Please use a PC Browser to access Register-Tadawul

A Look At Empire State Realty Trust (ESRT) Valuation After New Rolex Lease In Williamsburg

Empire State Realty Trust, Inc. Class A ESRT | 5.93 | -2.15% |

Rolex lease in Williamsburg puts fresh attention on Empire State Realty Trust

Empire State Realty Trust (ESRT) recently signed a lease with Tourneau, LLC for a Rolex retail store at its North Sixth Street Collection in Williamsburg, Brooklyn. The agreement is drawing fresh attention to the REIT's retail footprint and leasing activity.

The Rolex lease and upcoming fourth quarter 2025 results arrive after a weak stretch for the shares, with a 30 day share price return of 8.19% decline and a 1 year total shareholder return of 31.81% decline, which suggests recent momentum has been fading as the market reassesses both growth potential and risk around ESRT’s New York focused portfolio and retail leasing story.

If this kind of single name news has you thinking more broadly about where to put fresh capital, it could be a good moment to check out fast growing stocks with high insider ownership.

With ESRT shares showing negative returns over 1, 3, and 5 years and trading below the average analyst target price, you have to ask yourself: is this New York focused REIT quietly undervalued, or is the market already pricing in whatever growth lies ahead?

Most Popular Narrative: 23.6% Undervalued

At a last close of US$6.39 versus a narrative fair value of US$8.36, the valuation gap hinges on how you see ESRT’s future earnings power and cash flows.

The analysts have a consensus price target of $8.967 for Empire State Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $8.0.

One possible question is why a company with shrinking earnings projections still screens as undervalued. Revenue edging higher, margins tightening, and a punchy future P/E all sit at the core of this narrative. The real story is in how those moving pieces get discounted back using an 8.25% rate. If you want to see exactly which assumptions support that gap to fair value, the full narrative lays it all out.

Result: Fair Value of $8.36 (UNDERVALUED)

However, you also have to weigh softer tourism trends at the Observatory and rising operating expenses, which could pressure margins and challenge the view that the stock is currently undervalued.

Another View: P/E Tells A Different Story

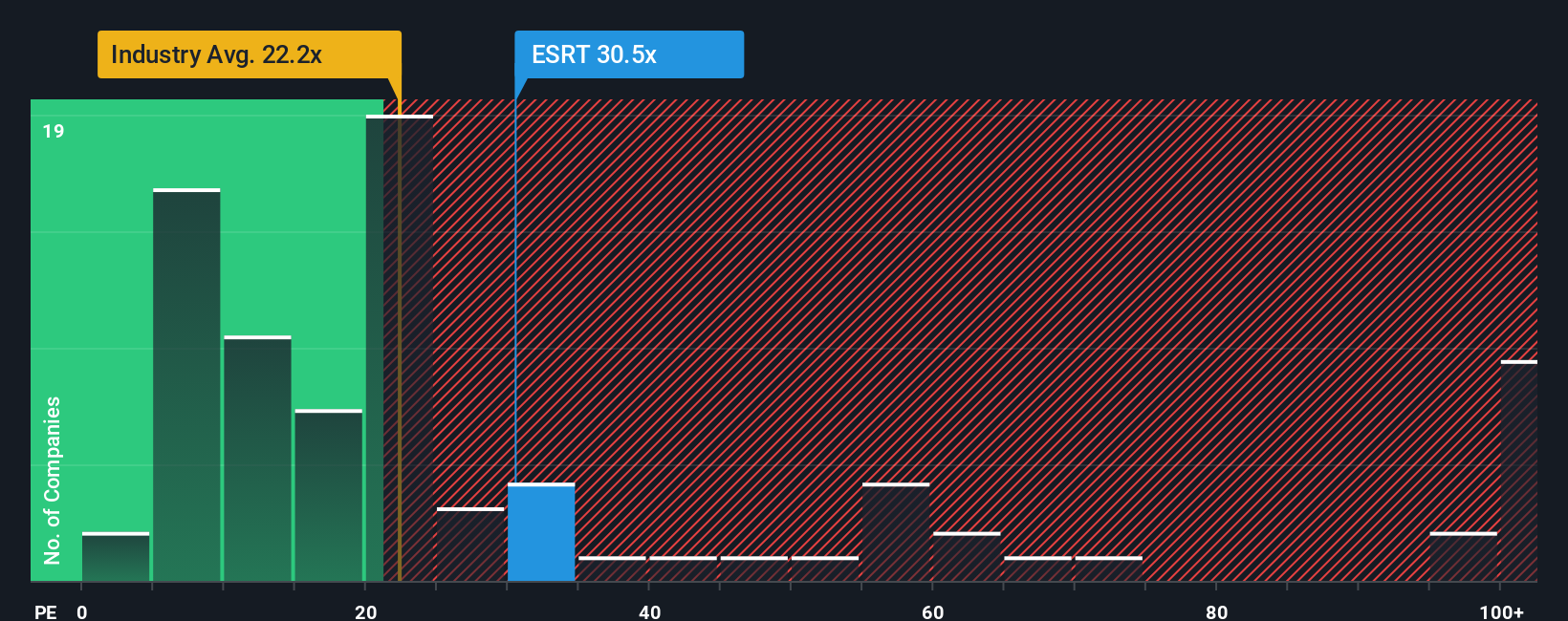

Our SWS fair ratio suggests ESRT’s current P/E of 31.2x sits above where the market could settle over time at 25.1x. It is also below the US Office REITs average of 31.9x but above the global peer group at 22.2x. This raises a simple question: is the risk skewed toward a lower multiple or a catch up by peers?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Empire State Realty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Empire State Realty Trust Narrative

If you think the current story around ESRT misses something, or you would rather work from your own assumptions and data, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Empire State Realty Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If ESRT has sparked your interest, do not stop here. Widen your watchlist with a few focused idea lists that could surface opportunities you have not considered yet.

- Scan for potential value by checking out these 879 undervalued stocks based on cash flows, which lines up current prices against underlying cash flow strength.

- Spot growth themes early by running through these 28 AI penny stocks, where companies are tied to artificial intelligence trends across different sectors.

- Add a different return profile by reviewing these 12 dividend stocks with yields > 3%, which combines income potential with equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.