Please use a PC Browser to access Register-Tadawul

A Look At Globus Medical (GMED) Valuation As Strong 2025 And 2026 Guidance Lifts Investor Confidence

Globus Medical Inc Class A GMED | 90.59 | -0.36% |

Globus Medical (GMED) is back in focus after management issued new guidance that points to fourth quarter 2025 sales of about US$823.2 million and full year 2025 revenue of roughly US$2.936b.

The guidance update has arrived after a strong run in the shares, with a 90-day share price return of 67.26% and a 1-year total shareholder return of 9.32%. This suggests that momentum has recently picked up from a more modest long term profile.

If this kind of guidance driven move has your attention, it could be a useful moment to scan other healthcare stocks that might be reacting to similar catalysts.

With the shares up sharply and management now pointing to roughly US$2.936b in 2025 revenue and US$3.18b to US$3.22b in 2026, is Globus Medical still undervalued, or are markets already pricing in that future growth?

Most Popular Narrative Narrative: 1.1% Undervalued

With Globus Medical closing at US$94.62 against a narrative fair value of US$95.70, the current setup frames only a slight valuation gap but a very detailed earnings story.

The fair value estimate has risen slightly from $91.20 to $95.70 per share, reflecting modestly higher long-term earnings expectations. The future P/E multiple has increased from 27.2x to 28.7x, indicating a somewhat higher valuation being placed on projected earnings.

Want to see what is behind that higher fair value and richer future P/E tag? The narrative leans on steadier growth, firmer margins, and a specific earnings runway. Curious which assumptions really carry the weight in this model.

Result: Fair Value of $95.70 (UNDERVALUED)

However, that story could unravel if the integration of Nevro and NuVasive drags on margins or if slower spine procedure growth caps the revenue that the model is banking on.

Another Angle on Valuation

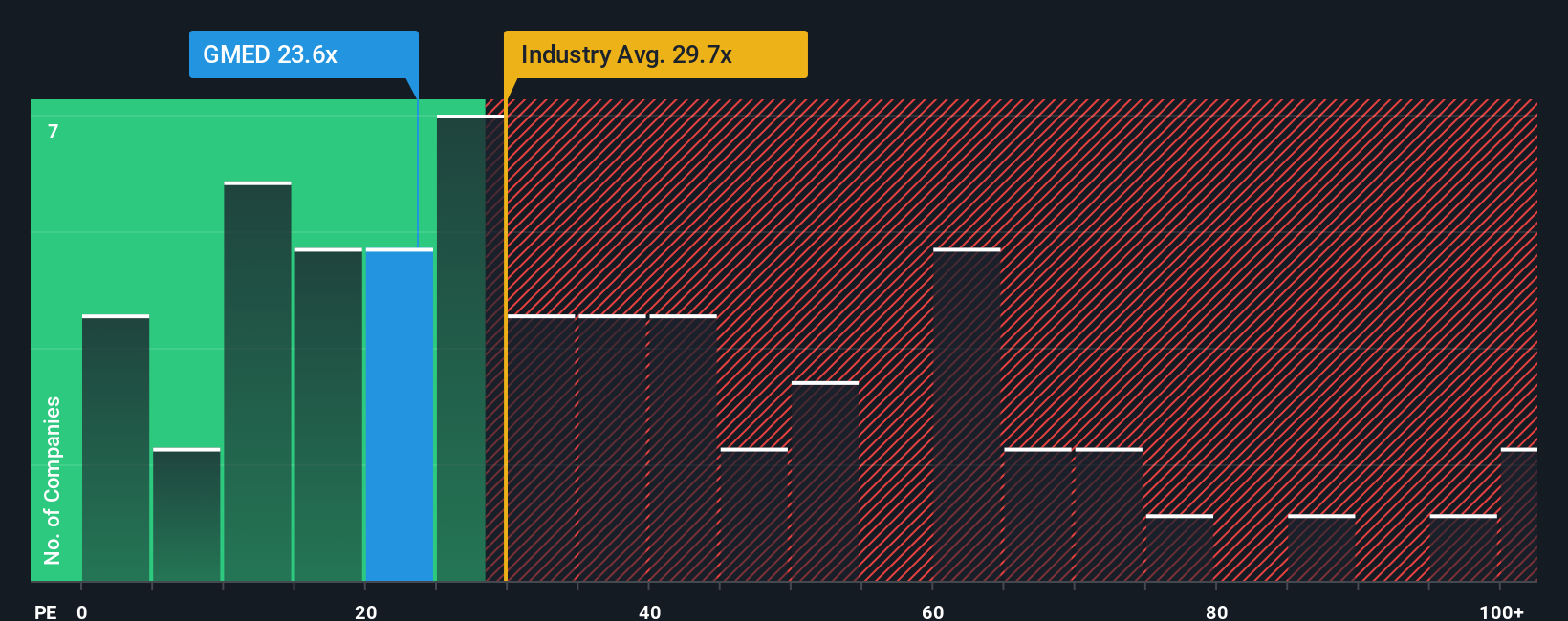

Our fair value work using earnings multiples sends a more cautious signal. At a P/E of 29.9x versus an estimated fair ratio of 22x, the shares look expensive, even though they sit roughly in line with the US Medical Equipment industry at 30.8x. Is the market already paying up for perfect execution?

Build Your Own Globus Medical Narrative

If you are not fully aligned with this view or simply prefer to stress test the assumptions yourself, you can create your own narrative in a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Globus Medical.

Looking for more investment ideas?

If Globus Medical has sparked your interest, do not stop here. Use the screener to hunt for other opportunities that match how you like to invest.

- Spot potential deep value setups by scanning these 881 undervalued stocks based on cash flows that might not yet be in the spotlight.

- Tap into the AI trend by checking out these 28 AI penny stocks that are tied to artificial intelligence themes.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that offer higher yields than the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.