Please use a PC Browser to access Register-Tadawul

A Look At FTI Consulting (FCN) Valuation After February Senior Leadership Appointments

FTI Consulting, Inc. FCN | 161.62 | -0.38% |

FTI Consulting (FCN) has been busy reshaping its senior leadership, with a cluster of February appointments across healthcare, chemicals, business transformation and intellectual property. These changes give investors fresh context for thinking about the stock.

At a share price of US$173.36, FTI Consulting has seen a 4.8% 90 day share price return and a 1.8% year to date share price return, while the 1 year total shareholder return of 10.2% decline contrasts with a 62.0% gain over five years. This suggests long term holders have still seen meaningful value even as recent sentiment has cooled.

If these leadership changes have you thinking more broadly about where growth and expertise might show up next, it could be worth scanning 23 top founder-led companies as a source of fresh ideas beyond consulting.

With revenue of US$3.7b, net income of US$266.05m and a share price close to its US$177.50 analyst target, the real question is whether recent appointments leave upside on the table or whether markets already price in future growth.

Most Popular Narrative: 2.3% Undervalued

With FTI Consulting last closing at $173.36 against a fair value narrative of $177.50, the current setup points to a small valuation gap that hinges heavily on how its earnings story plays out over the next few years.

The consulting industry's trend toward consolidation and the challenging macro climate are expected to drive "shakeouts" among weaker competitors, strengthening FTI's competitive position, client retention, and potential for market share gains, all of which could result in sustainable margin expansion and earnings growth.

Want to see what kind of revenue run rate and margin profile sits behind that fair value? The narrative leans on steady top line progress, firmer profitability and a lower earnings multiple than many peers. The mix of growth, efficiency and discounting assumptions is more complex than it first appears.

Result: Fair Value of $177.50 (UNDERVALUED)

However, this hinges on consulting demand holding up, since increased automation or weaker restructuring and transaction activity could leave those earnings and P/E assumptions looking stretched.

Another Angle On Valuation

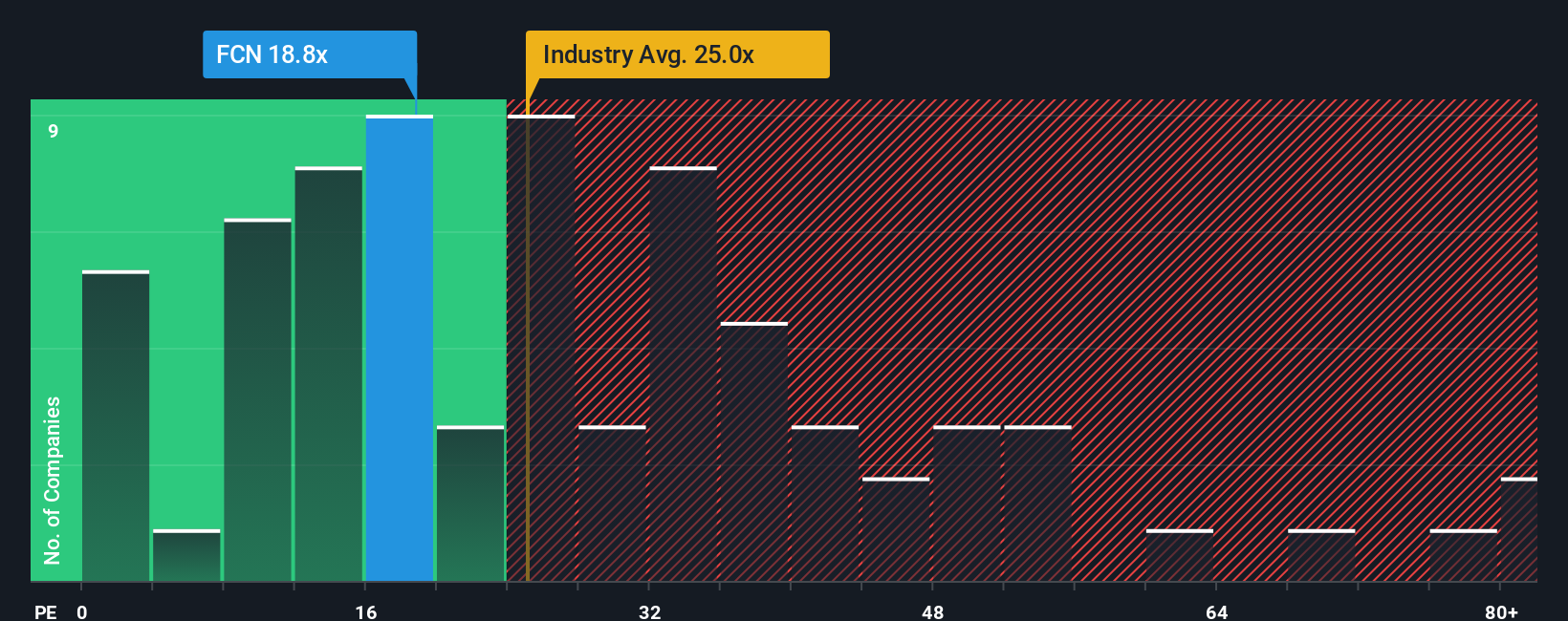

While the fair value narrative leans on future earnings and a lower P/E in a few years, today’s numbers tell a slightly different story. FCN trades on a P/E of 19.7x versus 21.3x for the US Professional Services industry and a 24.2x fair ratio, which suggests the market currently applies a discount rather than a premium. If sentiment or earnings quality shift, does that gap feel like a cushion or a warning sign to you?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTI Consulting for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTI Consulting Narrative

If you look at the numbers and draw a different conclusion, or simply prefer to test your own view using the same data, you can build a personalised thesis in just a few minutes. To begin, start with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Looking for more investment ideas?

If you like what you learned about FTI Consulting, do not stop there. Use the same framework to size up other opportunities that might suit your style.

- Broaden your opportunity set with screener containing 24 high quality undiscovered gems, which looser screens might capture while still passing solid fundamental checks.

- Strengthen your focus on resilience by scanning 83 resilient stocks with low risk scores, which aim to keep risk scores in check while you assess potential returns.

- Sharpen your hunt for quality by checking solid balance sheet and fundamentals stocks screener (45 results), which pair healthier finances with room for your own investment thesis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.