Please use a PC Browser to access Register-Tadawul

A Look At Everus Construction Group (ECG) Valuation After Strong Third Quarter Earnings Surprise

Everus Construction Group, Inc. ECG | 89.72 | +1.39% |

Everus Construction Group (ECG) is back in focus after third quarter 2025 earnings came in well ahead of analyst expectations, with EPS 52.05% higher and revenue 30% above the prior year.

The strong third quarter update comes after a mixed few months in the market, with a small 1.25% 1 month share price return and a 2.29% year to date share price gain. The 1 year total shareholder return of 18.84% points to momentum that has been building over a longer horizon, even as the recent 1 day and 7 day share price moves have been slightly weaker and investors digest the incoming auditor change and new leadership appointment.

If earnings surprises like Everus have your attention, this could be a good moment to broaden your watchlist with aerospace and defense stocks.

With the stock at $91.22 and trading at a discount of about 15% to the average analyst price target of $104.80, you have to ask: is this a genuine opening, or is the market already pricing in future growth?

Most Popular Narrative: 13.7% Undervalued

Against Everus Construction Group's last close of $91.22, the most followed narrative points to a fair value of about $105.67 using an 8.6% discount rate.

Escalating power infrastructure needs tied to data centers, electric vehicles, industrial reshoring and undergrounding are supporting sustained T&D backlog growth and higher revenue visibility, reinforcing multi year revenue expansion.

Curious what has to happen for that higher valuation to make sense? Revenue, margins and earnings all play a specific role in this story.

Result: Fair Value of $105.67 (UNDERVALUED)

However, you also need to weigh the risk that data center demand cools, or that labor costs and shortages squeeze margins more than analysts currently expect.

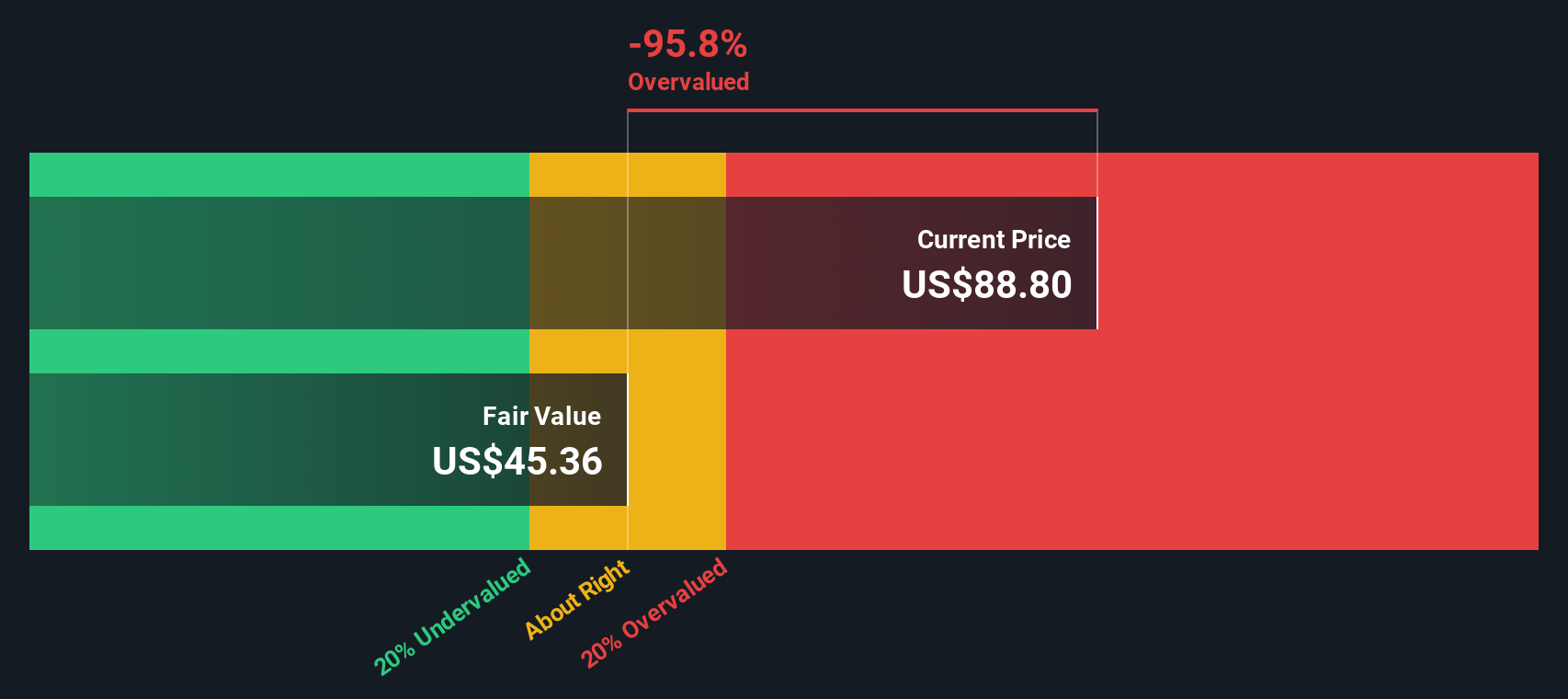

Another View: Cash Flows Paint a Different Picture

While the consensus narrative points to a fair value of $105.67 and labels Everus Construction Group as 13.7% undervalued, our DCF model tells a different story. On that cash flow view, a fair value of about $79.96 suggests the current $91.22 share price is closer to overvalued territory. So which lens do you trust more: earnings or cash flows?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Everus Construction Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Everus Construction Group Narrative

If you see the story differently, or simply want to test your own assumptions against the numbers, you can create a custom Everus view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Everus Construction Group.

Looking for more investment ideas?

If Everus has sharpened your thinking, do not stop here. The next step is lining up a few fresh ideas that could challenge your current watchlist.

- Spot potential turnarounds early by scanning these 3524 penny stocks with strong financials that pair smaller share prices with stronger financial profiles than you might expect.

- Zero in on future facing themes by tracking these 109 healthcare AI stocks bringing data driven tools into medical diagnostics, treatment planning and hospital operations.

- Position yourself ahead of crypto headlines by reviewing these 18 cryptocurrency and blockchain stocks connected to payment rails, blockchain infrastructure and digital asset services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.