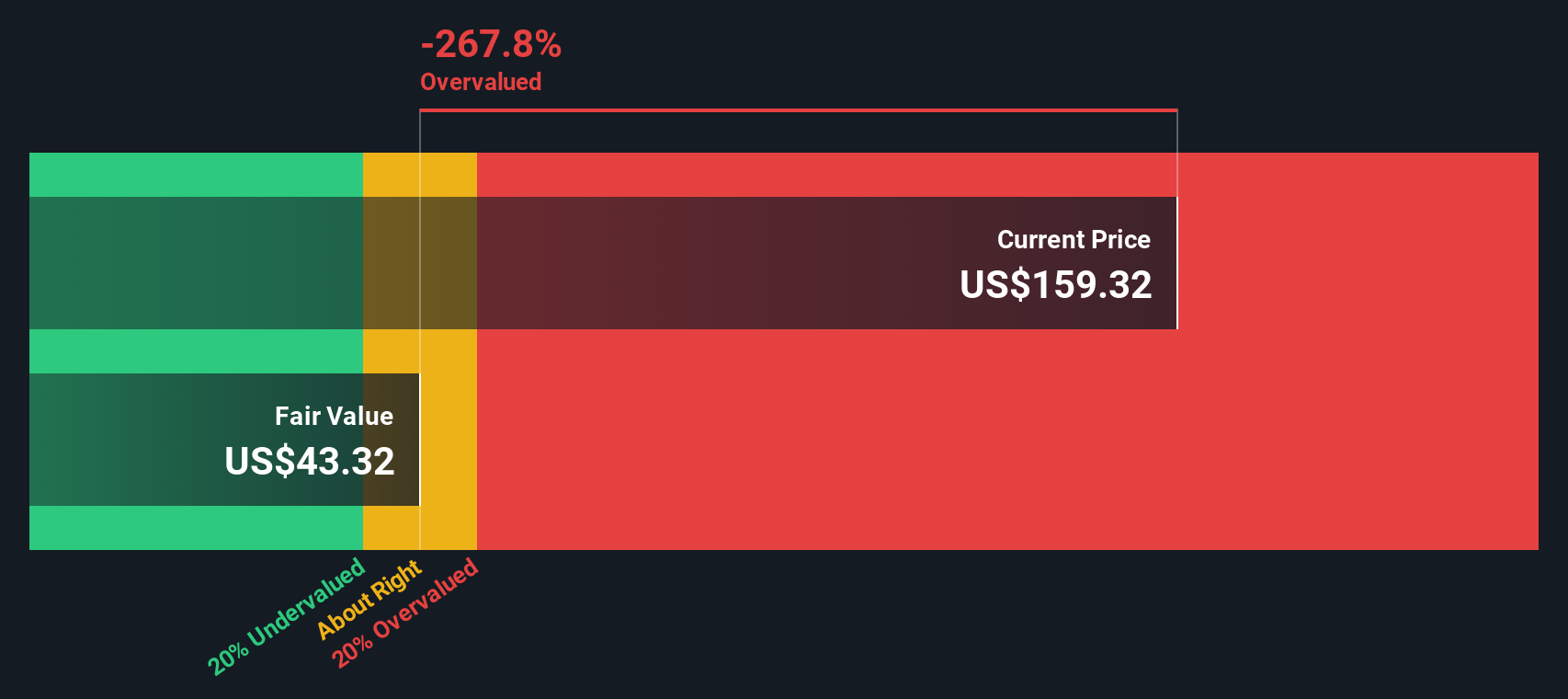

That 36.9% discount to a $214 fair value is one story. Our DCF model tells a very different one, with an estimate of $66.53 compared with the current $135.1 share price, which screens as overvalued based on that perspective. Which narrative do you think better matches the risks you see?

Build Your Own Credo Technology Group Holding Narrative

If you see the numbers differently, or prefer to stress test the assumptions yourself, you can build a fresh Credo view in minutes with Do it your way.

A great starting point for your Credo Technology Group Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Credo has you thinking about what else might be worth your attention, do not stop here. Broaden your watchlist and pressure test your next move.

- Scan for potential turnaround candidates and higher risk reward setups by checking out these 3524 penny stocks with strong financials that already clear basic financial quality filters.

- Target the intersection of growth and cutting edge technology by reviewing these 24 AI penny stocks that are directly tied to artificial intelligence themes.

- Hunt for mispriced opportunities using these 880 undervalued stocks based on cash flows that screen for companies trading below cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.