Please use a PC Browser to access Register-Tadawul

A Look At Douglas Emmett (DEI) Valuation After Recent Analyst Downgrades On Occupancy And FFO Concerns

Douglas Emmett, Inc DEI | 10.46 | +2.85% |

Several firms have recently downgraded Douglas Emmett (DEI), pointing to persistent weakness in occupancy and leasing momentum across its Los Angeles office portfolio, along with lower funds from operations estimates and a slower regional recovery.

The recent downgrades arrive after a difficult period for investors, with a 1 year total shareholder return of 32.94% decline and a 5 year total shareholder return of 50.07% decline. The latest US$11.12 share price reflects fading momentum after a 15.76% drop in the 3 month share price return.

If you are reassessing your exposure to office focused REITs, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With the share price at US$11.12, trading below the latest analyst price target and an indicated intrinsic discount, the key question is whether you are seeing a genuine undervaluation here or if the market is already pricing in future growth.

Most Popular Narrative: 18.7% Undervalued

At a last close of US$11.12 against a narrative fair value of US$13.68, the gap centers on how future earnings power is being modelled.

The analysts have a consensus price target of $17.773 for Douglas Emmett based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $13.0.

Curious what has to happen to margins for this valuation to stack up? Revenue assumptions, profit conversion and the future earnings multiple all carry weight here.

Result: Fair Value of $13.68 (UNDERVALUED)

However, you cannot ignore that weaker office occupancy and higher interest expenses are already pressuring revenues and FFO. In addition, 2025 guidance flags negative net income per share.

Another View: High P/E Signals A Very Different Story

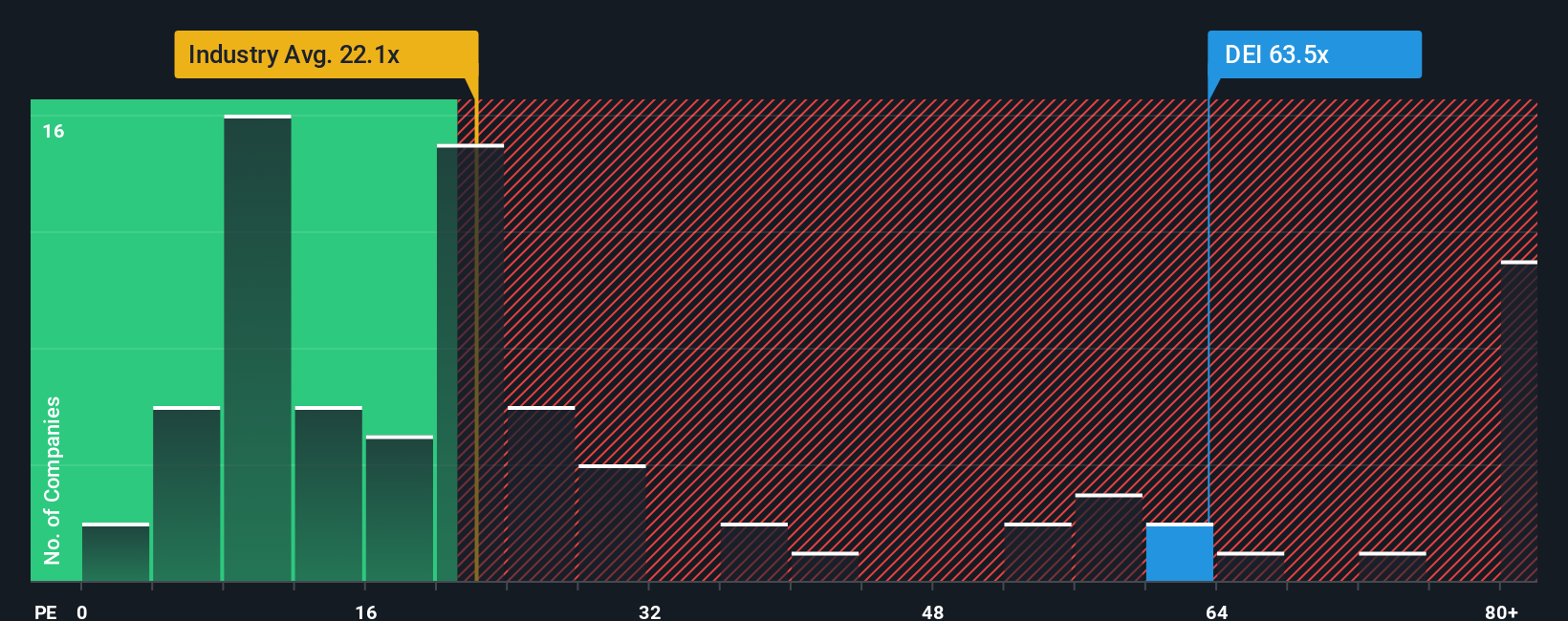

The DCF work points to Douglas Emmett trading below fair value, but the earnings multiple tells you something else. At a P/E of 89.3x, the shares are priced far above the Global Office REITs average of 22.4x, the peer average of 40x, and the fair ratio of 11.9x.

That gap suggests a lot of optimism is already baked into the earnings-based valuation, which could mean less room for error if occupancy or funds from operations underwhelm. As you weigh the DCF upside against this rich multiple, consider which signal matters more for you right now.

Build Your Own Douglas Emmett Narrative

If you see the story differently or want to stress test these assumptions with your own inputs, you can build a custom view in just a few minutes using Do it your way.

A great starting point for your Douglas Emmett research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If this analysis has you rethinking your next move, do not stop here. Broaden your watchlist and let data rich stock ideas do more of the work.

- Spot potential value candidates early by scanning these 873 undervalued stocks based on cash flows that may offer more compelling pricing based on cash flows.

- Consider long term technology shifts by filtering for these 24 AI penny stocks capturing companies tied to artificial intelligence themes.

- Put income at the center of your plan by screening these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.